- United States

- /

- Machinery

- /

- NYSE:MLI

Mueller Industries (MLI): Margin Improvement Reinforces Bullish Narratives on Operational Efficiency

Reviewed by Simply Wall St

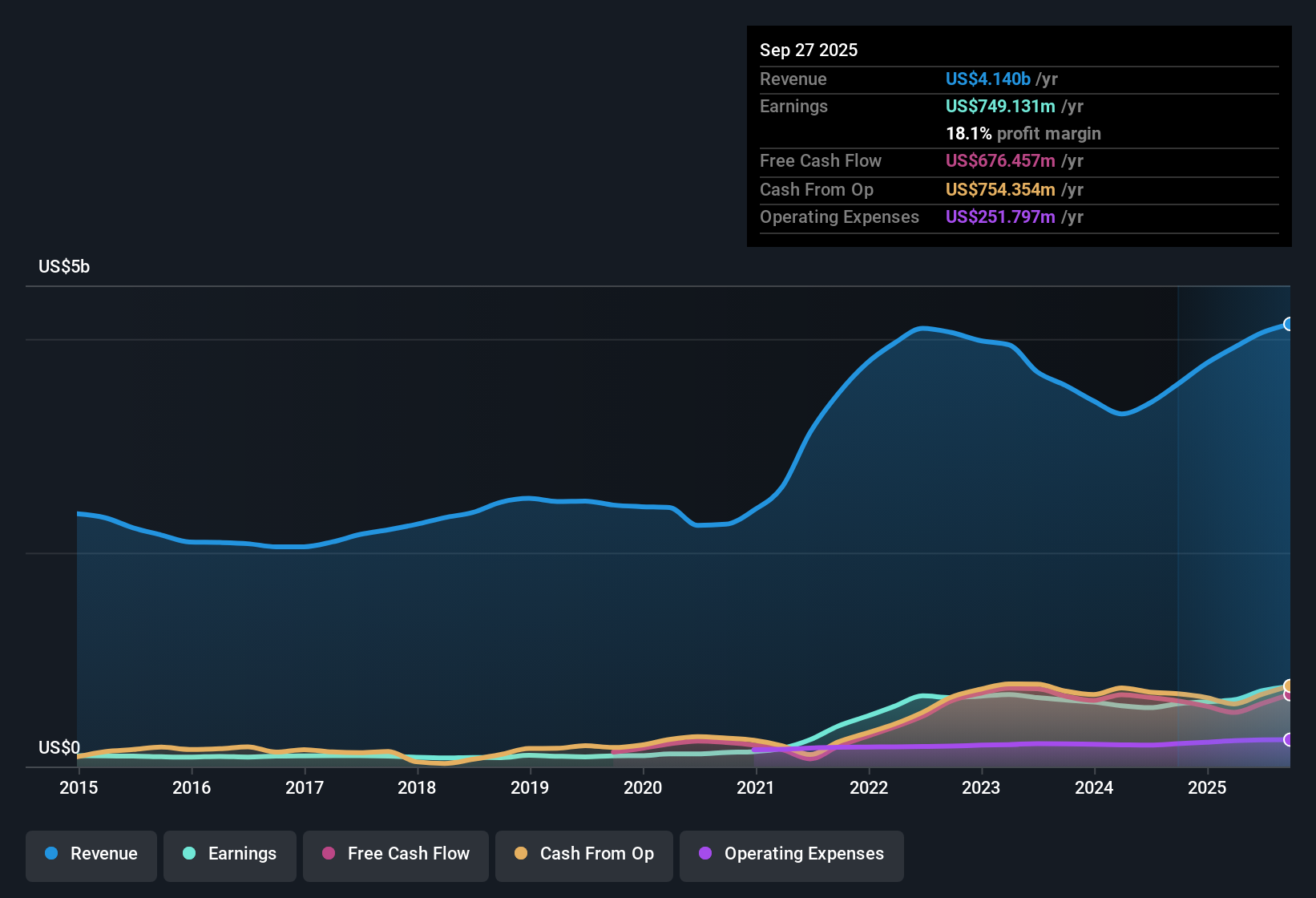

Mueller Industries (MLI) delivered a standout year with earnings climbing 27.8%, far outpacing its five-year average earnings growth of 18.7% per year. Net profit margins improved to 18.1% from 16.4% last year, signaling stronger operational efficiency for the manufacturer. As investors digest these headline results, the company’s track record of steady profit growth and expanding margins is likely to be a key focus during this earnings season.

See our full analysis for Mueller Industries.Next, we’ll compare these impressive numbers to the dominant narratives investors have been tracking to see which perspectives are backed by the results, and which might need a rethink.

Curious how numbers become stories that shape markets? Explore Community Narratives

Growth Projections Trail US Market

- Mueller's revenue is forecast to rise by 5.5% annually and earnings by 2.3% per year. Both rates lag the broader US market expectations of 10.1% and 15.5% respectively.

- Despite these slower projections, recent outperformance—with earnings growth hitting 27.8% last year—offers a reminder that the company can exceed moderate expectations.

- Recent performance has outpaced its five-year average, hinting that the market's prevailing view may be too conservative if operational momentum continues.

- However, forward-looking investors will watch closely to see if the anticipated deceleration materializes or if the company repeats its history of surprises.

Margins Push Higher Against Industry Backdrop

- Net profit margins improved from 16.4% to 18.1% year over year, underlining notable gains in operational efficiency not always achieved across the industrials sector.

- Taking into account the prevailing market view, this margin expansion heavily supports the narrative of management discipline and sector-aligned execution.

- Consistent profit and revenue growth, alongside superior margin performance, suggests the company’s operating model may be more resilient than competitors facing higher cost pressures.

- No material risks were flagged in recent statements, which quiets critics concerned about margin sustainability for now.

P/E Ratio Signals Relative Value

- Mueller’s price-to-earnings ratio of 15.4x stands at a significant discount to both peer (27.6x) and industry (24.6x) averages, even as share price reached $104.21.

- This valuation gap invites further scrutiny of upside potential. The prevailing market view emphasizes that attractive pricing, when combined with a record of strong margins and growth, can make a company stand out to value-focused investors.

- With no material risks disclosed in filings, this undervaluation adds a layer of reassurance for those concerned about downside surprises.

- Relative value could become a central theme if the industry continues to attract capital and high-quality operators command premium multiples.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Mueller Industries's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Despite robust recent earnings, Mueller’s future growth projections lag the US market and signal slower expansion ahead compared to its peers.

For more consistent growth potential, check out stable growth stocks screener (2095 results), where you’ll find companies delivering reliable profit and sales gains across a range of cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MLI

Mueller Industries

Manufactures and sells copper, brass, and aluminum products in the United States, the United Kingdom, Canada, Asia and the Middle East, and Mexico.

Outstanding track record with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives