- United States

- /

- Aerospace & Defense

- /

- NYSE:LMT

Lawsuits Over Internal Controls and Contracts Might Change The Case For Investing In Lockheed Martin (LMT)

Reviewed by Simply Wall St

- Several law firms recently announced class action lawsuits against Lockheed Martin, alleging that the company failed to disclose internal control weaknesses and overstated its ability to deliver on contract commitments, following the disclosure of significant pre-tax losses on classified programs in late 2024, early 2025, and July 2025.

- These lawsuits claim that Lockheed Martin made materially misleading statements, which has resulted in substantial attention from investors and triggered a series of legal actions focused on risk management and financial reporting practices.

- Let's examine how concerns about Lockheed Martin's internal controls and contract risk management could affect its investment outlook.

Outshine the giants: these 20 early-stage AI stocks could fund your retirement.

Lockheed Martin Investment Narrative Recap

Owning shares in Lockheed Martin often means believing in the long-term resilience of U.S. defense spending and the company’s ability to deliver advanced military platforms, even through periods of operational turbulence. The recent class action lawsuits focused on internal controls and contract delivery risk have drawn sharp attention, but the biggest near-term catalyst, ongoing demand for next-generation platforms, remains intact, while the most immediate risk continues to be the potential for further financial charges on complex legacy programs.

Among Lockheed Martin’s recent announcements, its expanded collaboration for the F-16 Block 70 program in the Philippines stands out. This initiative underlines the company's emphasis on global partnerships, technology transfer, and reinforcing its international backlog, reinforcing the business catalysts rooted in broad customer demand and long-term platform relevance.

By contrast, investors should be aware that persistent cost overruns on fixed-price contracts are still...

Read the full narrative on Lockheed Martin (it's free!)

Lockheed Martin's outlook sees revenues reaching $81.0 billion and earnings climbing to $7.1 billion by 2028. This is based on an expected annual revenue growth rate of 4.1% and a $2.9 billion increase in earnings from the current $4.2 billion.

Uncover how Lockheed Martin's forecasts yield a $487.16 fair value, a 9% upside to its current price.

Exploring Other Perspectives

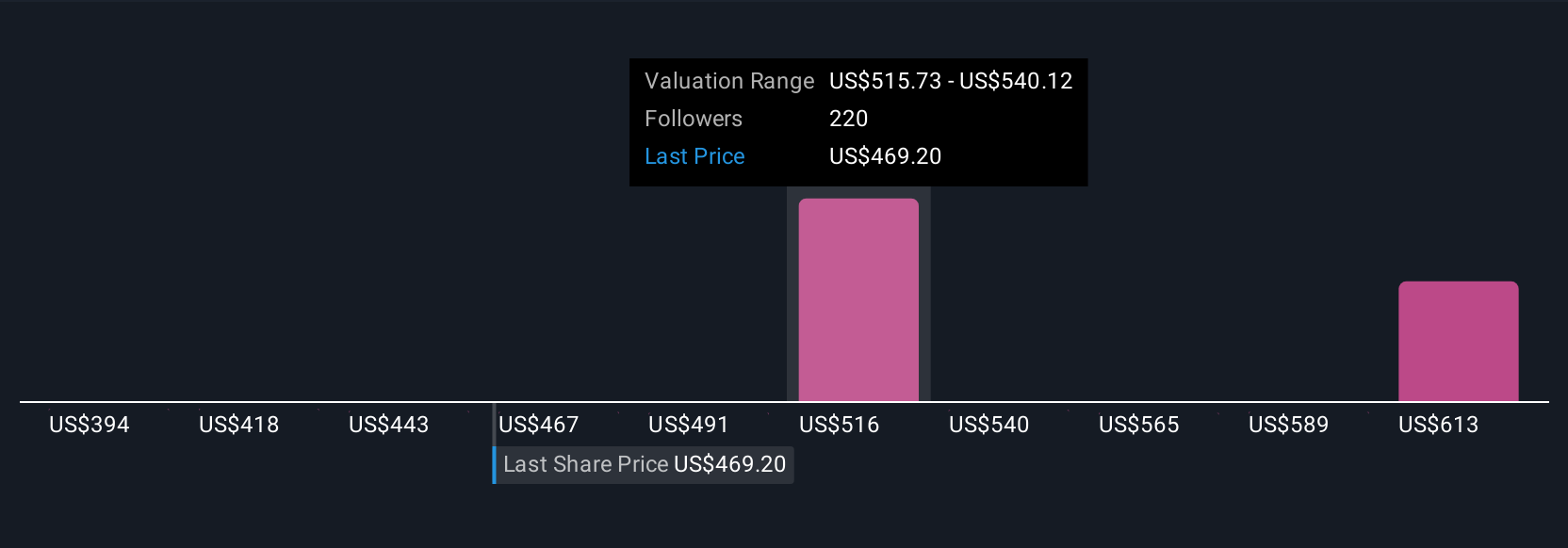

Twenty-four fair value estimates from the Simply Wall St Community range from US$374 to US$576 per share. While opinions are split, many are weighing Lockheed Martin’s exposure to classified contract risks which may affect future profit margins.

Explore 24 other fair value estimates on Lockheed Martin - why the stock might be worth as much as 29% more than the current price!

Build Your Own Lockheed Martin Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Lockheed Martin research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Lockheed Martin research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Lockheed Martin's overall financial health at a glance.

No Opportunity In Lockheed Martin?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LMT

Lockheed Martin

An aerospace and defense company, engages in the research, design, development, manufacture, integration, and sustainment of technology systems, products, and services worldwide.

Undervalued average dividend payer.

Similar Companies

Market Insights

Community Narratives