- United States

- /

- Aerospace & Defense

- /

- NYSE:NOC

Northrop Grumman (NOC) Valuation: Assessing Upside Potential Ahead of Earnings and Analyst Upgrades

Reviewed by Simply Wall St

Northrop Grumman (NOC) is set to announce its earnings this week, drawing attention from investors as expectations for revenue growth are higher than last year. Recent analyst upgrades have added momentum ahead of the report.

See our latest analysis for Northrop Grumman.

Northrop Grumman's share price has surged 29% year to date, outpacing the broader market. Its one-year total shareholder return of nearly 18% highlights growing optimism, fueled in part by upbeat earnings expectations and a series of recent analyst upgrades.

If defense stocks and industry momentum have you interested, take the next step and discover See the full list for free.

Given the stock’s strong rally and a wave of bullish analyst upgrades, the key question is whether Northrop Grumman still offers upside for new investors or if the market has already anticipated its next leg of growth.

Most Popular Narrative: 2.2% Undervalued

Northrop Grumman's narrative fair value ($615.56) sits modestly above its last close price of $602, signaling potential for further upside if narrative conditions play out. This positions the stock slightly ahead of market expectations and highlights how analysts are weighing upcoming catalysts.

The ramp-up of advanced autonomous and integrated systems such as Beacon and IBCS, combined with ongoing investments in solid rocket motor capacity (targeting a near-doubling by 2029), positions the company to capitalize on high-growth, higher-margin market segments. This may enhance future operating margins and underlying cash flow.

Want to see how this high-margin vision turns into valuation? The narrative blends aggressive growth assumptions and ambitious program expansions with premium future earnings multiples. Find out what financial levers, projections, and bold sector forecasts support this above-market fair value.

Result: Fair Value of $615.56 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, despite optimism, reliance on large government contracts and potential production delays remain key risks that could challenge Northrop Grumman's growth story.

Find out about the key risks to this Northrop Grumman narrative.

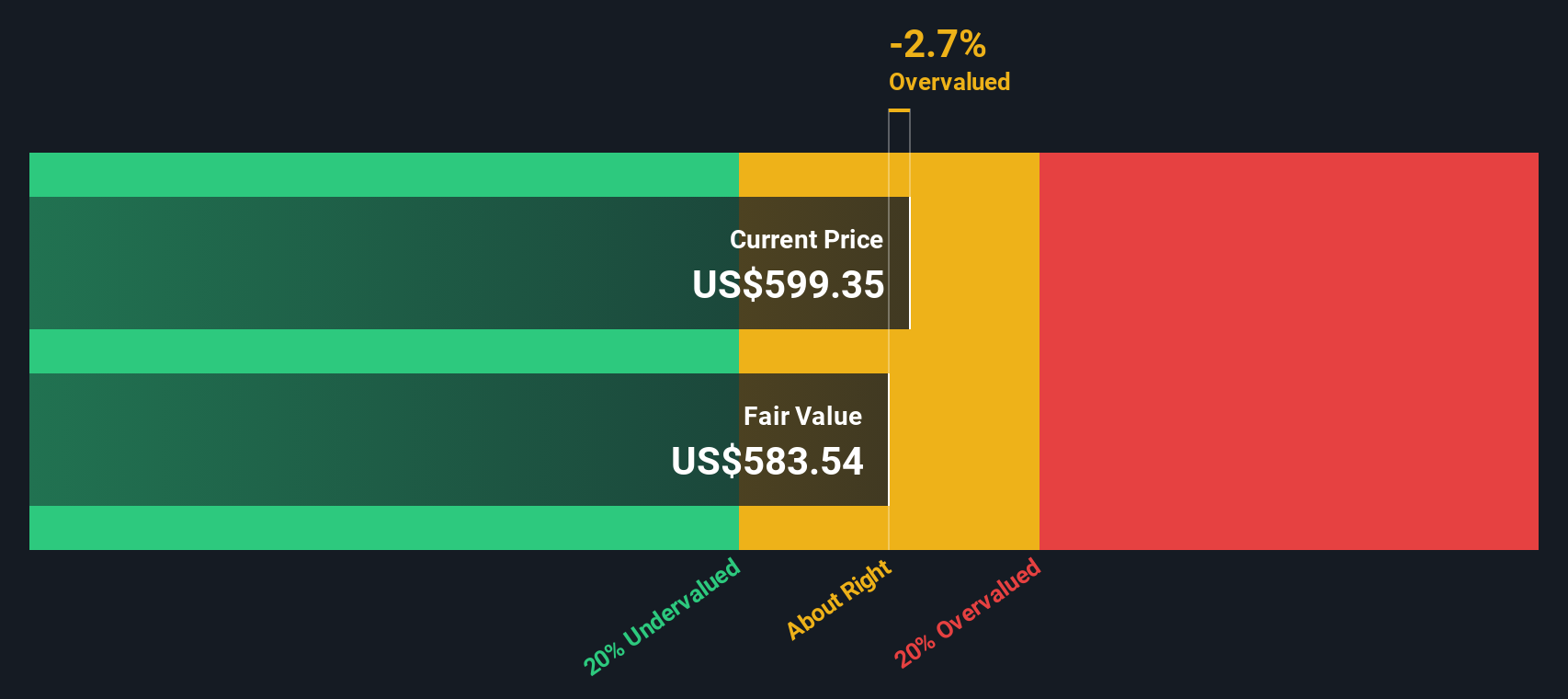

Another View: Our DCF Model's Verdict

Taking a step back, our SWS discounted cash flow (DCF) model suggests Northrop Grumman, currently trading at $602, sits above its calculated fair value of $541.48. This presents a more conservative take, hinting at limited upside unless new growth surprises materialize. Which method will prove right as market conditions evolve?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Northrop Grumman for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Northrop Grumman Narrative

If you want to dive into the numbers and craft your own perspective, you can build a personal narrative in just a few short minutes. Do it your way

A great starting point for your Northrop Grumman research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t let your next big opportunity slip away. Use the Simply Wall Street Screener to target stocks that match what matters to you and your investment goals.

- Unlock potential growth by checking out these 874 undervalued stocks based on cash flows, which may be trading below their intrinsic value right now.

- Capture innovation trends by scanning these 24 AI penny stocks, powered by advancements in artificial intelligence and smart technologies.

- Secure regular income by reviewing these 17 dividend stocks with yields > 3%, offering yields above 3% for reliable cash flow.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Northrop Grumman might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NOC

Northrop Grumman

Operates as an aerospace and defense technology company in the United States, the Asia/Pacific, Europe, and internationally.

Proven track record average dividend payer.

Similar Companies

Market Insights

Community Narratives