- United States

- /

- Machinery

- /

- NYSE:OSK

The Bull Case For Oshkosh (OSK) Could Change Following US Army’s $89M Palletized Vehicle Contract—Learn Why

Reviewed by Sasha Jovanovic

- Oshkosh Defense LLC announced in early October that the U.S. Army awarded an US$89 million order for Palletized Load System A2 vehicles, kits, and installs under the Family of Heavy Tactical Vehicles V contract.

- This contract not only advances the Army's fleet modernization but also highlights Oshkosh's progress in integrating autonomous technologies and active safety systems into military applications.

- Next, we’ll examine how this new Army contract could shape Oshkosh’s longer-term growth narrative and focus on defense innovation.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Oshkosh Investment Narrative Recap

To be a long-term Oshkosh shareholder, you need to believe in the company's ability to secure recurring government contracts and continuously deliver innovation in specialty vehicles, especially as it balances cyclical demand and pricing pressures across segments. The recent US$89 million Army contract confirms Oshkosh’s relevance in defense modernization, but it is not likely to materially move the needle on the short-term risk of order backlog softness or persistent margin pressure in more competitive, cyclical end markets. Of the company’s latest announcements, Oshkosh’s raised full-year earnings guidance stands out as the most relevant in light of its current contract wins. This upward revision to expectations is backed by improved margins despite a challenging international trade backdrop and could bolster investor confidence as the company continues to report fluctuating sales and sector-wide volatility. On the flip side, investors should also consider the risk that comes if key end-markets soften further or competition intensifies...

Read the full narrative on Oshkosh (it's free!)

Oshkosh's forecast envisions $12.0 billion in revenue and $940.2 million in earnings by 2028. This scenario assumes 5.1% annual revenue growth and a $289.8 million increase in earnings from the current $650.4 million level.

Uncover how Oshkosh's forecasts yield a $150.54 fair value, a 15% upside to its current price.

Exploring Other Perspectives

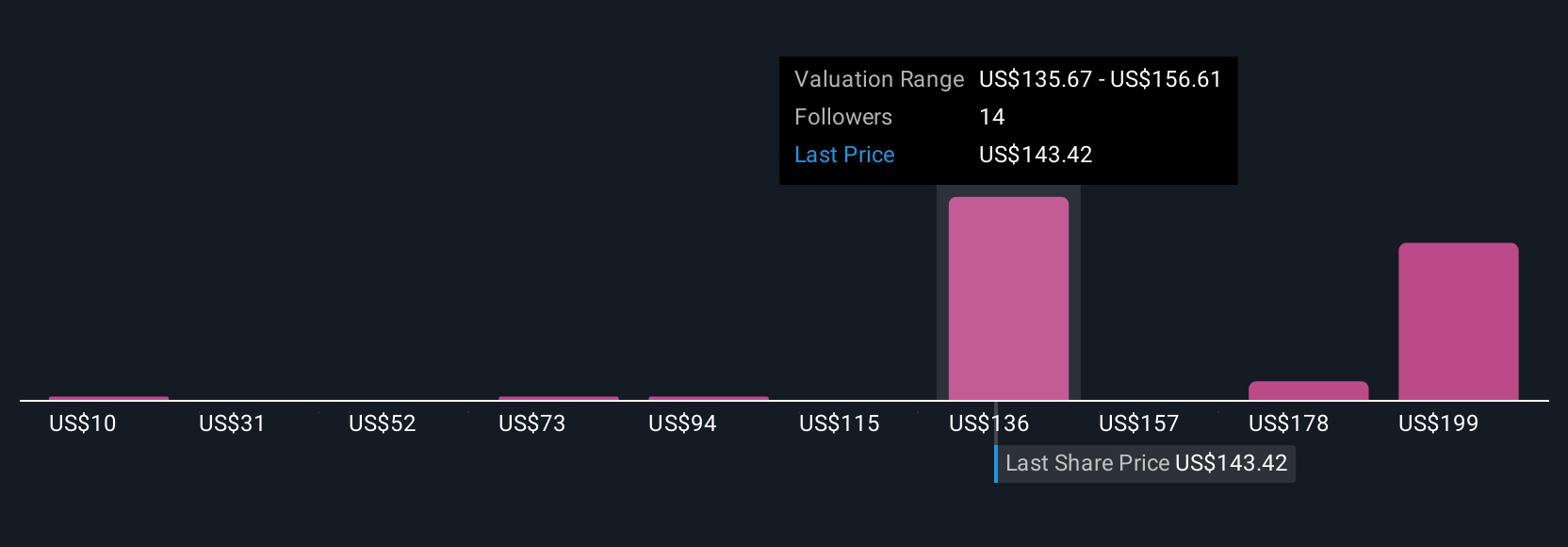

Seven fair value estimates from the Simply Wall St Community for Oshkosh range widely, from US$10 to US$213.57 per share. Competitive pricing pressure and the potential for further end-market weakness are risks you should weigh as you explore these diverse viewpoints.

Explore 7 other fair value estimates on Oshkosh - why the stock might be worth less than half the current price!

Build Your Own Oshkosh Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Oshkosh research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Oshkosh research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Oshkosh's overall financial health at a glance.

No Opportunity In Oshkosh?

Our top stock finds are flying under the radar-for now. Get in early:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:OSK

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives