- United States

- /

- Aerospace & Defense

- /

- NYSE:LMT

Lockheed Martin (LMT) Valuation Spotlight After Securing Germanium Supply Chain Deal with Korea Zinc

Reviewed by Simply Wall St

Lockheed Martin (LMT) just took a decisive step to secure its future supply chain by signing a Memorandum of Understanding with Korea Zinc for the procurement and supply of germanium. With resource security moving higher on the global agenda, this agreement aims to ensure Lockheed Martin gets critical minerals for its defense and aerospace technologies without relying on China or other geopolitically sensitive sources. The deal is more than just paperwork. It signals that management is proactively managing the risks and costs tied to material sourcing, which can impact everything from product delivery to project profitability.

This new MOU landed just after several other strategic moves for Lockheed Martin, highlighting a shift toward strengthening supply resilience. Despite steady operational performance, the stock has delivered a negative return over the past year while losing some ground recently, even though there was a small rise in the past month. Longer-term investors have seen gain, but momentum has clearly cooled since last year. It is the kind of sideways price action that often leaves investors re-evaluating how much future growth or ongoing risks are already factored into the share price.

With the company actively building supply chain strength and recent share price trends reflecting mixed sentiment, the current situation may prompt investors to consider whether the markets have already accounted for future prospects.

Most Popular Narrative: 3.7% Undervalued

The prevailing narrative suggests Lockheed Martin is trading at a modest discount to its fair value, making it an interesting candidate for investors looking for value in the defense sector.

Lockheed Martin's technological leadership in areas like stealth, electronic warfare, hypersonics, and integrated air/missile defense systems is being validated by operational success and customer priorities. This supports future contract wins and an expanding addressable market, which may lift revenues and provide opportunities for higher-margin, next-generation products.

Curious what underpins this valuation? The analysts’ model relies on future growth drivers, margin recovery, and profit estimates. These factors hint at bold assumptions that could surprise even seasoned followers. Which key metric will really decide if this slight undervaluation is justified? The numbers tell a story you do not want to miss.

Result: Fair Value of $476.67 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent cost overruns on major programs or shifting defense budget priorities could undermine these optimistic earnings projections and put pressure on future growth.

Find out about the key risks to this Lockheed Martin narrative.Another View: Discounted Cash Flow Says Undervalued

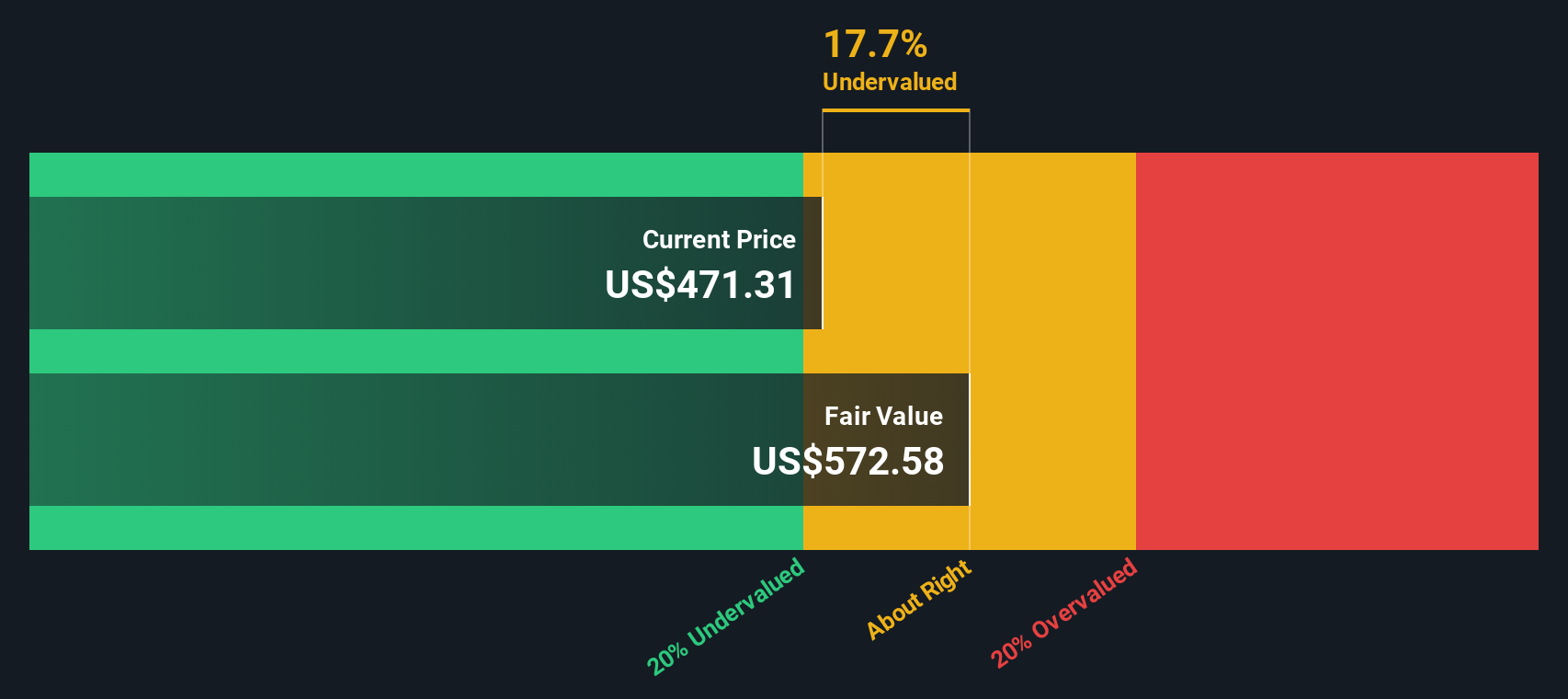

Looking from a different angle, our SWS DCF model also finds that the stock trades below its estimated fair value. Two approaches, same verdict. Is there more to this story than meets the eye?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Lockheed Martin for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Lockheed Martin Narrative

If you want a different perspective or prefer to draw your own conclusions from the numbers, you can build your own narrative in just a few minutes. Do it your way

A great starting point for your Lockheed Martin research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Hesitating could mean missing out on the next big opportunity. Take charge of your research and set yourself up for smarter investments by evaluating these handpicked strategies below.

- Spot the potential in tiny companies with solid balance sheets and growth stories by checking out penny stocks with strong financials.

- Unlock the future of healthcare by targeting innovators harnessing artificial intelligence through our curated list of healthcare AI stocks.

- Catch overlooked bargains as you scan the market for companies showing strong fundamentals and appealing value using undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NYSE:LMT

Lockheed Martin

An aerospace and defense company, engages in the research, design, development, manufacture, integration, and sustainment of technology systems, products, and services worldwide.

Undervalued average dividend payer.

Similar Companies

Market Insights

Community Narratives