- United States

- /

- Machinery

- /

- NYSE:OSK

Should Oshkosh’s (OSK) Oregon Street Layoffs and New Coverage Shift Investor Views on Its Strategy?

Reviewed by Sasha Jovanovic

- Oshkosh Corporation, which reported a significant drop in Q3 2025 sales, plans to lay off 160 employees at its Oregon Street plant in January 2026, while Barclays has initiated analyst coverage on the company.

- Together, the workforce reduction and fresh analyst attention highlight how Oshkosh is adjusting its operations and investor profile amid shifting demand.

- Next, we’ll explore how Oshkosh’s planned job cuts at the Oregon Street plant may influence the company’s existing investment narrative.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

Oshkosh Investment Narrative Recap

To own Oshkosh, you generally need to believe in its ability to convert cyclical demand for specialty vehicles and large government contracts into resilient earnings and cash flow. The announced Oregon Street layoffs, following softer Q3 2025 sales, point to near term volume pressure but do not appear to change the key short term catalyst around executing on its backlog, nor the central risk that end market cyclicality and contract exposure can swing results.

Barclays’ new analyst coverage, alongside Oshkosh’s continued dividend at US$0.51 per share, keeps attention on how consistently the company can turn its contract wins and infrastructure exposure into reliable free cash flow. This coverage arrives as Oshkosh continues to show improving earnings quality and maintains its capital return profile, which many investors watch closely as a practical signal of management’s confidence in the business through cycles.

Yet, against that backdrop, Oshkosh’s dependence on large government contracts introduces a concentration risk that investors should be aware of if...

Read the full narrative on Oshkosh (it's free!)

Oshkosh's narrative projects $12.0 billion revenue and $940.2 million earnings by 2028. This requires 5.1% yearly revenue growth and about a $289.8 million earnings increase from $650.4 million today.

Uncover how Oshkosh's forecasts yield a $153.08 fair value, a 17% upside to its current price.

Exploring Other Perspectives

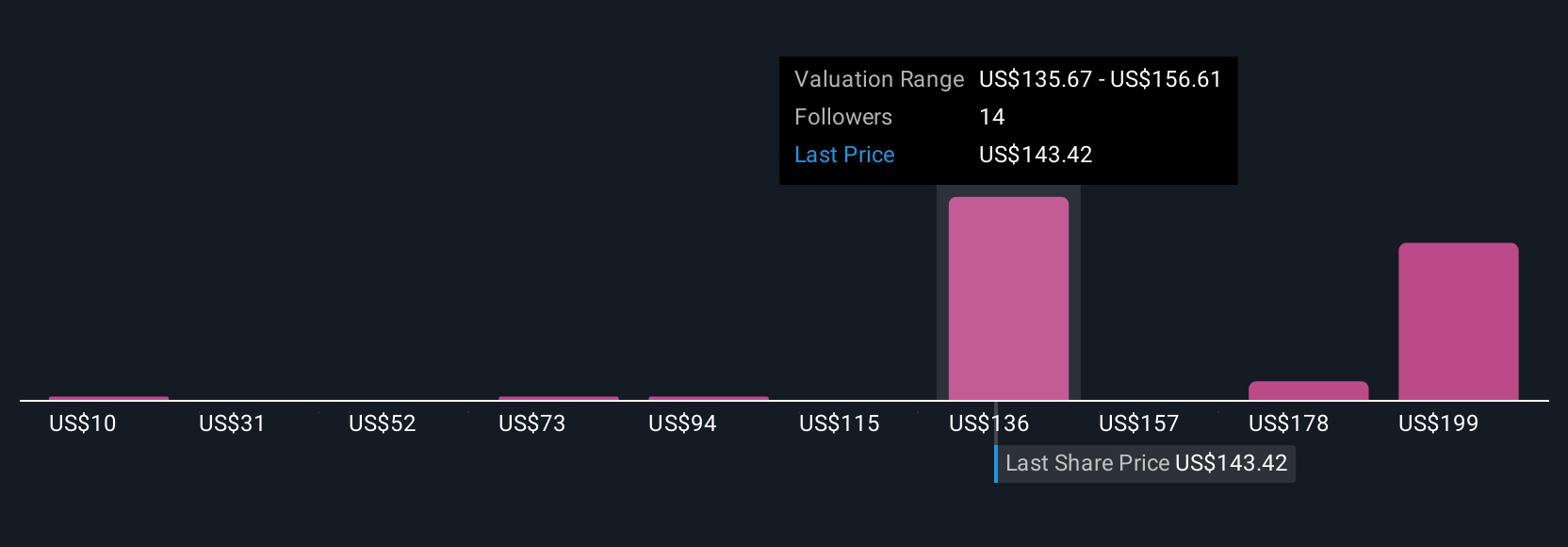

Seven fair value estimates from the Simply Wall St Community span roughly US$10 to about US$237 per share, showing how far apart individual views can be. Against that wide range, the ongoing risk that government funding or contract timing shifts could unsettle Oshkosh’s earnings underlines why it can be helpful to compare several of these perspectives before forming your own view.

Explore 7 other fair value estimates on Oshkosh - why the stock might be worth as much as 81% more than the current price!

Build Your Own Oshkosh Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Oshkosh research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Oshkosh research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Oshkosh's overall financial health at a glance.

Interested In Other Possibilities?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:OSK

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026