- United States

- /

- Aerospace & Defense

- /

- NYSE:NOC

Does Northrop Grumman’s Lowered Guidance Signal Shifting Growth Momentum for NOC?

Reviewed by Sasha Jovanovic

- Northrop Grumman recently reported strong third-quarter profits and operational gains, but lowered its full-year revenue guidance to US$41.7 billion–US$41.9 billion, citing delays in contract awards and challenges in its aeronautics-systems business.

- Alongside improved segment margins, international growth, and progress with key programs like the B-21 bomber, these mixed results reflect both momentum and headwinds for the company’s outlook.

- We'll assess how the reduced revenue guidance and contract timing issues influence Northrop Grumman’s investment narrative and growth prospects.

Find companies with promising cash flow potential yet trading below their fair value.

Northrop Grumman Investment Narrative Recap

To be a shareholder in Northrop Grumman, you need to believe in the ongoing strength of global defense spending, the company’s ability to deliver on next-generation platforms like the B-21 bomber, and resilience in the face of contract timing risks. The recent lowering of full-year revenue guidance, prompted by delayed contract awards and headwinds in the aeronautics-systems business, is a reminder that even operational gains and international growth cannot fully offset the company’s exposure to large, lumpy U.S. government contracts and budget uncertainty in the near term. Accordingly, these timing issues appear to be material for the stock’s short-term direction, emphasizing contract flow as the most important near-term catalyst and contract delays as the biggest immediate risk.

One highly relevant announcement is Northrop Grumman’s downwards revision of 2025 sales guidance to US$41.7–US$41.9 billion, which moves the midpoint below previous expectations. This comes despite the company increasing its profit outlook and continuing to execute well on key programs, including B-21 test milestones, missile defense contracts, and a significant rise in international sales. The guidance cut, still paired with improved margin performance, brings the central question back to revenue visibility and execution risk on major program awards, which are likely to shape sentiment and stock performance until new contract activity improves.

Yet, despite solid quarterly results, investors should be aware that large program delays remain a meaningful risk for Northrop Grumman’s earnings visibility and...

Read the full narrative on Northrop Grumman (it's free!)

Northrop Grumman's outlook anticipates $47.5 billion in revenue and $4.4 billion in earnings by 2028. This is based on a projected 5.5% annual revenue growth rate and reflects a $0.5 billion increase in earnings from the current $3.9 billion.

Uncover how Northrop Grumman's forecasts yield a $647.22 fair value, a 9% upside to its current price.

Exploring Other Perspectives

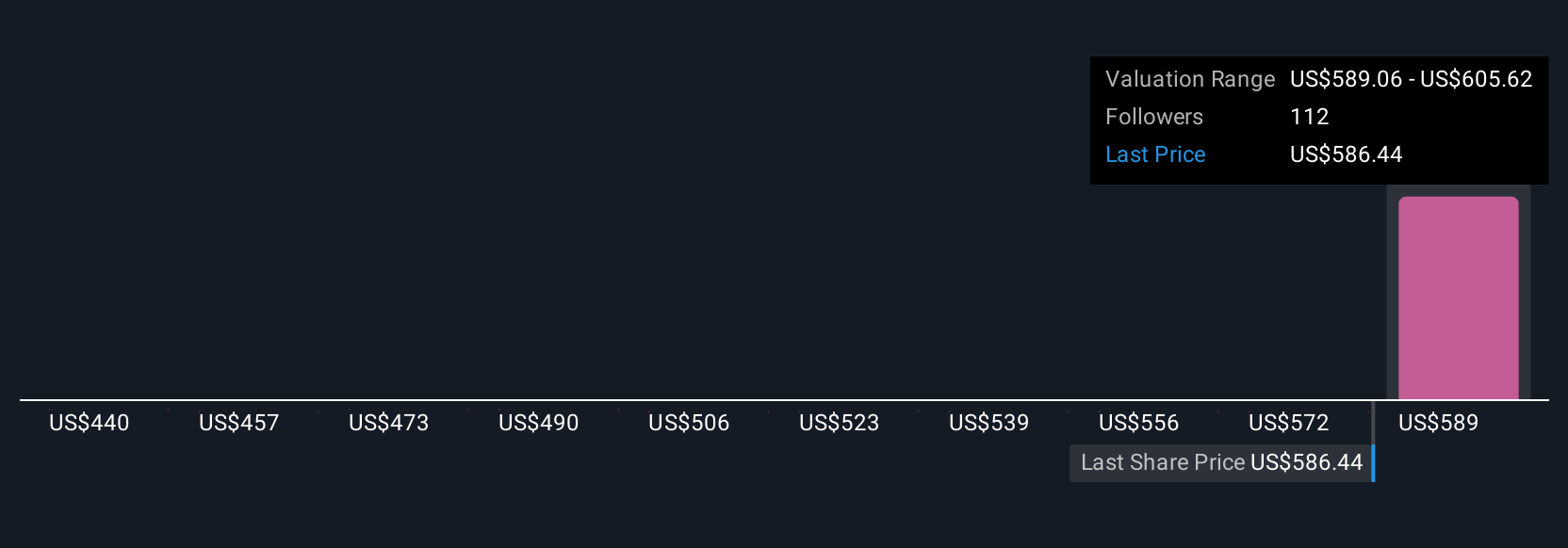

Six different private investor fair value estimates in the Simply Wall St Community range from US$392.89 to US$647.22, a spread of more than US$250 per share. Contract timing and program delays continue to loom over the company’s outlook, reminding you that multiple viewpoints often point toward very different expectations for Northrop Grumman’s future progress.

Explore 6 other fair value estimates on Northrop Grumman - why the stock might be worth 34% less than the current price!

Build Your Own Northrop Grumman Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Northrop Grumman research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Northrop Grumman research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Northrop Grumman's overall financial health at a glance.

Contemplating Other Strategies?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Northrop Grumman might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NOC

Northrop Grumman

Operates as an aerospace and defense technology company in the United States, the Asia/Pacific, Europe, and internationally.

Solid track record established dividend payer.

Similar Companies

Market Insights

Community Narratives