- United States

- /

- Aerospace & Defense

- /

- NYSE:NOC

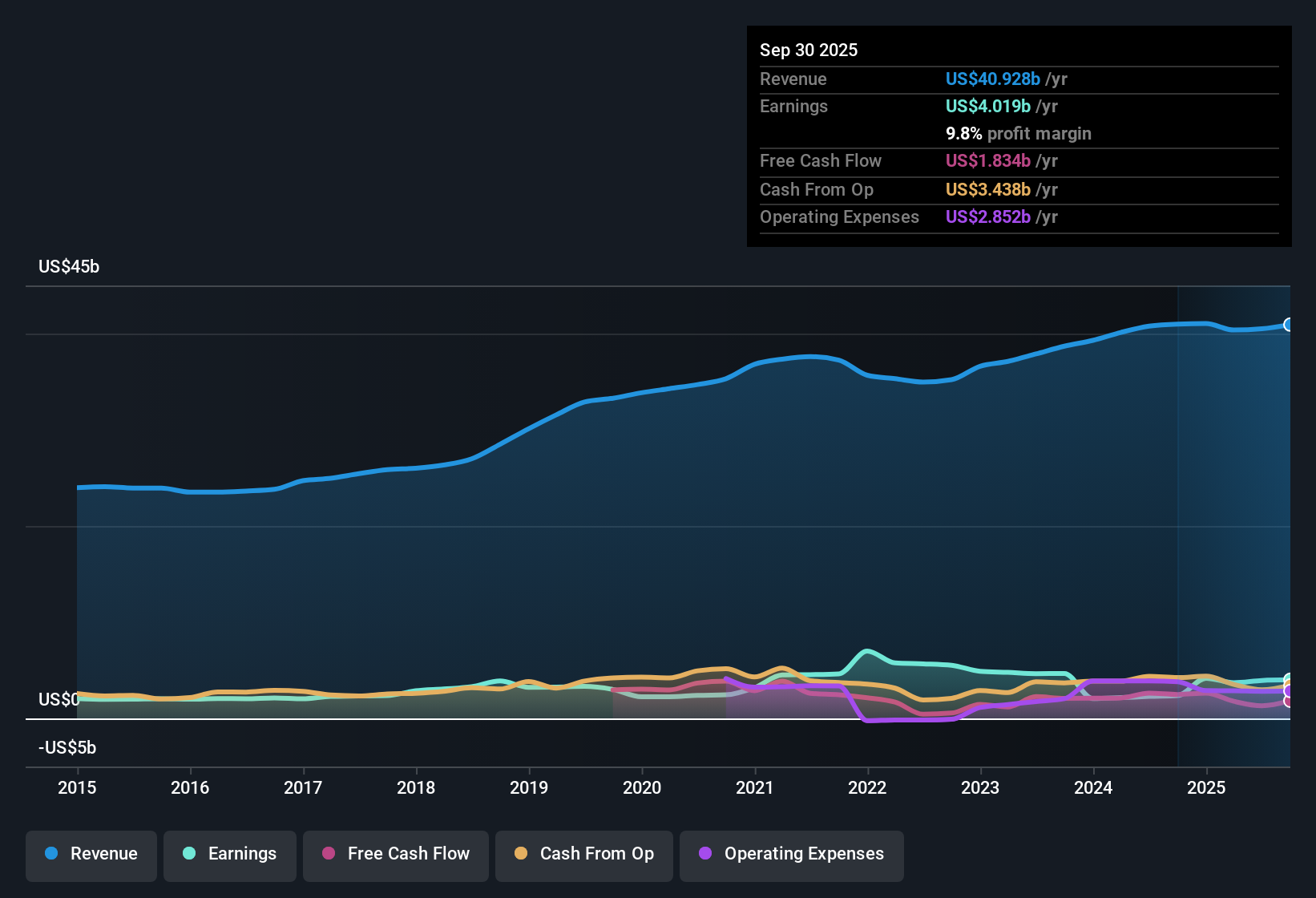

Northrop Grumman (NOC) Earnings Surge 69% Challenges Muted Growth Narrative

Reviewed by Simply Wall St

Northrop Grumman (NOC) delivered standout earnings this year, with profit surging by 69.2% and net profit margins climbing to 9.8%, compared to last year's 5.8%. While forward-looking growth and revenue expectations are more reserved, forecasts still call for annual EPS growth of around 4.1% and revenue rising 4.9% per year. Both figures trail behind the broader US market’s pace.

See our full analysis for Northrop Grumman.Next, we’ll see how these figures stack up when set against the major narratives that shape investor sentiment and drive expectations around Northrop Grumman’s outlook.

See what the community is saying about Northrop Grumman

PE Ratio Stays Below Industry Average

- Northrop Grumman’s Price-to-Earnings ratio of 21.4x is well below both the Aerospace & Defense industry average (39.0x) and its direct peer group (37.3x). This means current investors pay less per dollar of earnings compared to most competitors.

- The analysts' consensus view notes that while shares are trading just above DCF fair value ($599.35 compared to DCF fair value of $587.62), the discounted PE relative to peers and the sector supports Northrop’s position as a comparatively well-priced, high-quality stock.

- This valuation gap is in line with a consensus price target of 647.22, which is 8% above the present share price, indicating moderate upside if forecasts remain unchanged.

- Consensus also points out that Northrop’s lower PE may help balance muted long-term growth expectations compared with the faster-growing US market.

Profit Margins Climb, Room to Narrow

- Net profit margins have risen to 9.8%, a significant increase from last year’s 5.8%. However, analysts expect this figure to contract slightly to 9.3% within three years.

- The analysts' consensus view notes that while operating margins have been recently supported by stronger international demand and higher-margin contracts, heavy dependence on major US defense programs could introduce future volatility.

- Consensus highlights that current strength is driven by the ramp-up of higher-margin platforms, such as B-21 Raider and Sentinel, which are contributing to improved profitability.

- However, ongoing execution risks and shifting government priorities could affect margin stability over the next few years.

Dividend Remains a Highlight Amid Slower Growth

- Northrop Grumman remains recognized for its attractive dividends, even as profit and revenue are expected to grow more slowly than the market (company EPS growth forecast: 4.1% compared to US market 15.5%).

- The analysts' consensus view explains that this steady payout supports the investment appeal for income-focused shareholders, particularly given the company’s strong profitability and lower valuation compared to peers.

- Consensus finds that even with a slower growth outlook, Northrop’s consistent dividend and strong record of earnings can provide stability for long-term holders.

- With share repurchases expected to reduce outstanding shares by about 1.7% per year, consensus anticipates that dividend sustainability and share buyback support will remain attractive features.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Northrop Grumman on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a unique take on these results? Share your perspective and shape your story in minutes by clicking Do it your way.

A great starting point for your Northrop Grumman research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Northrop Grumman’s limited earnings and revenue growth forecasts indicate slower expansion compared to the broader market, which may limit future upside potential for investors.

If you want to target companies with stronger, more consistent growth, use our stable growth stocks screener (2087 results) to zero in on businesses delivering reliable performance year after year.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Northrop Grumman might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NOC

Northrop Grumman

Operates as an aerospace and defense technology company in the United States, the Asia/Pacific, Europe, and internationally.

Solid track record established dividend payer.

Similar Companies

Market Insights

Community Narratives