- United States

- /

- Construction

- /

- NYSE:MTZ

Is MasTec's (MTZ) Acquisition Ambitions a New Chapter in Its Growth Strategy?

Reviewed by Simply Wall St

- Earlier this month, MasTec’s leadership revealed at industry conferences and in public statements that the company is actively seeking acquisition opportunities, with CFO Paul DiMarco emphasizing a focus on deals that would add to earnings and expand service offerings.

- This disclosure coincides with strong analyst sentiment and sector-wide momentum following macroeconomic signals of easing inflation, further highlighting MasTec’s selective approach to M&A as it weighs both growth prospects and operational discipline.

- We'll explore how MasTec’s openness to value-accretive acquisitions could influence its investment narrative and long-term growth expectations.

AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

MasTec Investment Narrative Recap

To be a MasTec shareholder today, you need to believe in the long-term expansion of North America's infrastructure and MasTec's ability to capitalize on rising demand for energy, utility, and communication projects. The company’s recent openness toward selective acquisitions may complement the ongoing sector momentum, but does not materially shift the most significant short-term catalyst: operational leverage from strong backlog execution. The greatest near-term risk remains execution on large projects with elevated fixed costs, especially if demand or project timing falters.

Among recent company updates, MasTec’s raised earnings guidance for 2025 stands out. This reflects management’s expectation for higher revenue and profitability, underscoring the importance of robust project pipeline conversion and efficient cost control as short-term catalysts. The latest M&A commentary may support long-term growth, yet near-term performance still hinges on delivering against ambitious internal targets and managing operational complexity.

By contrast, investors also need to be aware of how client concentration could expose MasTec to unpredictable swings in revenue if...

Read the full narrative on MasTec (it's free!)

MasTec's narrative projects $17.2 billion in revenue and $730.8 million in earnings by 2028. This requires 9.6% yearly revenue growth and a $465.2 million earnings increase from $265.6 million currently.

Uncover how MasTec's forecasts yield a $205.39 fair value, a 8% upside to its current price.

Exploring Other Perspectives

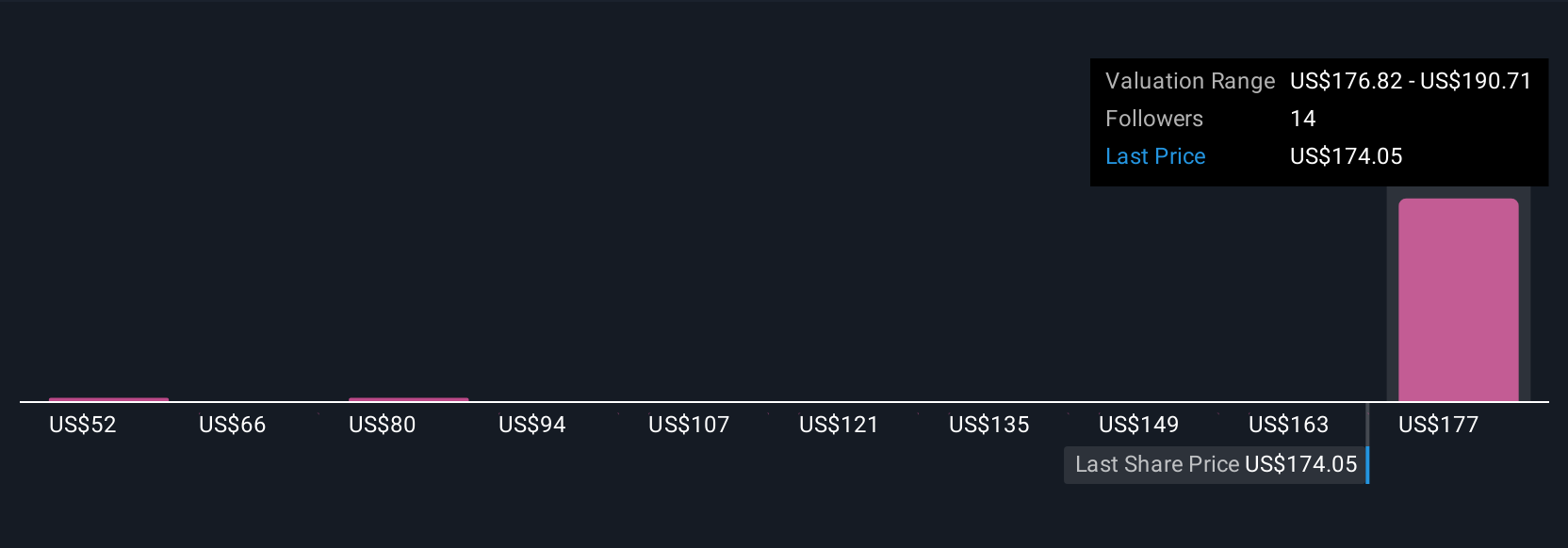

Four Simply Wall St Community members estimate MasTec’s fair value from US$51.88 to US$205.39, showing a broad spectrum of views. With execution risk on large projects an ongoing concern, different assumptions about revenue consistency can lead to dramatically different outlooks.

Explore 4 other fair value estimates on MasTec - why the stock might be worth as much as 8% more than the current price!

Build Your Own MasTec Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your MasTec research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free MasTec research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate MasTec's overall financial health at a glance.

No Opportunity In MasTec?

Our top stock finds are flying under the radar-for now. Get in early:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- This technology could replace computers: discover 25 stocks that are working to make quantum computing a reality.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MTZ

MasTec

An infrastructure construction company, provides engineering, building, installation, maintenance, and upgrade services for communications, energy, utility, and other infrastructure primarily in the United States and Canada.

Proven track record with moderate growth potential.

Similar Companies

Market Insights

Community Narratives