- United States

- /

- Aerospace & Defense

- /

- NYSE:NOC

Northrop Grumman (NOC): Assessing Valuation After New Defense Contracts Boost Sector Optimism

Reviewed by Kshitija Bhandaru

Northrop Grumman (NOC) shares are in focus after the company secured new contracts worth nearly $146 million, covering counter-explosive device systems and F-35 radar procurement. Broader gains across defense stocks are also supporting sentiment in the sector.

See our latest analysis for Northrop Grumman.

Northrop Grumman’s recent contract wins arrive amid steady sector momentum, driven by increased Pentagon spending and industry-wide pushes for advanced defense systems. Despite these tailwinds, the company’s share price has held steady overall, while its total shareholder returns have moved up modestly over the past year and grown more strongly over longer horizons. This signals slow but consistent progress rather than a surge in short-term momentum.

If Northrop’s latest moves have you eyeing the broader defense sector, now is a good time to explore other industry leaders. See the full list with our See the full list for free..

Given these strong contract wins and a share price hovering just below analyst targets, the key question for investors is whether Northrop Grumman’s growth is already fully reflected in the current valuation or if a true buying opportunity remains.

Most Popular Narrative: Fairly Valued

Northrop Grumman’s latest share price of $605.01 sits just above the narrative’s estimated fair value of $603.32, placing it in line with consensus expectations. This close gap points to a market that has already priced in many of the company’s widely discussed growth drivers.

Accelerating U.S. and allied defense spending, supported by substantial increases in procurement and RDT&E budgets (for example, a 22% increase in U.S. spending for FY26) and significant new funding for key Northrop Grumman programs (B-21, Sentinel, and E-2D), is expected to drive sustained revenue growth and provide multi-year order visibility.

What’s the math fueling this fair value? Analysts are projecting higher sales, tighter margins, and a surprisingly optimistic earnings milestone. Curious about the assumptions that power this precise price target? Unlock the full valuation story to discover what could sway the balance in the next few years.

Result: Fair Value of $603.32 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained reliance on major U.S. contracts and shifting global defense trends could quickly challenge the fair value story for Northrop Grumman.

Find out about the key risks to this Northrop Grumman narrative.

Another View: What Do the Multiples Say?

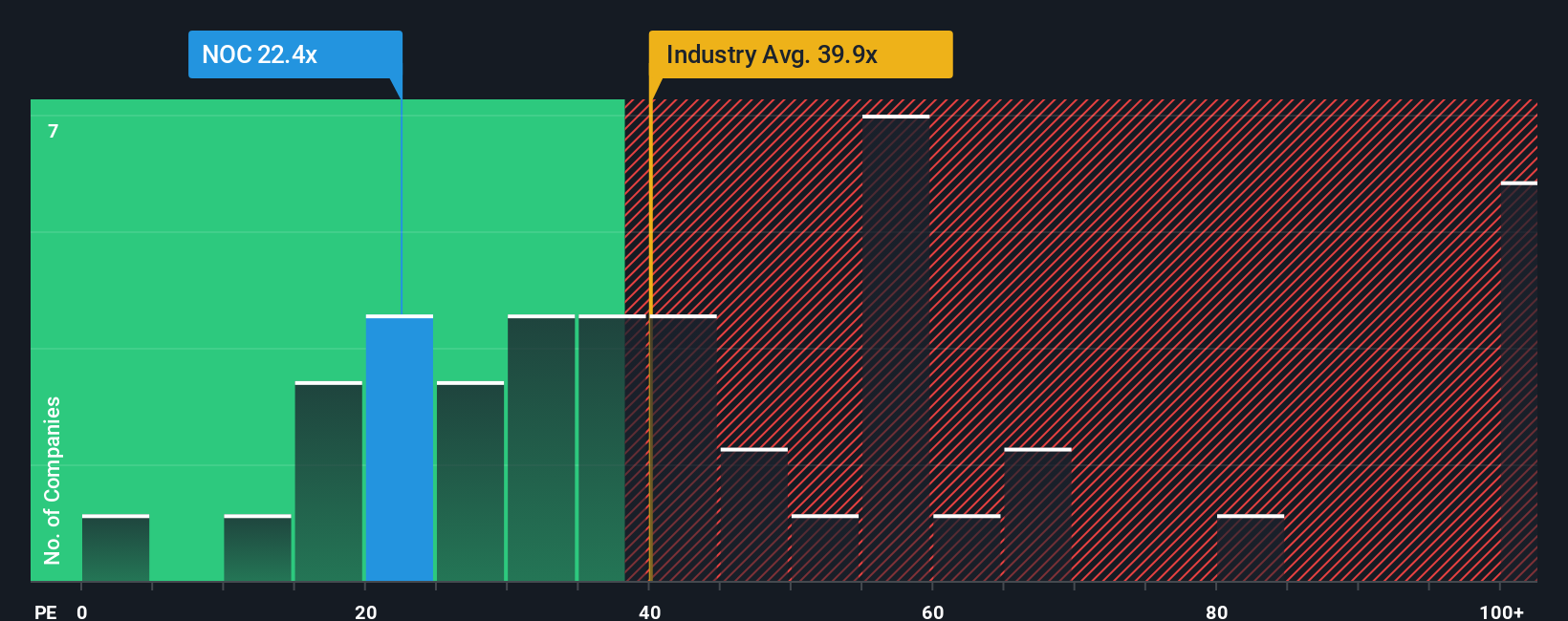

Looking at Northrop Grumman’s valuation through the lens of price-to-earnings, shares trade at 22x, which is not only below the industry average of 39.1x but also under the fair ratio of 26.2x for this company. This implies the market is pricing in less growth or more risk. Are the concerns justified?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Northrop Grumman Narrative

If you see the story differently, or simply want to dig into the data yourself for a fresh perspective, you can create your own narrative in just a few minutes. Do it your way

A great starting point for your Northrop Grumman research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Take your investing to the next level with actionable stock picks tailored to different trends and strategies, so you never miss out on new opportunities.

- Tap into higher yields by seeing which companies make the cut with these 19 dividend stocks with yields > 3%, offering strong and sustainable payouts above market averages.

- Supercharge your watchlist by honing in on these 906 undervalued stocks based on cash flows, with untapped growth potential based on cash flow fundamentals and current market inefficiencies.

- Push the boundaries of innovation by searching these 26 quantum computing stocks, at the forefront of quantum computing breakthroughs and next-generation technology.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Northrop Grumman might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NOC

Northrop Grumman

Operates as an aerospace and defense technology company in the United States, the Asia/Pacific, Europe, and internationally.

Proven track record average dividend payer.

Similar Companies

Market Insights

Community Narratives