- United States

- /

- Machinery

- /

- NYSE:OTIS

Will Otis’s (OTIS) Gen3 Core Expansion Redefine Its Role in the Smart Elevator Market?

Reviewed by Sasha Jovanovic

- Earlier in November 2025, Otis Worldwide expanded its Gen3 Core elevator range, introducing higher load capacities, larger cabs and doors, and new digital features aimed at the low-rise building segment in the U.S. and Canada.

- This update enables Otis to address broader building needs, including integration with service robots and enhanced digital monitoring, potentially positioning the company at the forefront of smart, sustainable elevator solutions.

- We'll explore how the enhanced Gen3 Core’s advanced digital connectivity and upgraded capacities may reinforce Otis’s long-term modernization narrative.

Find companies with promising cash flow potential yet trading below their fair value.

Otis Worldwide Investment Narrative Recap

To be an Otis Worldwide shareholder, one needs to believe in the long-term modernization and service opportunity as buildings across mature markets age and sustainability standards tighten. The recent Gen3 Core update strengthens Otis’s position in the North American low-rise segment and reinforces its modernization story, yet does not materially alter the dominant near-term catalyst, the accelerating momentum in modernization orders, or address the ongoing risk from weak new equipment demand in China and commercial real estate softness.

Among recent announcements, the launch of the Arise™ MOD Prime and MOD Plus modernization solutions for Europe is closely relevant. Modernization remains a key earnings driver, and expanding tailored upgrade options across markets helps Otis maintain strong service revenue potential, especially as demand for new installations remains muted in several regions.

However, in contrast, investors should be aware that persistent pricing and volume pressure in China, a critical risk for future growth, could still weigh on results if recent weakness continues in...

Read the full narrative on Otis Worldwide (it's free!)

Otis Worldwide's outlook anticipates $16.4 billion in revenue and $1.9 billion in earnings by 2028. Achieving these targets calls for a 5.0% annual revenue growth rate and a $0.4 billion increase in earnings from the current $1.5 billion.

Uncover how Otis Worldwide's forecasts yield a $103.25 fair value, a 16% upside to its current price.

Exploring Other Perspectives

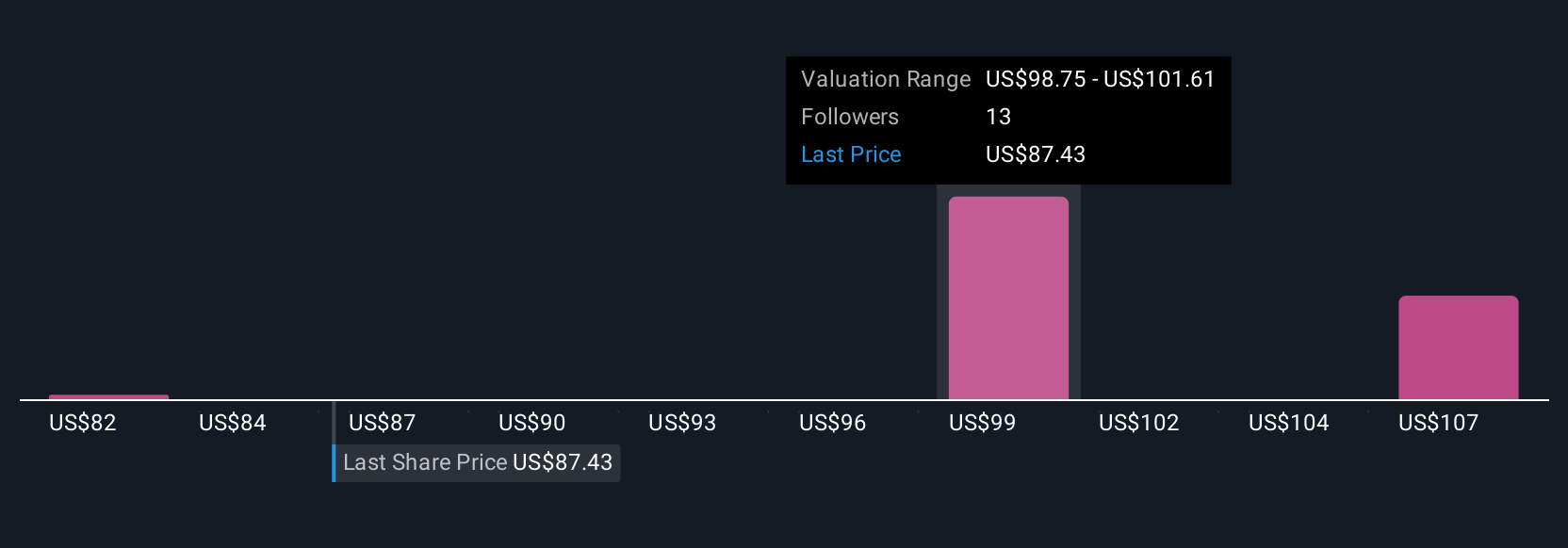

Five members of the Simply Wall St Community estimate Otis’s fair value from US$81.56 to US$109.62, reflecting wide-ranging views. Your perception of modernization growth versus ongoing China risk may inform where you fit within this spectrum.

Explore 5 other fair value estimates on Otis Worldwide - why the stock might be worth 8% less than the current price!

Build Your Own Otis Worldwide Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Otis Worldwide research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Otis Worldwide research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Otis Worldwide's overall financial health at a glance.

Looking For Alternative Opportunities?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:OTIS

Otis Worldwide

Engages in manufacturing, installation, and servicing of elevators and escalators in the United States, China, and internationally.

Fair value second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.