- United States

- /

- Electrical

- /

- NYSE:NRGV

Not Many Are Piling Into Energy Vault Holdings, Inc. (NYSE:NRGV) Stock Yet As It Plummets 27%

The Energy Vault Holdings, Inc. (NYSE:NRGV) share price has fared very poorly over the last month, falling by a substantial 27%. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 25% in that time.

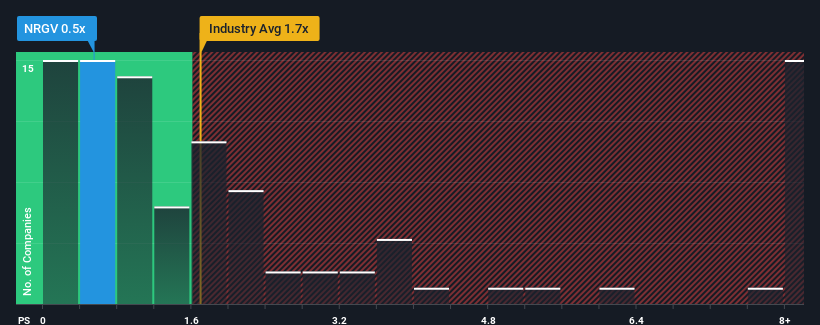

Following the heavy fall in price, Energy Vault Holdings' price-to-sales (or "P/S") ratio of 0.5x might make it look like a buy right now compared to the Electrical industry in the United States, where around half of the companies have P/S ratios above 1.7x and even P/S above 4x are quite common. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Energy Vault Holdings

What Does Energy Vault Holdings' Recent Performance Look Like?

Energy Vault Holdings certainly has been doing a good job lately as it's been growing revenue more than most other companies. It might be that many expect the strong revenue performance to degrade substantially, which has repressed the share price, and thus the P/S ratio. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Keen to find out how analysts think Energy Vault Holdings' future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The Low P/S?

The only time you'd be truly comfortable seeing a P/S as low as Energy Vault Holdings' is when the company's growth is on track to lag the industry.

Retrospectively, the last year delivered an exceptional 134% gain to the company's top line. However, the latest three year period hasn't been as great in aggregate as it didn't manage to provide any growth at all. So it appears to us that the company has had a mixed result in terms of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 69% per annum during the coming three years according to the six analysts following the company. With the industry only predicted to deliver 34% each year, the company is positioned for a stronger revenue result.

With this in consideration, we find it intriguing that Energy Vault Holdings' P/S sits behind most of its industry peers. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

What Does Energy Vault Holdings' P/S Mean For Investors?

Energy Vault Holdings' P/S has taken a dip along with its share price. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

A look at Energy Vault Holdings' revenues reveals that, despite glowing future growth forecasts, its P/S is much lower than we'd expect. When we see strong growth forecasts like this, we can only assume potential risks are what might be placing significant pressure on the P/S ratio. It appears the market could be anticipating revenue instability, because these conditions should normally provide a boost to the share price.

Before you settle on your opinion, we've discovered 4 warning signs for Energy Vault Holdings that you should be aware of.

If you're unsure about the strength of Energy Vault Holdings' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Energy Vault Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:NRGV

Energy Vault Holdings

Develops and deploys utility-scale energy storage solutions in United States, Australia, and internationally.

Adequate balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives