- United States

- /

- Machinery

- /

- NYSE:RBC

Should RBC Bearings’ (RBC) Revenue Growth and Index Inclusion Prompt a Strategic Reassessment by Investors?

Reviewed by Sasha Jovanovic

- In recent news, RBC Bearings reported strong revenue growth and improved operating margins, with analysts also projecting accelerating demand over the coming year across its aerospace and industrial segments. The company’s inclusion in the Russell 1000 Index underscores its status as a leading force among U.S. large-cap industrial manufacturers.

- RBC Bearings' advances in operational efficiency and demand outlook are key signals for ongoing innovation and resilience in the precision components market.

- We'll examine how RBC Bearings’ improved margins and expected growth trajectory could alter the company’s broader investment narrative.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

RBC Bearings Investment Narrative Recap

To be a shareholder in RBC Bearings, you need confidence in the continued reliability of aerospace and industrial demand, as well as the company’s ability to innovate within a complex supply chain. While strong recent revenue and margin improvements have reinforced expectations for growth, these positive signals have not materially reduced short-term risk from global supply chain constraints, particularly around specialty materials that remain crucial for production consistency.

Of all recent developments, the company’s inclusion in the Russell 1000 Index stands out, cementing its reputation among large-cap U.S. industrials. This formal recognition of RBC’s market presence comes at a time when accelerating demand in aerospace is seen as a major catalyst for near-term performance, even as longer-term risks around customer concentration still linger.

But despite margin gains and broader index exposure, investors must also be aware that exposure to a handful of large aerospace and defense clients means RBC’s results could quickly shift if these customers change purchasing patterns or face production slowdowns...

Read the full narrative on RBC Bearings (it's free!)

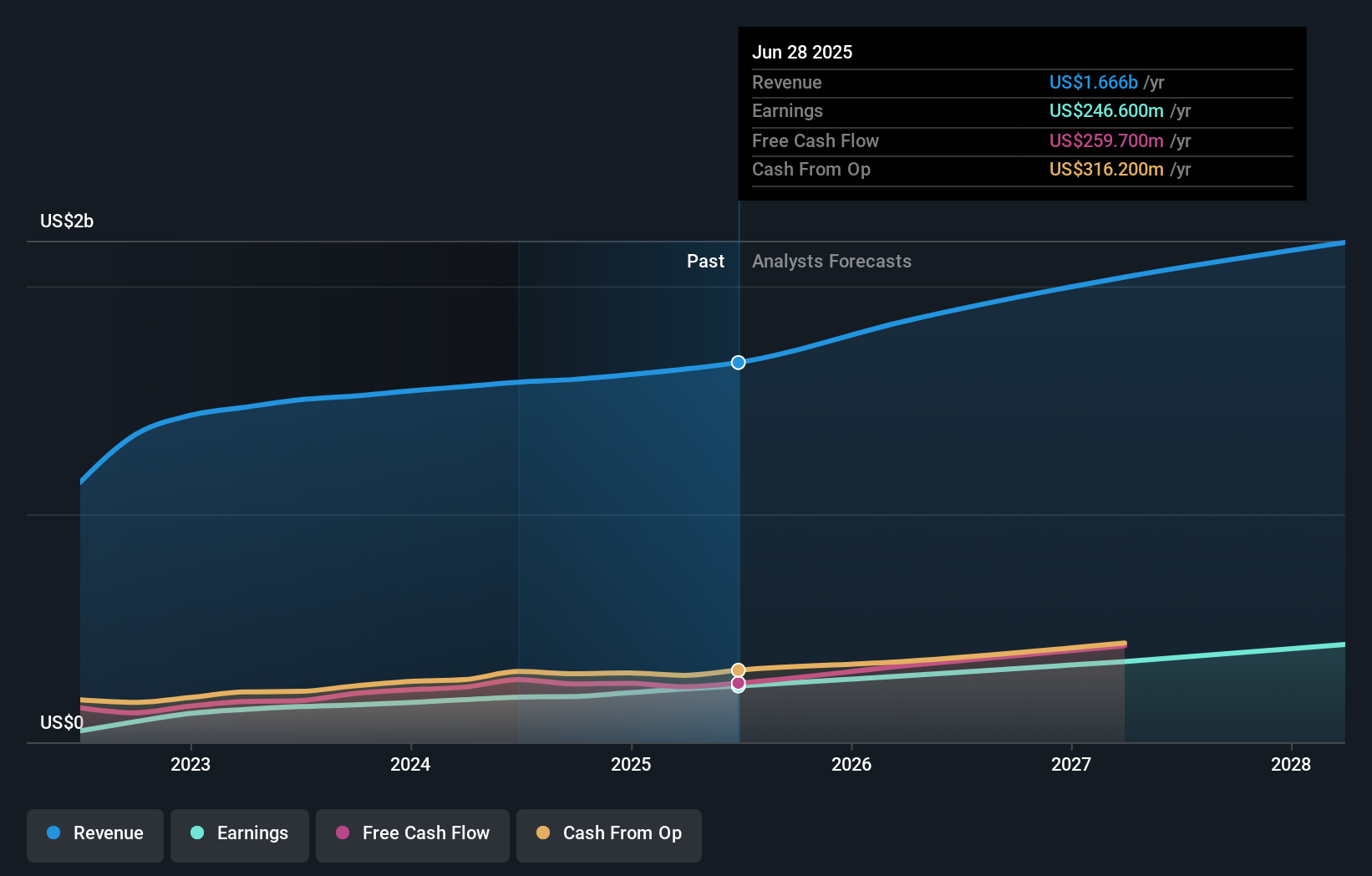

RBC Bearings’ outlook anticipates $2.3 billion in revenue and $445.8 million in earnings by 2028. This scenario assumes an 11.1% annual revenue growth and an increase in earnings of about $199 million from current earnings of $246.6 million.

Uncover how RBC Bearings' forecasts yield a $452.67 fair value, a 18% upside to its current price.

Exploring Other Perspectives

Two individual fair value estimates from the Simply Wall St Community span from US$329 to US$453 per share, underscoring wide-ranging outlooks ahead of recent events. With supply chain constraints still at the forefront, you’ll find a broad spectrum of views shaping discussion about RBC’s earnings and future performance.

Explore 2 other fair value estimates on RBC Bearings - why the stock might be worth as much as 18% more than the current price!

Build Your Own RBC Bearings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your RBC Bearings research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free RBC Bearings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate RBC Bearings' overall financial health at a glance.

Ready For A Different Approach?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Find companies with promising cash flow potential yet trading below their fair value.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RBC

RBC Bearings

Manufactures and markets engineered precision bearings, components, and systems in the United States and internationally.

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives