- United States

- /

- Machinery

- /

- NYSE:PRLB

A Look at Proto Labs’s Valuation Following Record-Breaking Quarterly Results

Reviewed by Simply Wall St

Most Popular Narrative: Fairly Valued

The most widely followed narrative judges Proto Labs as fairly valued, with only a slight discount to its estimated fair value. This suggests the stock price currently reflects the consensus view of its near-term opportunities and risks.

Digital infrastructure, resilient supply chains, and strong financial health enable investments in automation and global expansion. These factors support margin improvement and long-term earnings growth. Reliance on key accounts, regional weaknesses, and margin pressures from competition and tariffs threaten profitability in light of the ongoing need for costly operational and technological investments.

The growth story behind Proto Labs’ current valuation is not just hype. Behind these numbers are bold projections on both revenue expansion and future profitability, plus a profit multiple that signals unusually high confidence. Curious about which assumptions send this fair value calculation soaring? The analyst consensus narrative contains surprising details that could change how you see Proto Labs’ trajectory.

Result: Fair Value of $50 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.However, ongoing weakness in European manufacturing and customer concentration pose real risks. These factors could quickly shift Proto Labs’ outlook and valuation.

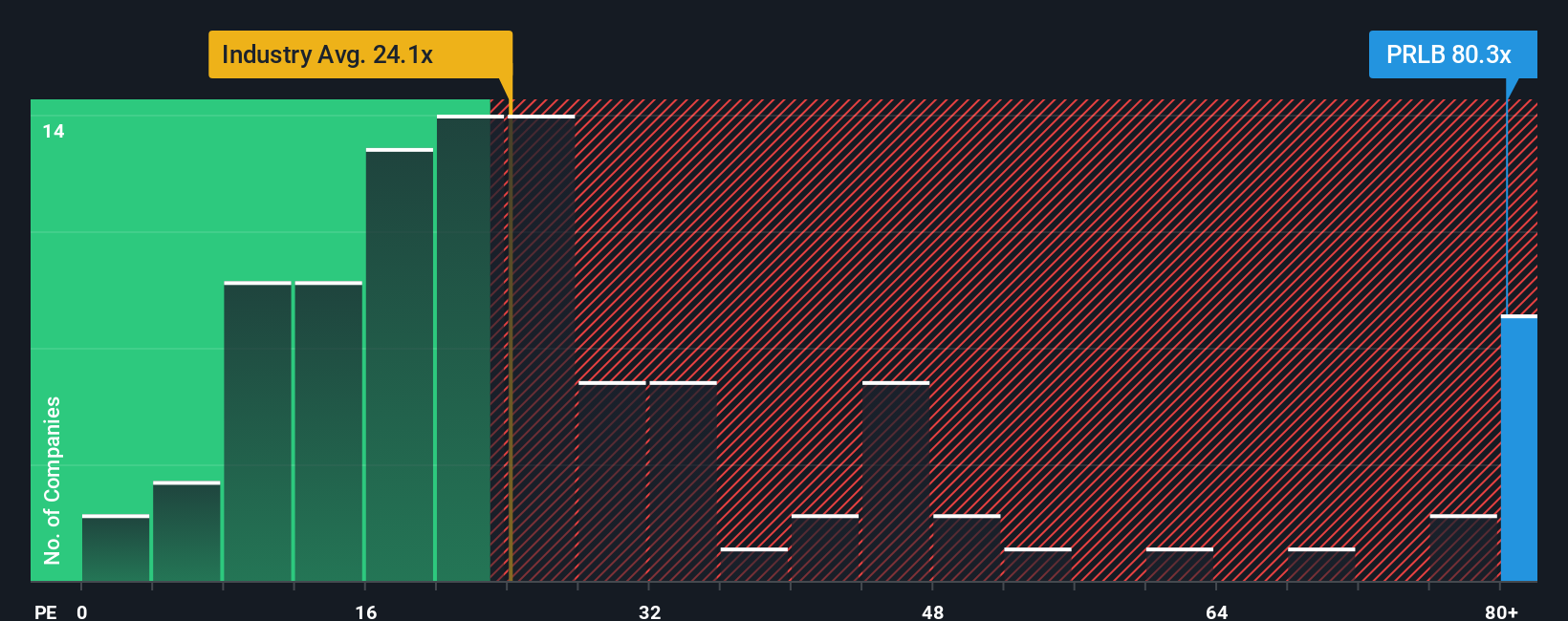

Find out about the key risks to this Proto Labs narrative.Another View: Market Ratios Tell a Different Story

While the main narrative sees fair value, some investors look at market ratios and see Proto Labs trading well above industry standards. This could signal a stretched price, or it might simply reflect strong future growth expectations.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Proto Labs Narrative

If you see things differently or want to take a hands-on approach, you can dig into the numbers and put together your own perspective in just a few minutes. Do it your way.

A great starting point for your Proto Labs research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors always stay a step ahead, and Simply Wall Street makes that easy with powerful tools to help you catch opportunities before the crowd. If you want to spot tomorrow’s winners or shake up your portfolio with fresh ideas, explore these options:

- Unlock steady income growth by tracking companies known for their generous yields using our dividend stocks with yields > 3%.

- Position yourself at the forefront of innovation by tapping into breakthrough companies disrupting the healthcare industry using healthcare AI stocks.

- Get a head start on finding undervalued gems set for a comeback with the help of our undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PRLB

Proto Labs

Operates as a digital manufacturer of custom parts in the United States and Europe.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives