- United States

- /

- Building

- /

- NYSE:OC

Should You Rethink Owens Corning After Its 18% Drop and New Roofing Acquisition?

Reviewed by Bailey Pemberton

Wondering what to do with your Owens Corning stock right now? You are definitely not alone. The company’s share price has seen its share of drama this year, from a dip of 18.1% since January to a 10.8% slide in just the past month. Even at these lower levels, though, it is hard to ignore that Owens Corning is sitting on a 100.4% gain over the past five years. That is a track record most investors would be happy to claim. A turbulent macro environment, shifting interest rate expectations, and broader construction sector jitters have certainly influenced recent moves. Still, these swings could be giving value-oriented investors something compelling to consider.

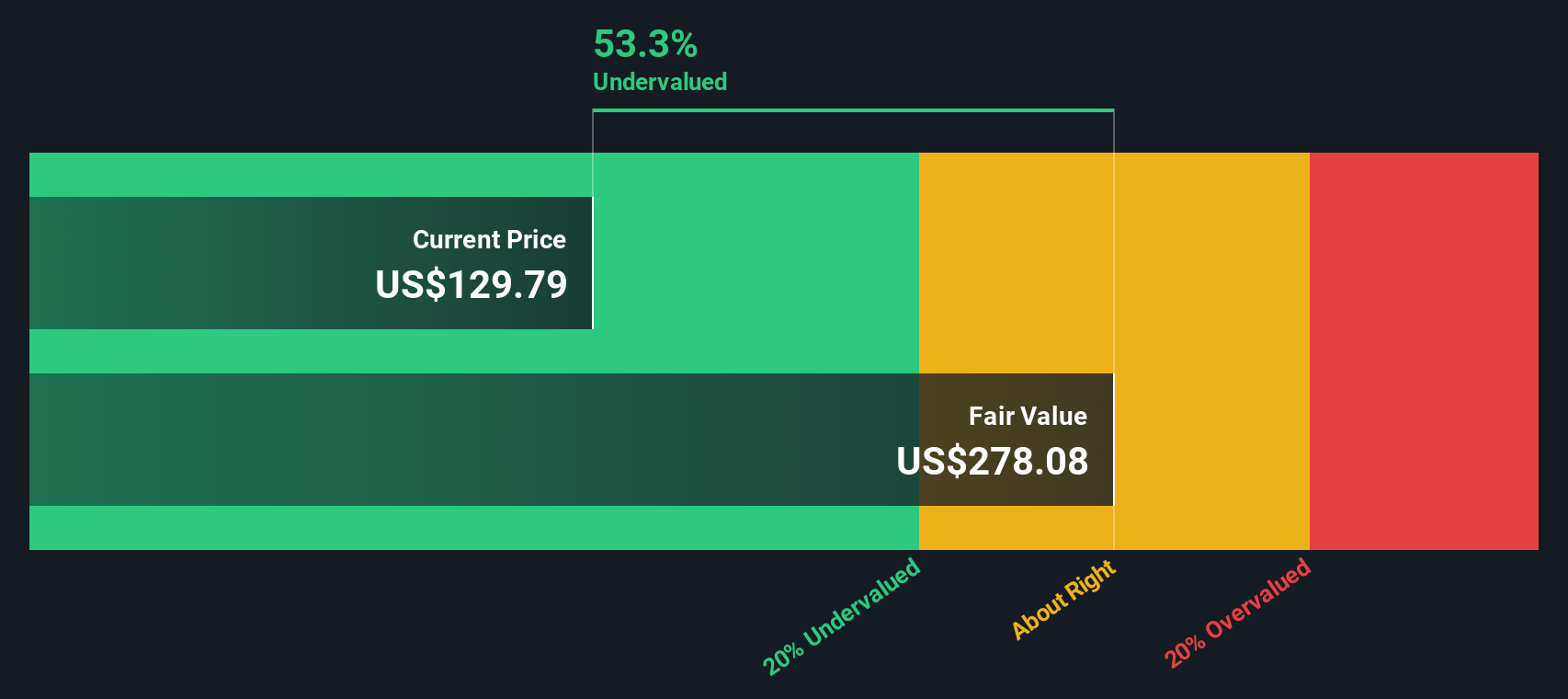

Despite the recent volatility, the company scores a perfect 6 out of 6 on valuation checks. That means Owens Corning comes up as undervalued by every major method our model considers. Does that mean it is automatically a strong buy? Not so fast. The real answer often depends on how you weigh those methods and what else might be hiding in the numbers. Next, we will break down exactly why Owens Corning’s valuation looks so attractive right now, and, later, introduce you to a smarter way to make sense of all those figures.

Why Owens Corning is lagging behind its peers

Approach 1: Owens Corning Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting its future cash flows and discounting them back to today’s value. For Owens Corning, this approach uses both analyst forecasts and long-term projections to calculate how much future free cash flow is really worth in today’s dollars.

As of the last twelve months, Owens Corning has generated $962.7 million in free cash flow. Analysts expect this figure to climb steadily, with forecasts reaching $1.4 billion by 2027. Beyond that, projections continue to rise, with estimated free cash flows surpassing $2.4 billion by 2035. However, numbers beyond 2027 are extrapolated and not directly from analysts.

Based on these cash flow estimates, the DCF model calculates Owens Corning’s intrinsic value at $326.21 per share. With the current share price trading at a 57.5% discount to this value, the model suggests the stock is substantially undervalued by DCF standards.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Owens Corning is undervalued by 57.5%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Owens Corning Price vs Earnings

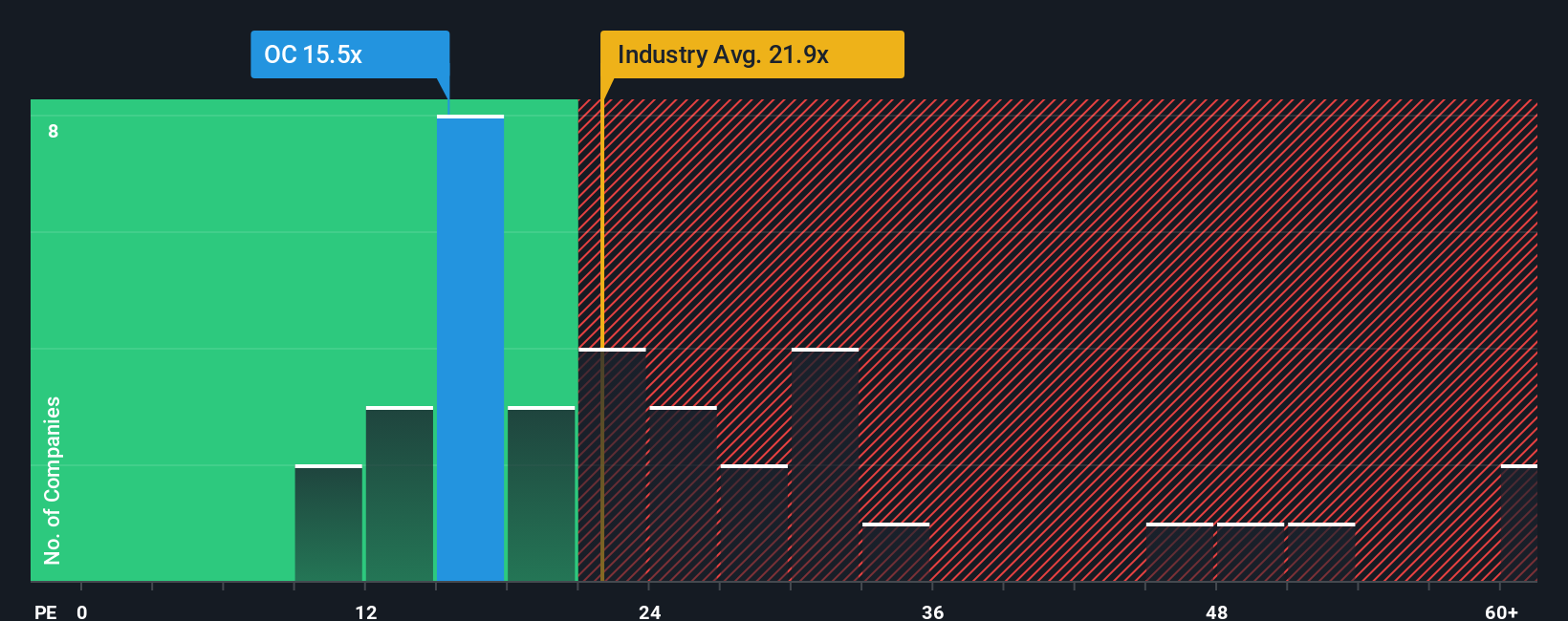

The Price-to-Earnings (PE) ratio is a popular way to value companies that are steadily profitable, like Owens Corning. Since it tells you how much investors are paying for each dollar of current earnings, it offers a quick pulse check on how the market views the company’s growth prospects and risks compared to its actual bottom line.

Generally, a higher PE is justified for businesses with above-average growth or lower risk, as investors are willing to pay more for future profits. Conversely, companies facing slower growth or greater uncertainty receive a lower PE. This makes benchmarking crucial. Owens Corning currently trades at 16.5x earnings, while the building industry average stands at 22.4x, and its closest peers average 24.6x. On face value, that is a considerable discount.

However, a simple average ignores the nuances that determine what a “fair” multiple should be. This is where Simply Wall St’s proprietary Fair Ratio comes in. For Owens Corning, this is calculated at 37.5x. Unlike broad peer or industry comparisons, the Fair Ratio fine-tunes expectations by factoring in growth rates, risk, profit margins, sector, and even market capitalization. This helps ensure the benchmark reflects Owens Corning’s specific situation rather than just broad averages.

With the actual PE (16.5x) well below the Fair Ratio (37.5x), Owens Corning currently appears significantly undervalued on an earnings basis.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Owens Corning Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a smarter, more flexible way to organize your investment view. A Narrative is simply your story about a company, bringing together your expectations for its future business performance, your assumptions about fair value, and how those numbers could play out based on what you know and believe. Narratives link the numbers to what actually matters by connecting the company's strategy, its latest results, and industry trends to a custom financial forecast and a fair value estimate, making it easy to see your rationale at a glance.

On Simply Wall St’s Community page, used by millions of investors, you can quickly build your own Narrative or explore those created by others. Narratives allow you to make buy or sell decisions by directly comparing the fair value from your forecast to the current price, and since they update automatically as new earnings or news are released, your outlook remains current without extra effort.

For example, two Owens Corning Narratives might look quite different: one investor, focused on sustainable construction trends and margin expansion, could estimate a fair value of $210.00 and a higher future earnings path, while another, more concerned about construction headwinds and competition, sets their fair value at $157.00. Narratives help you test your own thesis and see how it stacks up against the latest data and the views of others so you make more confident, informed decisions with every trade.

Do you think there's more to the story for Owens Corning? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:OC

Owens Corning

Provides residential and commercial building products in the United States, Europe, the Asia Pacific, and internationally.

Very undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives