- United States

- /

- Machinery

- /

- NYSE:OTIS

Is Otis India's Major Hyderabad Contract Win Reshaping the Investment Case for Otis Worldwide (OTIS)?

Reviewed by Sasha Jovanovic

- Otis India recently announced it secured a significant contract with My Home Group to deliver 169 high-speed elevator systems for three luxury residential projects in Hyderabad, underscoring the company's advanced engineering and premium positioning in the region.

- This deal not only highlights Otis's growing traction in the fast-developing Indian market but also reflects ongoing demand for next-generation vertical transportation solutions in premium real estate.

- We'll explore how this major Indian contract win, combined with increased institutional interest from Canoe Financial, could influence Otis Worldwide's investment outlook.

We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Otis Worldwide Investment Narrative Recap

Otis Worldwide attracts shareholders who believe in the long-term resilience of urbanization, modernization, and recurring revenue from elevator services, especially as the company expands in high-growth markets like India. While the My Home Group contract in Hyderabad showcases Otis’s ongoing success in premium residential projects, its effect on the company’s most important short-term catalyst, global modernization demand and service revenue growth, is limited. However, risks tied to new equipment sales in China and margin pressures remain top of mind.

The September announcement of Otis providing 265 Gen2 Prime elevator systems in New Cairo is especially relevant, as it highlights the company’s continued push into large-scale, high-rise residential projects in emerging markets. This aligns with recent wins in India, reinforcing the view that geographic diversification and premium engineering underpin both current catalysts and ongoing opportunities for growth amid sector headwinds.

Yet, it’s crucial to recognize that while these wins bolster optimism, persistent challenges in China’s new equipment market may still factor significantly in Otis’s outlook, especially if...

Read the full narrative on Otis Worldwide (it's free!)

Otis Worldwide's outlook anticipates $16.4 billion in revenue and $1.9 billion in earnings by 2028. This scenario requires 5.0% annual revenue growth and a $0.4 billion increase in earnings from the current $1.5 billion.

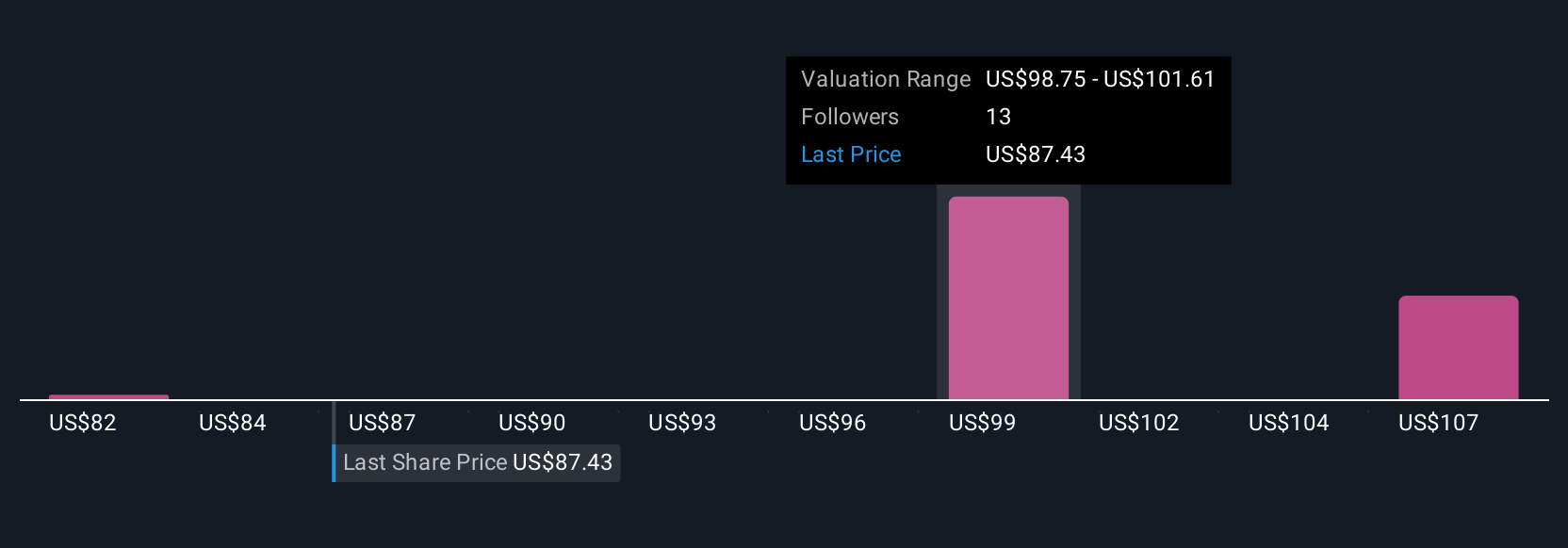

Uncover how Otis Worldwide's forecasts yield a $100.23 fair value, a 10% upside to its current price.

Exploring Other Perspectives

Three fair value estimates from the Simply Wall St Community range widely from US$81.56 to US$109.62 per share. Some of you see geographic expansion as a key driver, while others focus on risks in China that could affect long-term revenue growth, consider these perspectives as you weigh your own view of Otis’s potential.

Explore 3 other fair value estimates on Otis Worldwide - why the stock might be worth 11% less than the current price!

Build Your Own Otis Worldwide Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Otis Worldwide research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Otis Worldwide research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Otis Worldwide's overall financial health at a glance.

Interested In Other Possibilities?

Our top stock finds are flying under the radar-for now. Get in early:

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:OTIS

Otis Worldwide

Engages in manufacturing, installation, and servicing of elevators and escalators in the United States, China, and internationally.

Good value with proven track record.

Similar Companies

Market Insights

Community Narratives