- United States

- /

- Construction

- /

- NYSE:MTZ

MasTec (MTZ) Explores M&A Opportunities To Enhance Earnings And Expand Service Offerings

Reviewed by Simply Wall St

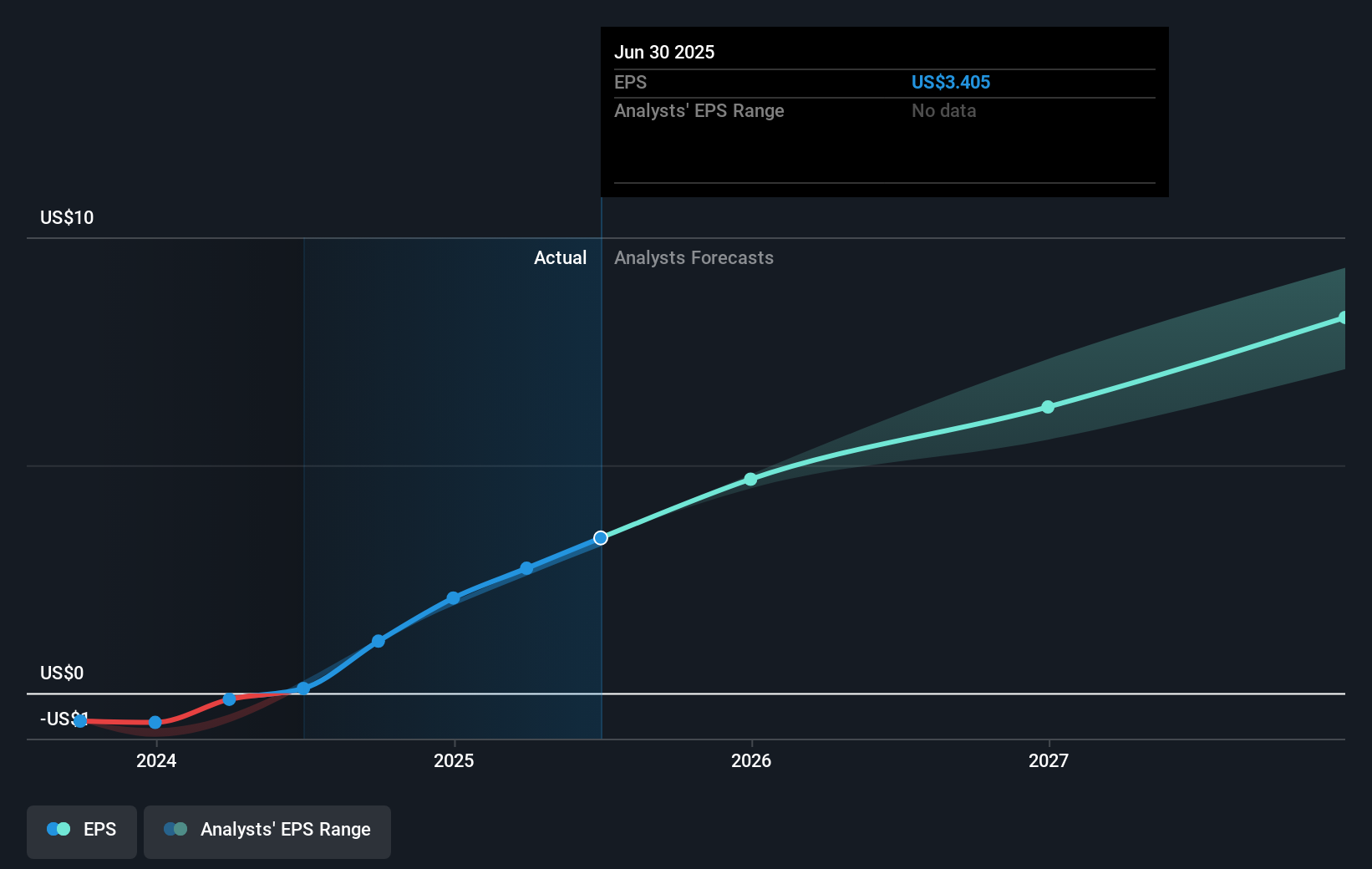

MasTec (MTZ) is actively pursuing growth through mergers and acquisitions, as stated by CFO Paul Dimarco, which aligns with the company's strategic goals and could boost its market position. Over the past quarter, MasTec's share price rose by 16%, a significant movement that coincides with a broader positive market trend, where major U.S. stock indexes have also achieved record highs. The company's Q2 2025 earnings report, which showed substantial year-over-year growth in sales and net income, along with raised guidance for future performance, likely supported this upward momentum. Additionally, the improvement in overall market sentiment, fueled by expected Federal Reserve rate cuts, would have further bolstered investor confidence in MasTec's future prospects.

We've spotted 2 warning signs for MasTec you should be aware of, and 1 of them is a bit concerning.

The recent news regarding MasTec's active pursuit of growth through mergers and acquisitions could have significant implications on the company's future trajectory, directly impacting the forecasts for revenue and earnings. This strategic focus aligns with the company's strengths in its core markets of energy and communications infrastructure, potentially enhancing revenue and scaling opportunities. With the share price currently at US$190.12, close to the analyst price target of US$205.39, investor confidence may be bolstered by these expansion efforts, considering the favorable broader market trends and renewed policy support.

Over the past five years, MasTec's total shareholder return has been considerable, with an increase of over 300%. This impressive growth surpasses the one-year performance of the US construction market, where MasTec's returns have exceeded the industry's 56.6% benchmark. Such growth highlights the company's success in capitalizing on industry trends and executing its strategic plans.

By integrating recent policy developments and operational efficiencies, the company is well-positioned to sustain its revenue momentum and uplift earnings forecasts, projected to grow by 9.6% annually over the next few years. Analysts, however, advise weighing these assumptions against potential risks, such as dependency on top-tier customers and regulatory shifts, which could dampen the anticipated market upside if demand or execution falters.

Explore historical data to track MasTec's performance over time in our past results report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MTZ

MasTec

An infrastructure construction company, provides engineering, building, installation, maintenance, and upgrade services for communications, energy, utility, and other infrastructure primarily in the United States and Canada.

Proven track record with moderate growth potential.

Similar Companies

Market Insights

Community Narratives