- United States

- /

- Machinery

- /

- NYSE:PRLB

Did Record-Breaking Revenue Just Shift Proto Labs' (PRLB) Investment Narrative?

Reviewed by Simply Wall St

- In the past quarter, Proto Labs delivered revenues that surpassed analysts’ expectations and achieved a record high, reflecting robust business execution amid shifting industry conditions.

- A unique aspect of this performance is Proto Labs' ability to outperform consensus even as many peers face sector-wide challenges, highlighting the company’s resilience and operational effectiveness.

- We’ll assess how Proto Labs’ record quarterly revenue shapes the company’s investment narrative and outlook in advanced manufacturing.

Find companies with promising cash flow potential yet trading below their fair value.

Proto Labs Investment Narrative Recap

For shareholders of Proto Labs, confidence often rests on the company’s capacity to drive growth through its digital manufacturing edge and expansion in production-focused services, particularly CNC machining and sheet metal. The recent record quarterly revenue strengthens sentiment around these catalysts, but does not materially change concerns over customer concentration risk, the biggest near-term threat remains the potential volatility tied to a small set of large Aerospace & Defense clients.

Among recent announcements, Proto Labs’ new guidance for Q3 (revenue forecast: US$130.0 million to US$138.0 million) stands out as directly relevant to the earnings momentum highlighted in the latest results. This continued focus on guidance transparency aligns with shareholder interests and serves as a check on both growth expectations and evolving risks around margin pressure from sector headwinds.

By contrast, customer concentration risk may leave results more exposed than many investors realize, especially if...

Read the full narrative on Proto Labs (it's free!)

Proto Labs' outlook calls for $592.3 million in revenue and $33.7 million in earnings by 2028. This is based on analysts' assumptions of 5.2% annual revenue growth and an increase in earnings of $18.9 million from the current $14.8 million.

Uncover how Proto Labs' forecasts yield a $50.00 fair value, in line with its current price.

Exploring Other Perspectives

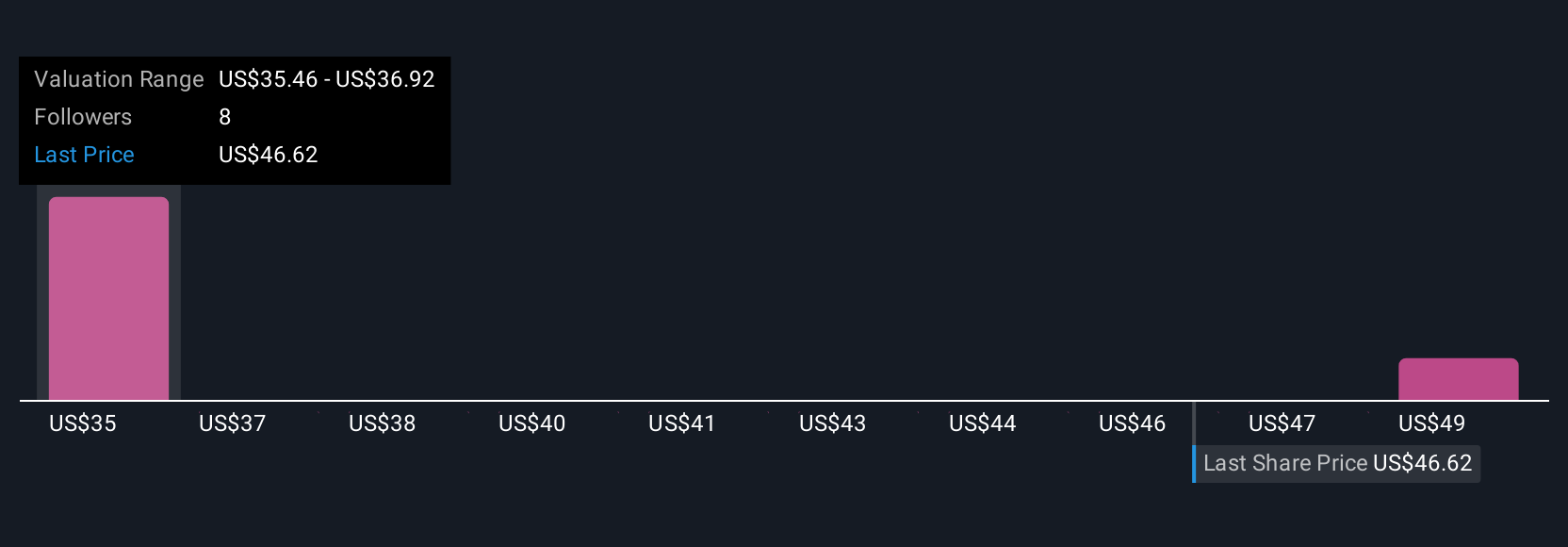

Simply Wall St Community fair value estimates for Proto Labs range widely from US$35.51 to US$50 across two investor views. While optimism surrounds expanding capabilities in high-requirement manufacturing, the risk of revenue swings tied to concentrated accounts could mean forecasts remain sensitive to single-customer dynamics.

Explore 2 other fair value estimates on Proto Labs - why the stock might be worth 28% less than the current price!

Build Your Own Proto Labs Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Proto Labs research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Proto Labs research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Proto Labs' overall financial health at a glance.

Interested In Other Possibilities?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- This technology could replace computers: discover 23 stocks that are working to make quantum computing a reality.

- Rare earth metals are the new gold rush. Find out which 29 stocks are leading the charge.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PRLB

Proto Labs

Operates as a digital manufacturer of custom parts in the United States and Europe.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026