- United States

- /

- Machinery

- /

- NYSE:OTIS

How Egypt’s Large Elevator Contract Could Influence Otis Worldwide’s (OTIS) Growth Story and Order Pipeline

Reviewed by Simply Wall St

- On September 8, 2025, Mountain View Real Estate Development announced that Otis Worldwide Corporation will supply and install 265 Otis Gen2® Prime elevator systems for several residential projects in Egypt, including developments in New Cairo and 6th of October City, featuring premium finishes and multiple stop configurations.

- This high-profile contract highlights Otis’s potential to strengthen its foothold in the Middle East and North Africa’s rapidly expanding residential real estate sector.

- We'll explore how this significant Egypt contract could influence Otis’s growth outlook and modernization order momentum in its investment narrative.

Rare earth metals are the new gold rush. Find out which 28 stocks are leading the charge.

Otis Worldwide Investment Narrative Recap

To be an Otis shareholder, one needs to believe in the company’s ability to grow its installed base and recurring service revenue through global urbanization, modernization, and innovative elevator solutions. The Egypt contract signals positive momentum for new equipment orders outside China, but does not materially shift the short-term catalyst, which is still driven by modernization backlogs and service margins. The biggest near-term risk remains the prolonged softness in China, where order declines and price competition are weighing on new equipment sales and pressuring margins.

The recently announced partnership with Singapore’s Land Transport Authority, where Otis will deploy over 500 escalators and elevators using its Otis ONE™ IoT platform, strongly aligns with these catalysts. Both the Egypt and Singapore contracts highlight execution in fast-growing markets and demand for connected, energy-efficient elevator systems, which are central to Otis’s push for high-margin service and modernization revenue growth.

By contrast, investors should also be aware that ongoing weakness in China’s construction sector has resulted in more than 20 percent declines in new equipment orders, which could...

Read the full narrative on Otis Worldwide (it's free!)

Otis Worldwide's outlook anticipates $16.4 billion in revenue and $1.9 billion in earnings by 2028. This relies on 5.0% annual revenue growth and a $0.4 billion increase in earnings from $1.5 billion today.

Uncover how Otis Worldwide's forecasts yield a $99.23 fair value, a 11% upside to its current price.

Exploring Other Perspectives

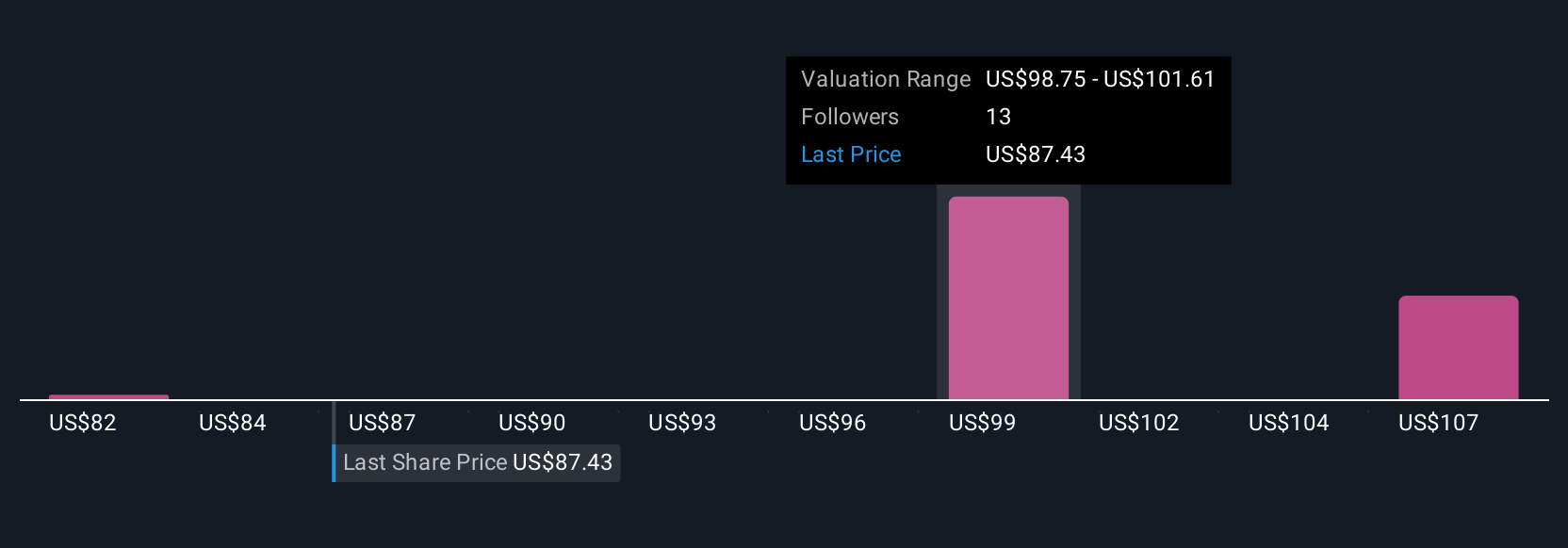

Fair value estimates from four Simply Wall St Community members span from US$81.56 to US$109.62, reflecting varied outlooks on Otis’s prospects. This diversity comes as the company’s modernization order momentum remains a key focus amid regional order volatility, making it useful to compare these distinct viewpoints.

Explore 4 other fair value estimates on Otis Worldwide - why the stock might be worth 9% less than the current price!

Build Your Own Otis Worldwide Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Otis Worldwide research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Otis Worldwide research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Otis Worldwide's overall financial health at a glance.

Want Some Alternatives?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- These 9 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:OTIS

Otis Worldwide

Engages in manufacturing, installation, and servicing of elevators and escalators in the United States, China, and internationally.

Good value with proven track record.

Similar Companies

Market Insights

Community Narratives