- United States

- /

- Machinery

- /

- NYSE:PNR

Is Pentair’s (PNR) Earnings Beat Shaping a New Growth Narrative for Investors?

Reviewed by Sasha Jovanovic

- Pentair recently reached a new 52-week high following the release of its latest earnings report, which showed earnings per share of $1.39 compared to the consensus estimate of $1.33.

- This trend highlights a pattern of consistent earnings outperformance by Pentair, accompanied by rising analyst estimates and optimism for future cash flow growth.

- We'll explore how Pentair's strong record of exceeding earnings expectations shapes the company's current investment narrative and outlook.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Pentair Investment Narrative Recap

Pentair appeals primarily to investors who believe in long-term growth fueled by water infrastructure investment and smart, sustainable solutions. The recent 52-week high following another earnings outperformance draws attention to upbeat analyst sentiment, but it does not materially alter the main near-term catalyst: a recovery in core residential pool equipment volumes, which remains sensitive to macroeconomic trends. The most significant short-term risk continues to be ongoing softness in residential demand and the potential for margin pressure if pricing power weakens or competitive pressures rise.

The announcement of Pentair's upcoming Q3 2025 results, scheduled for October 21, stands out as the event that could move sentiment in the short term. With full-year GAAP EPS guidance reaffirmed and the company reiterating a modest 1% to 2% sales growth outlook, this sets expectations and provides a measuring stick against which investors will gauge if upward momentum in earnings can continue or if risks to revenue or margins are intensifying.

In sharp contrast to the recent optimism, investors should pay attention to possible headwinds facing Pentair if...

Read the full narrative on Pentair (it's free!)

Pentair's outlook anticipates $4.6 billion in revenue and $943.8 million in earnings by 2028. This projection is based on a 3.7% annual revenue growth rate and a $334.4 million increase in earnings from the current $609.4 million.

Uncover how Pentair's forecasts yield a $116.84 fair value, a 5% upside to its current price.

Exploring Other Perspectives

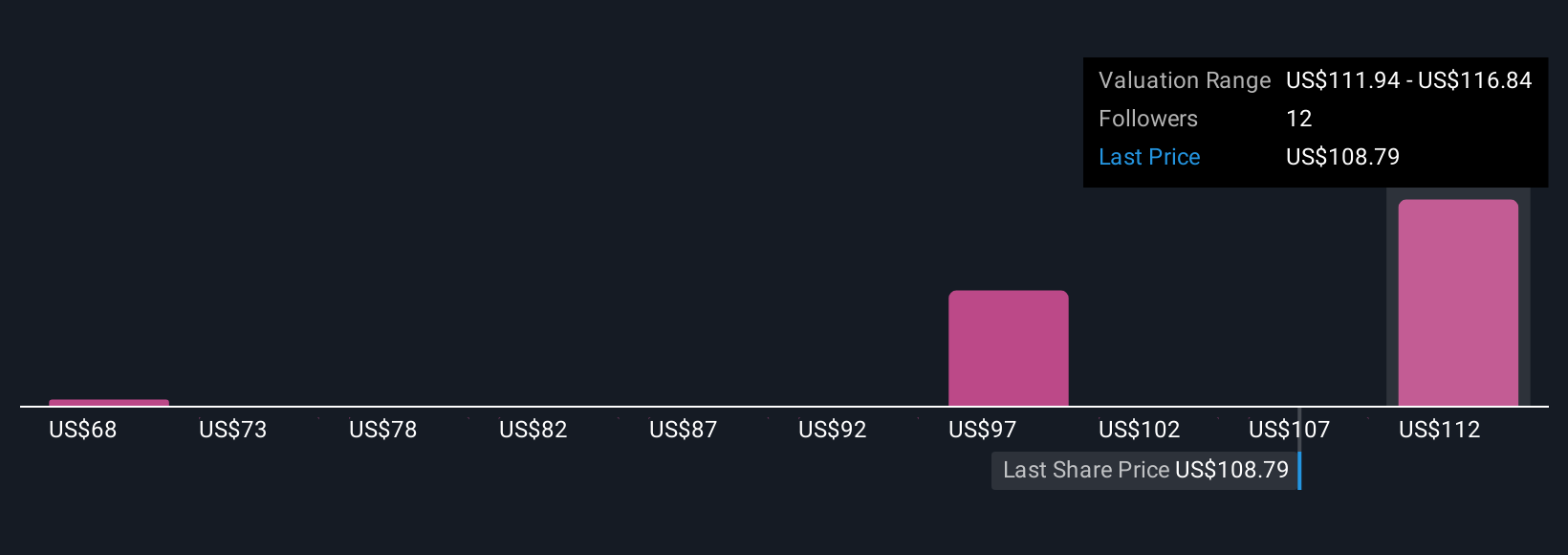

Simply Wall St Community members estimated Pentair's fair value to range from US$67.78 to US$116.84, reflecting three diverse analyses. While optimism surrounds infrastructure catalysts, opinions differ widely on valuation, prompting you to review several alternative perspectives.

Explore 3 other fair value estimates on Pentair - why the stock might be worth 39% less than the current price!

Build Your Own Pentair Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Pentair research is our analysis highlighting 1 key reward that could impact your investment decision.

- Our free Pentair research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Pentair's overall financial health at a glance.

Searching For A Fresh Perspective?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 35 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PNR

Pentair

Provides various water solutions in the United States, Western Europe, China, Eastern Europe, Latin America, the Middle East, Southeast Asia, Australia, Canada, and Japan.

Excellent balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives