- United States

- /

- Machinery

- /

- NYSE:MLI

How Strong Q2 2025 Earnings at Mueller Industries (MLI) Has Changed Its Investment Story

Reviewed by Simply Wall St

- Mueller Industries, Inc. recently reported its earnings for the second quarter and first half of 2025, highlighting strong growth as quarterly sales reached US$1,138.17 million and net income rose to US$245.92 million compared to the prior year.

- An interesting insight is that the company's significant increase in basic and diluted earnings per share points to improved margins and operational efficiency.

- We'll examine how the surge in both sales and earnings shapes Mueller Industries' investment narrative and signals its operational momentum.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

What Is Mueller Industries' Investment Narrative?

For shareholders in Mueller Industries, the investment case often centers around belief in the company’s ability to convert improving operational performance into long-term value. The latest quarterly results deliver a strong signal: both sales and earnings have jumped meaningfully, further supported by solid margins and a healthy increase in earnings per share. This performance builds momentum for key short-term catalysts, such as ongoing share buybacks, recent dividend increases, and recent index rebalancing that moved MLI into the Russell Midcap Value Benchmark. With a share price that remains well below consensus fair value ahead of the results, the earnings beat may be a material catalyst, potentially shifting sentiment and valuation discussions. However, the robust results could also renew focus on risks like significant insider selling and questions around board refreshment.

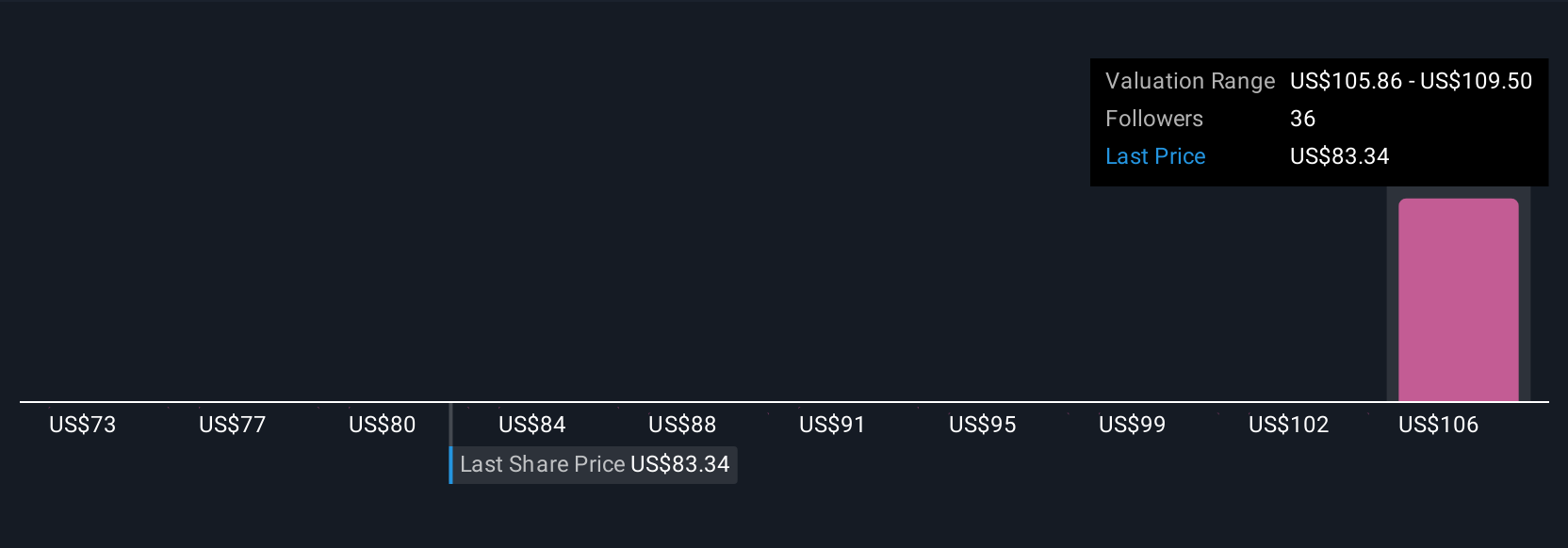

Yet, despite this growth, the issue of recent board turnover is something investors should watch closely. Mueller Industries' shares have been on the rise but are still potentially undervalued by 20%. Find out what it's worth.Exploring Other Perspectives

Build Your Own Mueller Industries Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Mueller Industries research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Mueller Industries research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Mueller Industries' overall financial health at a glance.

No Opportunity In Mueller Industries?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover 17 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MLI

Mueller Industries

Manufactures and sells copper, brass, and aluminum products in the United States, the United Kingdom, Canada, Asia and the Middle East, and Mexico.

Outstanding track record with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives