- United States

- /

- Machinery

- /

- NYSE:LXFR

Improved Revenues Required Before Luxfer Holdings PLC (NYSE:LXFR) Stock's 26% Jump Looks Justified

Luxfer Holdings PLC (NYSE:LXFR) shareholders would be excited to see that the share price has had a great month, posting a 26% gain and recovering from prior weakness. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 35% over that time.

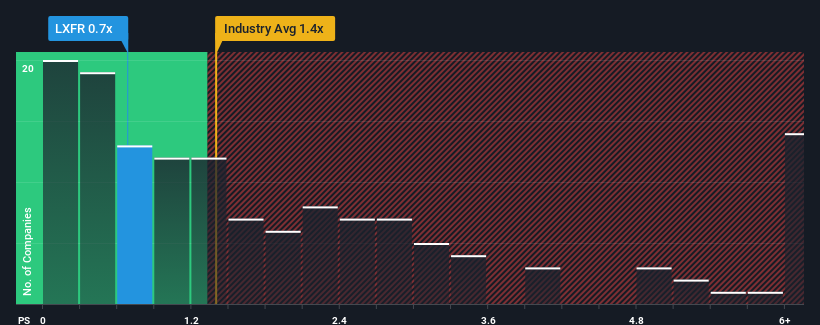

Although its price has surged higher, when close to half the companies operating in the United States' Machinery industry have price-to-sales ratios (or "P/S") above 1.4x, you may still consider Luxfer Holdings as an enticing stock to check out with its 0.7x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

Check out our latest analysis for Luxfer Holdings

What Does Luxfer Holdings' Recent Performance Look Like?

Luxfer Holdings could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

Want the full picture on analyst estimates for the company? Then our free report on Luxfer Holdings will help you uncover what's on the horizon.How Is Luxfer Holdings' Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as low as Luxfer Holdings' is when the company's growth is on track to lag the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 4.3%. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 25% in total. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to slump, contracting by 8.9% during the coming year according to the one analyst following the company. With the industry predicted to deliver 1.2% growth, that's a disappointing outcome.

With this information, we are not surprised that Luxfer Holdings is trading at a P/S lower than the industry. However, shrinking revenues are unlikely to lead to a stable P/S over the longer term. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

The Final Word

Despite Luxfer Holdings' share price climbing recently, its P/S still lags most other companies. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

It's clear to see that Luxfer Holdings maintains its low P/S on the weakness of its forecast for sliding revenue, as expected. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Unless there's material change, it's hard to envision a situation where the stock price will rise drastically.

You should always think about risks. Case in point, we've spotted 1 warning sign for Luxfer Holdings you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:LXFR

Luxfer Holdings

Provides high-performance materials, components, and high-pressure gas containment devices for defense, first response and healthcare, transportation, and general industrial applications.

Flawless balance sheet and good value.

Market Insights

Community Narratives