- United States

- /

- Machinery

- /

- NYSE:RBC

How Investors Are Reacting To RBC (RBC) Aerospace and Defense Revenue Outperformance This Quarter

Reviewed by Sasha Jovanovic

- Earlier this week, RBC Bearings reported quarterly revenues above analyst expectations, led by a strong beat in its Aerospace and Defense division, despite weaker performance in Diversified Industrials.

- This operational outperformance highlights strengthening demand in core markets and underscores RBC Bearings’ positioning to support long-term aerospace and defense industry expansion.

- We’ll explore how RBC Bearings’ outperformance in aerospace and defense could influence the company’s broader investment narrative and future prospects.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

RBC Bearings Investment Narrative Recap

To invest in RBC Bearings, you need confidence in the sustained global expansion of aerospace and defense, where the company has a growing backlog and industry demand is pushing for technologically advanced solutions. The recent quarterly outperformance in aerospace reinforces this narrative, but it does not fully resolve the biggest near-term risk: supply chain constraints in specialty alloys, which could still limit RBC's ability to meet long-term contract obligations if not addressed effectively.

Among the company's recent updates, its Q2 2026 results stand out, sales rose to US$455.3 million with earnings up year over year, fueled by the same robust aerospace demand that surprised to the upside this week. This aligns directly with the catalyst of increasing defense spending and modernization that supports the bullish thesis but also puts additional operational pressure on supply chain management as major contracts ramp up.

Yet, in contrast to upbeat quarterly results, investors should not overlook the ongoing challenge of sourcing critical materials...

Read the full narrative on RBC Bearings (it's free!)

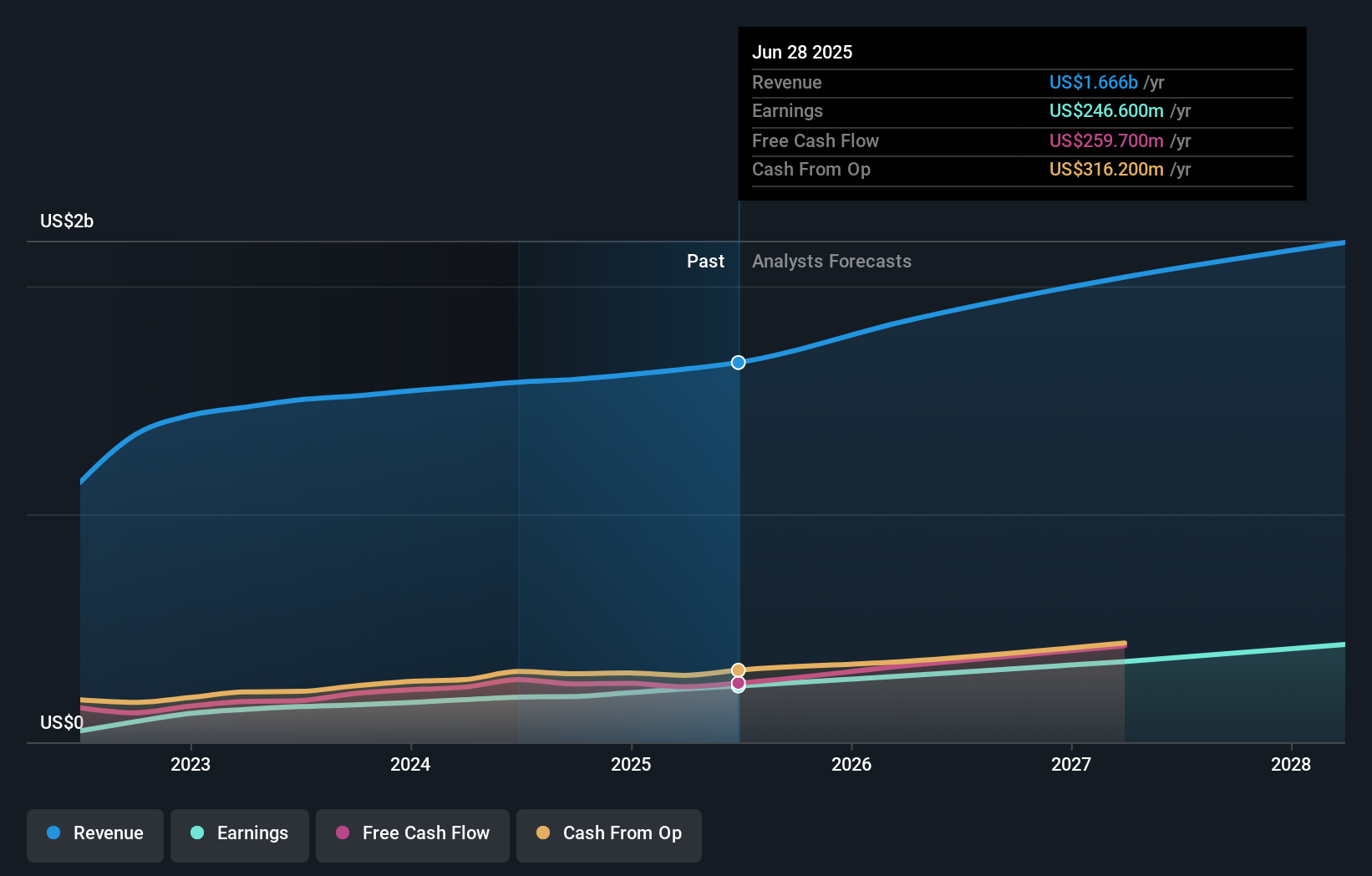

RBC Bearings' narrative projects $2.3 billion revenue and $445.8 million earnings by 2028. This requires 11.1% yearly revenue growth and an increase of $199.2 million in earnings from $246.6 million today.

Uncover how RBC Bearings' forecasts yield a $472.00 fair value, a 10% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members estimate RBC Bearings' fair value between US$314 and US$472, reflecting just two varied viewpoints. While strong growth in aerospace is a key catalyst, persistent supply chain constraints remain a critical factor for the company's performance, consider how these diverging opinions may shape your own outlook.

Explore 2 other fair value estimates on RBC Bearings - why the stock might be worth 27% less than the current price!

Build Your Own RBC Bearings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your RBC Bearings research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free RBC Bearings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate RBC Bearings' overall financial health at a glance.

No Opportunity In RBC Bearings?

Our top stock finds are flying under the radar-for now. Get in early:

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RBC

RBC Bearings

Manufactures and markets engineered precision bearings, components, and systems in the United States and internationally.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Near zero debt, Japan centric focus provides future growth

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.