- United States

- /

- Aerospace & Defense

- /

- NYSE:MAXR

Introducing Maxar Technologies (NYSE:MAXR), The Stock That Tanked 91%

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

It is a pleasure to report that the Maxar Technologies Inc. (NYSE:MAXR) is up 45% in the last quarter. But that doesn't change the fact that the returns over the last half decade have been stomach churning. Five years have seen the share price descend precipitously, down a full 91%. It's true that the recent bounce could signal the company is turning over a new leaf, but we are not so sure. The important question is if the business itself justifies a higher share price in the long term.

We really hope anyone holding through that price crash has a diversified portfolio. Even when you lose money, you don't have to lose the lesson.

View our latest analysis for Maxar Technologies

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

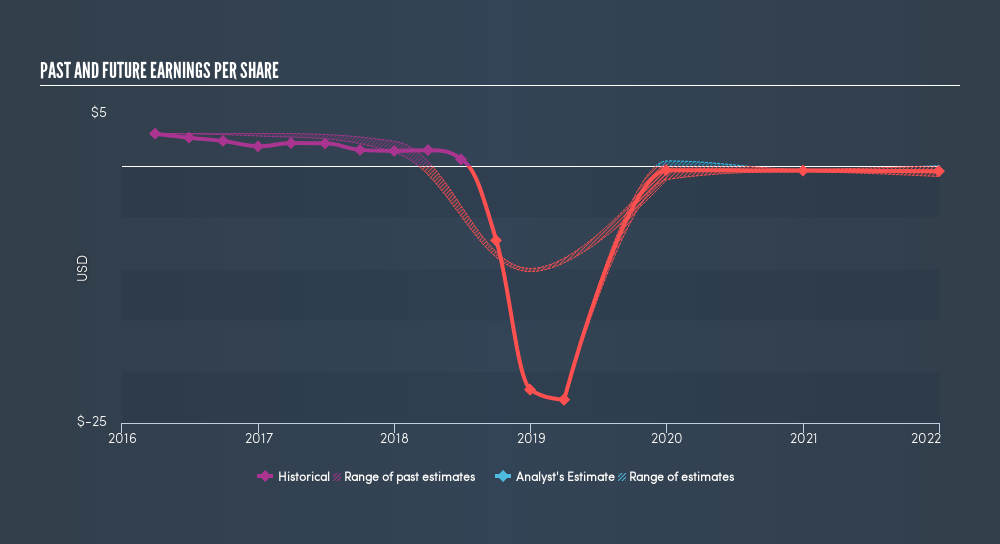

Over five years Maxar Technologies's earnings per share dropped significantly, falling to a loss, with the share price also lower. At present it's hard to make valid comparisons between EPS and the share price. But we would generally expect a lower price, given the situation.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

We like that insiders have been buying shares in the last twelve months. Even so, future earnings will be far more important to whether current shareholders make money. Dive deeper into the earnings by checking this interactive graph of Maxar Technologies's earnings, revenue and cash flow.

A Different Perspective

Maxar Technologies shareholders are down 85% for the year (even including dividends), but the market itself is up 4.6%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 37% per year over five years. We realise that Buffett has said investors should 'buy when there is blood on the streets', but we caution that investors should first be sure they are buying a high quality businesses. Investors who like to make money usually check up on insider purchases, such as the price paid, and total amount bought. You can find out about the insider purchases of Maxar Technologies by clicking this link.

Maxar Technologies is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NYSE:MAXR

Maxar Technologies

Maxar Technologies Inc. provides space solutions; and secure, precise, and geospatial intelligence solutions in the United States, Asia, South America, Europe, the Middle East, Australia, Canada, and internationally.

Reasonable growth potential with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives