- United States

- /

- Machinery

- /

- NYSE:NPO

Enpro (NPO): Assessing Valuation as Shares React to Ongoing U.S. Government Shutdown Uncertainty

Reviewed by Kshitija Bhandaru

Enpro (NPO) shares slipped as the U.S. government shutdown dragged into its seventh day, prompting renewed investor unease. Market-wide uncertainty has intensified as economic data is delayed and operations at key federal agencies are disrupted.

See our latest analysis for Enpro.

Enpro’s recent share price dip stands in contrast to its strong year so far, with the stock still tallying a 32% year-to-date price gain and a robust 40% one-year total shareholder return. Ongoing government shutdown worries may be shaking short-term sentiment, but the company’s longer performance points to underlying momentum that has given shareholders significant rewards over the past several years.

If you’re curious to expand your search beyond the headlines, this is a great moment to discover fast growing stocks with high insider ownership.

But with shares off their highs and external pressures dominating the headlines, investors are left to wonder if Enpro’s stock is trading below its intrinsic value or if the market is already pricing in continued growth ahead.

Most Popular Narrative: 7% Undervalued

Enpro's narrative fair value of $241 stands above its last close at $223.42, suggesting analyst optimism and anticipation of further upside for the stock.

Elevated focus on product differentiation and applied engineering expertise in Sealing Technologies is enabling greater penetration into high-growth end markets such as semiconductors, life sciences, and aerospace. This reduces cyclicality and drives both top-line expansion and improved segment margins.

Want to know the math fueling this upside? The key calculation behind the fair value hinges on ambitious profit targets and a bold leap in segment margins. Wondering what other aggressive growth projections shape this price? Dive deeper to see what's driving this bullish outlook.

Result: Fair Value of $241 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing exposure to volatile end-markets and potential setbacks in new platform execution could quickly alter the company’s current growth outlook.

Find out about the key risks to this Enpro narrative.

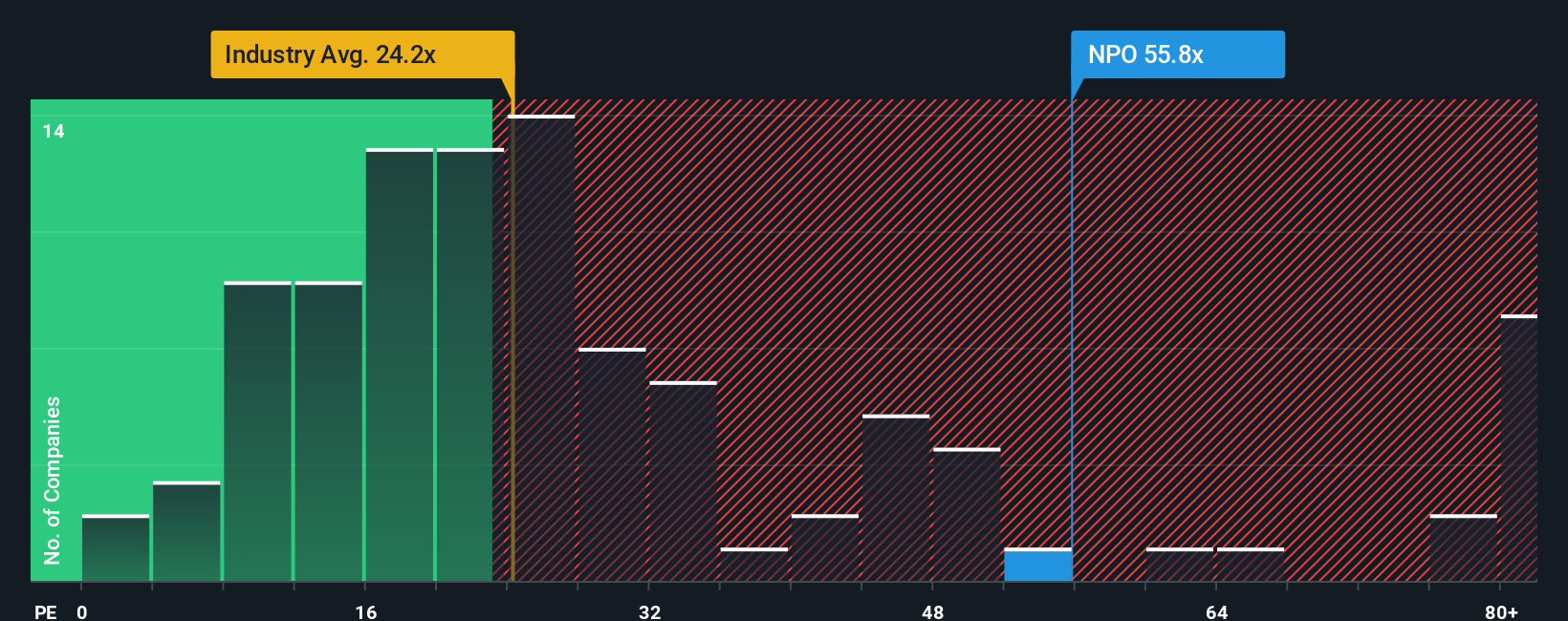

Another View: Market Multiples Paint a Different Picture

While analyst forecasts call for further upside, the stock’s current valuation using the common price-to-earnings measure tells a different story. Enpro’s ratio is a steep 55.6x, nearly double its peer average of 29x and well above the fair ratio of 32x. This premium suggests the market is factoring in a lot of future optimism, raising the risk that even small stumbles could prompt sharp corrections. Does this mean analyst targets are too bold, or is Enpro’s growth potential simply that strong?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Enpro Narrative

If these perspectives do not align with your own or you want to analyze the facts independently, you can craft your own take on Enpro in just a few minutes. Do it your way.

A great starting point for your Enpro research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If you want your portfolio to outpace the market, don't limit yourself. There are powerful opportunities ready for you right now on Simply Wall Street.

- Spot up-and-coming tech disruptors by checking out these 25 AI penny stocks, which are set to capitalize on the next wave of artificial intelligence.

- Secure consistent income by exploring these 19 dividend stocks with yields > 3%, offering attractive yields and stable cash flows for the long term.

- Position yourself ahead of trends by reviewing these 895 undervalued stocks based on cash flows, which could offer sizable upside if the market catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Enpro might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NPO

Enpro

An industrial technology company, design, develops, manufactures, and markets proprietary, value-added products and solutions to safeguard critical environments in the United States, Europe, Asia Pacific, and internationally.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives