- United States

- /

- Aerospace & Defense

- /

- NYSE:LOAR

Did Loar Holdings’ (LOAR) New EVP Appointment Signal a Shift in Integration Strategy?

Reviewed by Sasha Jovanovic

- Earlier this month, Loar Holdings Inc. announced that Jeremy Halford has joined as Executive Vice President, reporting to CEO Dirkson Charles, with operational oversight of subsidiaries including CAV Systems, Safe Flight, Applied Engineering, and The Freeman Company.

- Halford's extensive background in operational leadership and strategy at global industrial firms suggests a deliberate move by Loar Holdings to enhance its management capabilities for complex multi-site operations.

- With Halford's operational expertise, we’ll examine how this leadership change could influence Loar Holdings’ long-term growth and integration efforts.

Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

Loar Holdings Investment Narrative Recap

To own shares of Loar Holdings, an investor needs confidence in the company's expansion through acquisitions in specialized aerospace markets and its ability to smoothly integrate new subsidiaries. The recent appointment of Jeremy Halford as Executive Vice President strengthens Loar’s operational leadership and could help address integration challenges, one of the main risks for future growth, but by itself, the news is not likely to immediately impact short-term catalysts like new product rollouts or increased customer demand.

Of recent announcements, the company’s raised 2025 guidance for both sales and net income is most relevant. Stronger projected results reinforce the importance of leadership depth, as effective operational oversight may be critical to sustaining momentum, realizing synergies, and managing the risks that naturally arise with acquisition-driven growth.

However, given Loar’s reliance on bolt-on acquisitions, investors should watch for signs that integration risk is increasing and that...

Read the full narrative on Loar Holdings (it's free!)

Loar Holdings' outlook projects $656.1 million in revenue and $114.0 million in earnings by 2028. This scenario assumes a 13.2% annual revenue growth rate and a $69.6 million earnings increase from the current $44.4 million.

Uncover how Loar Holdings' forecasts yield a $97.20 fair value, a 19% upside to its current price.

Exploring Other Perspectives

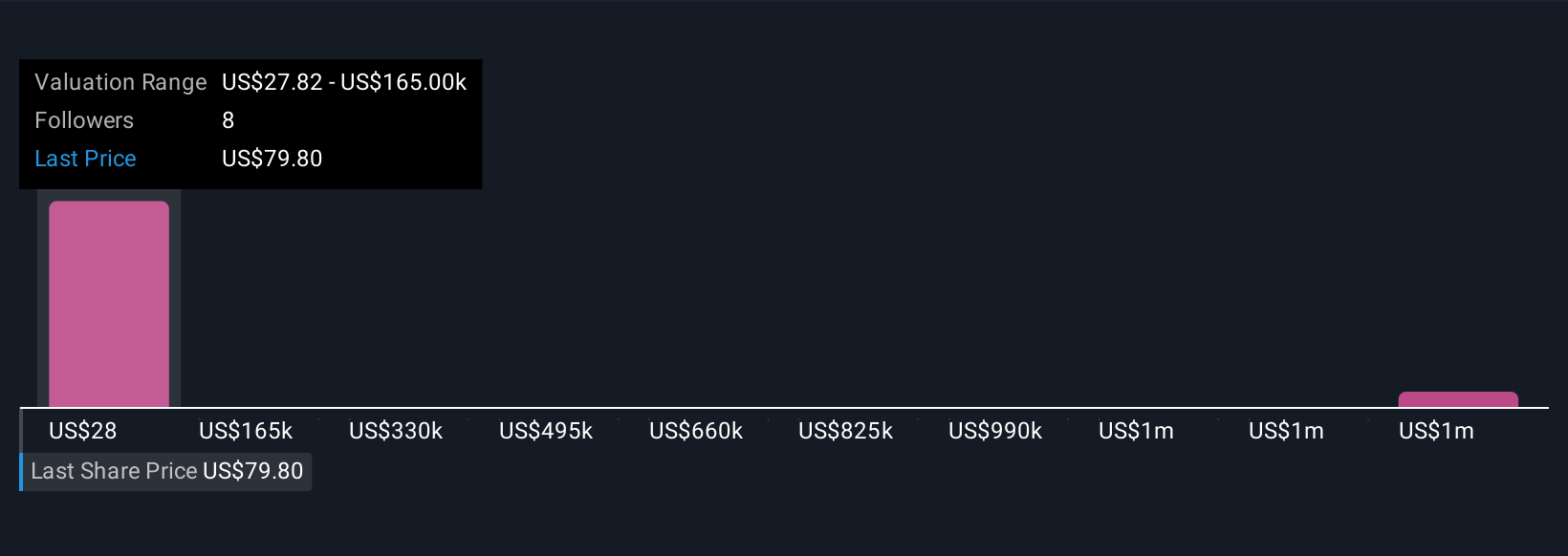

Fair value estimates from the Simply Wall St Community span from US$27.72 to US$116.62 across 4 individual views, illustrating wide variation in opinion. With integration risk remaining central to Loar’s outlook, readers can weigh several means of interpreting the company’s potential and risk profile.

Explore 4 other fair value estimates on Loar Holdings - why the stock might be worth as much as 43% more than the current price!

Build Your Own Loar Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Loar Holdings research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Loar Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Loar Holdings' overall financial health at a glance.

Ready For A Different Approach?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LOAR

Loar Holdings

Through its subsidiaries, designs, manufactures, and markets aerospace and defense components for aircraft, and aerospace and defense systems in the United States and internationally.

Reasonable growth potential with mediocre balance sheet.

Market Insights

Community Narratives