- United States

- /

- Trade Distributors

- /

- NYSE:MSM

MSC Industrial Direct Co., Inc. (NYSE:MSM) Should Be In Your Dividend Portfolio, Here's Why

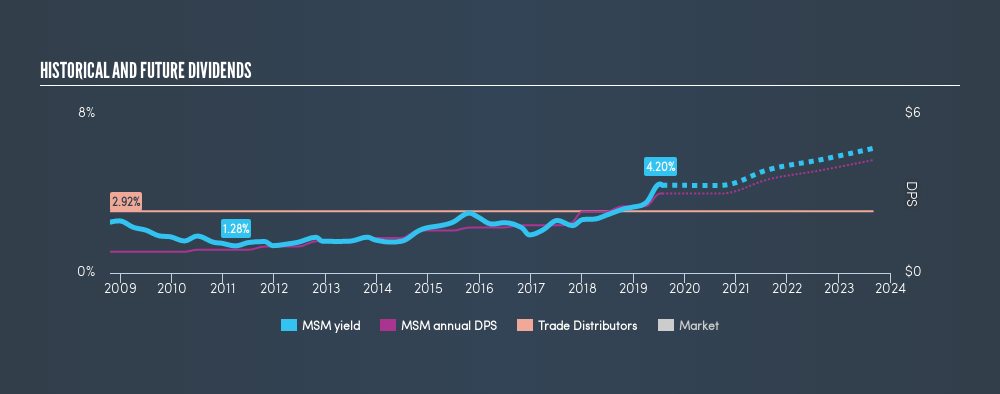

If you are an income investor, then MSC Industrial Direct Co., Inc. (NYSE:MSM) should be on your radar. MSC Industrial Direct Co., Inc., together with its subsidiaries, distributes metalworking and maintenance, repair, and operations (MRO) products in the United States, Canada, and the United Kingdom. Over the past 10 years, the US$4.0b market cap company has been growing its dividend payments, from $0.80 to $3. Currently yielding 4.1%, let's take a closer look at MSC Industrial Direct's dividend profile.

See our latest analysis for MSC Industrial Direct

What Is A Dividend Rock Star?

It is a stock that pays a consistent, reliable and competitive dividend over a long period of time, and is expected to continue to pay in the same manner many years to come. More specifically:

- Its annual yield is among the top 25% of dividend payers

- It consistently pays out dividend without missing a payment or significantly cutting payout

- Its has increased its dividend per share amount over the past

- It is able to pay the current rate of dividends from its earnings

- It is able to continue to payout at the current rate in the future

High Yield And Dependable

MSC Industrial Direct's yield sits at 4.1%, which is high for Trade Distributors stocks. But the real reason MSC Industrial Direct stands out is because it has a proven track record of continuously paying out this level of dividends, from earnings, to shareholders and can be expected to continue paying in the future. This is a highly desirable trait for a stock holding if you're investor who wants a robust cash inflow from your portfolio over a long period of time.

If there's one type of stock you want to be reliable, it's dividend stocks and their stable income-generating ability. MSM has increased its DPS from $0.80 to $3 in the past 10 years. It has also been paying out dividend consistently during this time, as you'd expect for a company increasing its dividend levels. This is an impressive feat, which makes MSM a true dividend rockstar.

MSC Industrial Direct has a trailing twelve-month payout ratio of 46%, which means that the dividend is covered by earnings. Going forward, analysts expect MSM's payout to increase to 61% of its earnings. Assuming a constant share price, this equates to a dividend yield of 4.1%. In addition to this, EPS should increase to $5.39. The higher payout forecasted, along with higher earnings, should lead to greater dividend income for investors moving forward.

When assessing the forecast sustainability of a dividend it is also worth considering the cash flow of the business. A company with strong cash flow, relative to earnings, can sometimes sustain a high pay out ratio.

Next Steps:

Investors of MSC Industrial Direct can continue to expect strong dividends from the stock. With its favorable dividend characteristics, if high income generation is still the goal for your portfolio, then MSC Industrial Direct is one worth keeping around. However, given this is purely a dividend analysis, I urge potential investors to try and get a good understanding of the underlying business and its fundamentals before deciding on an investment. Below, I've compiled three key factors you should further examine:

- Future Outlook: What are well-informed industry analysts predicting for MSM’s future growth? Take a look at our free research report of analyst consensus for MSM’s outlook.

- Valuation: What is MSM worth today? Even if the stock is a cash cow, it's not worth an infinite price. The intrinsic value infographic in our free research report helps visualize whether MSM is currently mispriced by the market.

- Other Dividend Rockstars: Are there strong dividend payers with better fundamentals out there? Check out our free list of these great stocks here.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NYSE:MSM

MSC Industrial Direct

Engages in the distribution of metalworking and maintenance, repair, and operations (MRO) products and services in the United States, Canada, Mexico, the United Kingdom, and internationally.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives