- United States

- /

- Aerospace & Defense

- /

- NYSE:NOC

The Bull Case For Northrop Grumman (NOC) Could Change Following Major Defense Contract Wins for F-35 Tech

Reviewed by Sasha Jovanovic

- In recent weeks, Northrop Grumman was awarded major contracts for advanced radar systems for the F-35 and counter-explosive device technologies, with work extending through 2029 and portions allocated to Australian military sales.

- These wins highlight Northrop Grumman's continued role as a core defense supplier for global armed forces and strengthen its visibility into long-term government procurement spending.

- We'll explore how the recent contract awards for key technologies may impact Northrop Grumman's growth prospects and investment case.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Northrop Grumman Investment Narrative Recap

To be a Northrop Grumman shareholder, you need to believe continued government and allied defense spending, along with success on major programs like B-21 and Sentinel, will outweigh exposure to large contract risks and shifting defense trends. The latest awards for radar and counter-explosive systems help support near-term visibility into order books, but do not fundamentally change the most important short-term catalysts, defense budget flows and B-21 timing, nor do they alter the biggest risks around program execution or future government demand.

Among recent announcements, the $97.5 million contract for advanced APG-85 radar systems stands out, underscoring Northrop Grumman’s role in core fighter jet technologies for the U.S. and its allies. This award highlights ongoing reliance on defense procurement and the company’s exposure to large, politically sensitive programs as catalysts that keep order momentum strong but also carry heightened risk should government priorities shift or budgets tighten.

However, it’s important for investors to keep in mind that if political priorities change or major government programs are delayed...

Read the full narrative on Northrop Grumman (it's free!)

Northrop Grumman is projected to reach $47.5 billion in revenue and $4.4 billion in earnings by 2028. This outlook assumes a 5.5% annual revenue growth rate and a $0.5 billion increase in earnings from the current $3.9 billion.

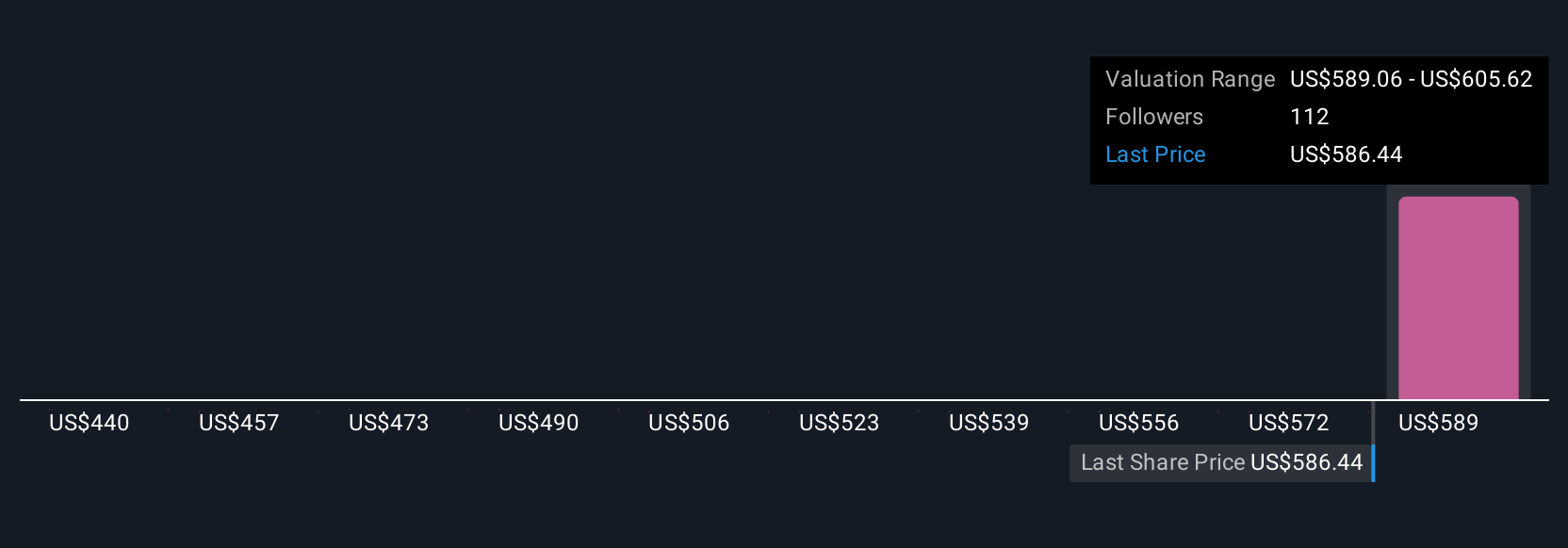

Uncover how Northrop Grumman's forecasts yield a $603.32 fair value, in line with its current price.

Exploring Other Perspectives

Five private investors in the Simply Wall St Community valued Northrop Grumman between US$450 and US$603,316 per share, showing substantial variation in outlooks. Against this backdrop of differing views, the company’s dependence on large U.S. government programs continues to be a major consideration as you weigh potential risks and opportunities.

Explore 5 other fair value estimates on Northrop Grumman - why the stock might be worth 26% less than the current price!

Build Your Own Northrop Grumman Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Northrop Grumman research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Northrop Grumman research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Northrop Grumman's overall financial health at a glance.

Searching For A Fresh Perspective?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Northrop Grumman might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NOC

Northrop Grumman

Operates as an aerospace and defense technology company in the United States, the Asia/Pacific, Europe, and internationally.

Proven track record average dividend payer.

Similar Companies

Market Insights

Community Narratives