- United States

- /

- Machinery

- /

- NYSE:OTIS

Otis Worldwide (NYSE:OTIS) Reports Lower Earnings, Updates 2025 Revenue Guidance

Reviewed by Simply Wall St

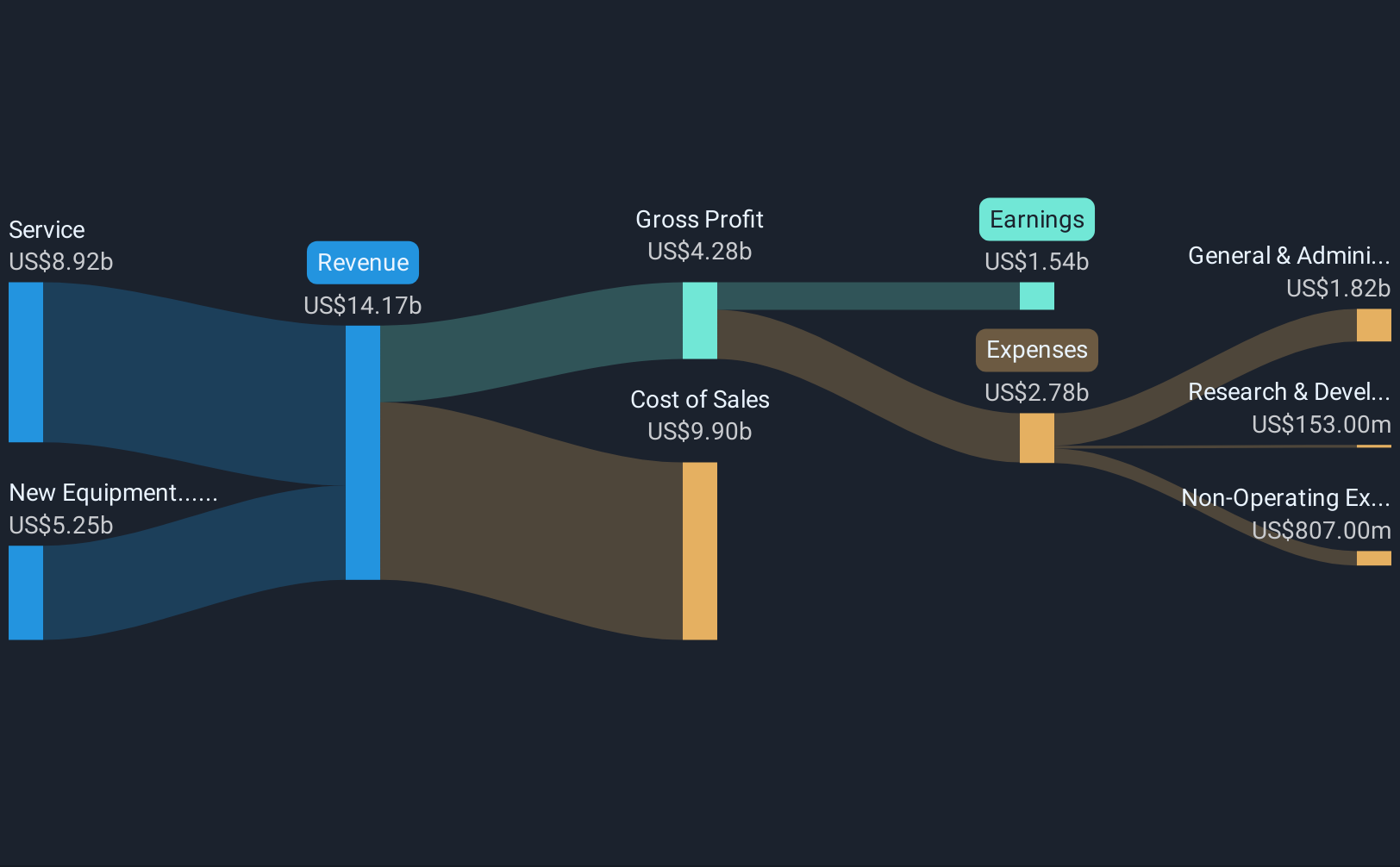

Otis Worldwide (NYSE:OTIS) announced its Q1 2025 earnings, revealing a decrease in sales and net income compared to the previous year. The company also updated its full-year earnings guidance and declared a quarterly dividend increase. Despite these developments, shares of Otis Worldwide saw a 4% decline over the last quarter. This decline contrasts with broader market movements, which have climbed recently as investors absorbed positive earnings reports and anticipated tariff news. While Otis's earnings and guidance adjustments may offer some insight, they also reflect potential market challenges that could counter the broader market's upbeat sentiment.

The recent earnings report from Otis Worldwide, presenting a decline in sales and net income along with updated guidance and a dividend increase, casts light on the company's ongoing challenges. This news aligns with the narrative that highlights regional new equipment sales volatility, particularly in China, coupled with an increased service-driven focus. Such factors may impact revenue and earnings forecasts, particularly given the ongoing tariff and trade policy uncertainties. However, the rising emphasis on maintenance and modernization, especially through initiatives like UpLift and the China transformation program, is expected to support profitability despite these hurdles.

Over a longer-term five-year period, Otis Worldwide's total shareholder return, including dividends, was 93.81%. This strong performance occurs amid a backdrop of fluctuating market conditions and underperformance against the US Market over the past year, which achieved a return of 3.6%. Over the same short-term period, Otis also surpassed the US Machinery industry, which experienced a 9.9% decline, demonstrating its resilience amidst sectoral headwinds.

The current share price of US$98.95 represents a slight discount to the consensus analyst price target of US$99.97. This suggests a general alignment with analyst expectations when considering future earnings growth and market conditions. The close proximity of the share price to the price target reflects the market's anticipation of steady growth, supported by strategic initiatives, while acknowledging possible risks stemming from regional volatility and external economic pressures.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:OTIS

Otis Worldwide

Engages in manufacturing, installation, and servicing of elevators and escalators in the United States, China, and internationally.

Proven track record second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives