Otis Worldwide Corporation's (NYSE:OTIS) dividend will be increasing to US$0.24 on 10th of June. This takes the annual payment to 1.1% of the current stock price, which is about average for the industry.

See our latest analysis for Otis Worldwide

Otis Worldwide's Earnings Easily Cover the Distributions

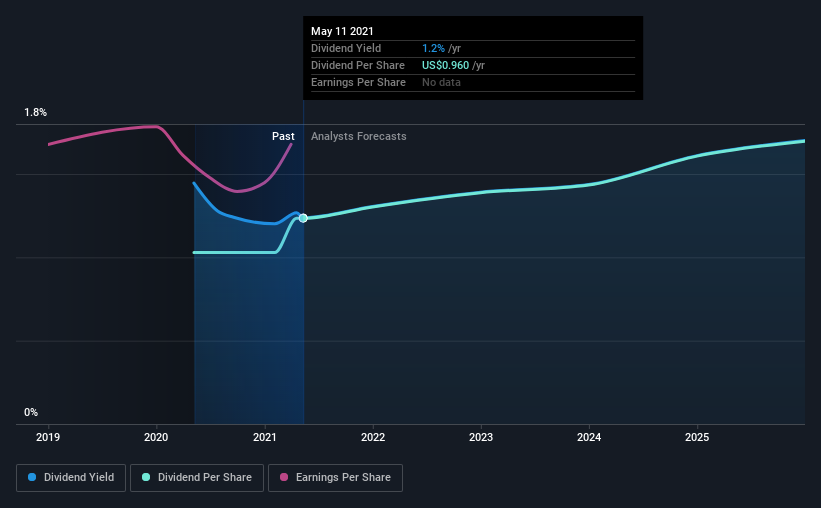

We aren't too impressed by dividend yields unless they can be sustained over time. However, prior to this announcement, Otis Worldwide's dividend was comfortably covered by both cash flow and earnings. As a result, a large proportion of what it earned was being reinvested back into the business.

Looking forward, earnings per share is forecast to rise by 17.3% over the next year. If the dividend continues along recent trends, we estimate the payout ratio will be 30%, which is in the range that makes us comfortable with the sustainability of the dividend.

Otis Worldwide Doesn't Have A Long Payment History

The company hasn't been paying a dividend for very long at all, so we can't really make a judgement on how stable the dividend has been. This doesn't mean that the company can't pay a good dividend, but just that we want to wait until it can prove itself.

Otis Worldwide Could Grow Its Dividend

Some investors will be chomping at the bit to buy some of the company's stock based on its dividend history. Otis Worldwide's earnings per share is up 4.1% over the past year. Rising earnings will make it easier for the company to keep paying dividends, and possibly even increase them. Earnings growth is slow, but on the plus side, the dividend payout ratio is low and dividends could grow faster than earnings, if the company decides to increase its payout ratio. We do note though, one year is too short a time to be drawing strong conclusions about a company's future prospects.

In Summary

Overall, it's great to see the dividend being raised and that it is still in a sustainable range. The payout ratio looks good, but unfortunately the company's dividend track record isn't stellar. The payment isn't stellar, but it could make a decent addition to a dividend portfolio.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. However, there are other things to consider for investors when analysing stock performance. For example, we've identified 3 warning signs for Otis Worldwide (1 is significant!) that you should be aware of before investing. We have also put together a list of global stocks with a solid dividend.

If you’re looking to trade Otis Worldwide, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NYSE:OTIS

Otis Worldwide

Engages in manufacturing, installation, and servicing of elevators and escalators in the United States, China, and internationally.

Solid track record and fair value.

Similar Companies

Market Insights

Community Narratives