- United States

- /

- Aerospace & Defense

- /

- NYSE:NPK

Do National Presto Industries's (NYSE:NPK) Earnings Warrant Your Attention?

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it completely lacks a track record of revenue and profit. And in their study titled Who Falls Prey to the Wolf of Wall Street?' Leuz et. al. found that it is 'quite common' for investors to lose money by buying into 'pump and dump' schemes.

So if you're like me, you might be more interested in profitable, growing companies, like National Presto Industries (NYSE:NPK). While profit is not necessarily a social good, it's easy to admire a business that can consistently produce it. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

Check out our latest analysis for National Presto Industries

How Fast Is National Presto Industries Growing Its Earnings Per Share?

Even with very modest growth rates, a company will usually do well if it improves earnings per share (EPS) year after year. So it's no surprise that some investors are more inclined to invest in profitable businesses. It's good to see that National Presto Industries's EPS have grown from US$5.78 to US$6.67 over twelve months. I doubt many would complain about that 15% gain.

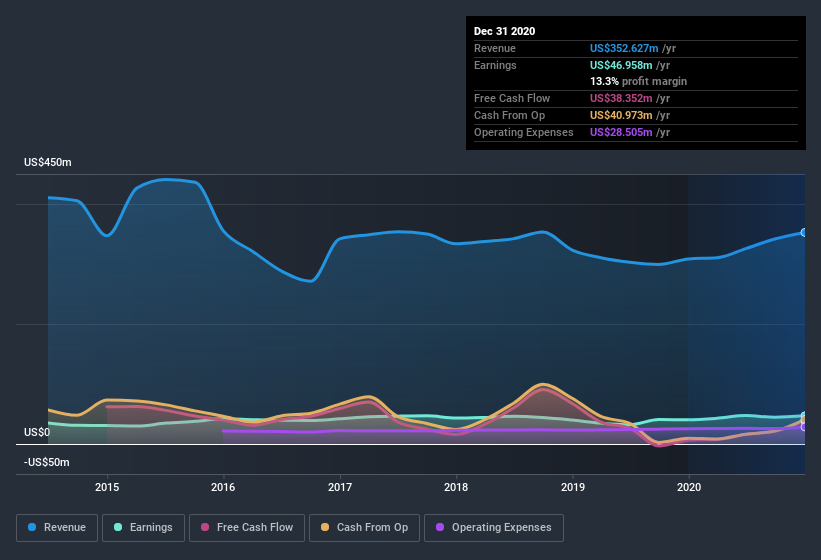

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. National Presto Industries maintained stable EBIT margins over the last year, all while growing revenue 14% to US$353m. That's a real positive.

In the chart below, you can see how the company has grown earnings, and revenue, over time. Click on the chart to see the exact numbers.

While profitability drives the upside, prudent investors always check the balance sheet, too.

Are National Presto Industries Insiders Aligned With All Shareholders?

It makes me feel more secure owning shares in a company if insiders also own shares, thusly more closely aligning our interests. As a result, I'm encouraged by the fact that insiders own National Presto Industries shares worth a considerable sum. Indeed, they have a glittering mountain of wealth invested in it, currently valued at US$190m. That equates to 26% of the company, making insiders powerful and aligned with other shareholders. So it might be my imagination, but I do sense the glimmer of an opportunity.

It means a lot to see insiders invested in the business, but I find myself wondering if remuneration policies are shareholder friendly. A brief analysis of the CEO compensation suggests they are. For companies with market capitalizations between US$400m and US$1.6b, like National Presto Industries, the median CEO pay is around US$2.2m.

The CEO of National Presto Industries only received US$722k in total compensation for the year ending . That's clearly well below average, so at a glance, that arrangement seems generous to shareholders, and points to a modest remuneration culture. CEO compensation is hardly the most important aspect of a company to consider, but when its reasonable that does give me a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of good governance, more generally.

Is National Presto Industries Worth Keeping An Eye On?

One important encouraging feature of National Presto Industries is that it is growing profits. Earnings growth might be the main game for National Presto Industries, but the fun does not stop there. With a meaningful level of insider ownership, and reasonable CEO pay, a reasonable mind might conclude that this is one stock worth watching. Before you take the next step you should know about the 1 warning sign for National Presto Industries that we have uncovered.

You can invest in any company you want. But if you prefer to focus on stocks that have demonstrated insider buying, here is a list of companies with insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you’re looking to trade National Presto Industries, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if National Presto Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NYSE:NPK

National Presto Industries

Provides housewares and small appliance, defense, and safety products in North America.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives