- United States

- /

- Aerospace & Defense

- /

- NYSE:LLAP

It's Down 31% But Terran Orbital Corporation (NYSE:LLAP) Could Be Riskier Than It Looks

Terran Orbital Corporation (NYSE:LLAP) shareholders won't be pleased to see that the share price has had a very rough month, dropping 31% and undoing the prior period's positive performance. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 58% loss during that time.

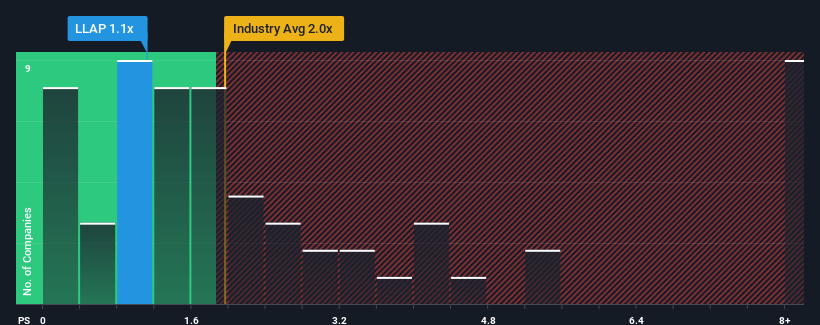

Since its price has dipped substantially, Terran Orbital may be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 1.1x, since almost half of all companies in the Aerospace & Defense industry in the United States have P/S ratios greater than 2x and even P/S higher than 5x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

Check out our latest analysis for Terran Orbital

What Does Terran Orbital's P/S Mean For Shareholders?

Terran Orbital certainly has been doing a good job lately as it's been growing revenue more than most other companies. Perhaps the market is expecting future revenue performance to dive, which has kept the P/S suppressed. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Terran Orbital.How Is Terran Orbital's Revenue Growth Trending?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Terran Orbital's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 86% gain to the company's top line. The latest three year period has also seen an incredible overall rise in revenue, aided by its incredible short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Turning to the outlook, the next three years should generate growth of 93% per annum as estimated by the four analysts watching the company. With the industry only predicted to deliver 7.5% each year, the company is positioned for a stronger revenue result.

With this information, we find it odd that Terran Orbital is trading at a P/S lower than the industry. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Key Takeaway

Terran Orbital's recently weak share price has pulled its P/S back below other Aerospace & Defense companies. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Terran Orbital's analyst forecasts revealed that its superior revenue outlook isn't contributing to its P/S anywhere near as much as we would have predicted. When we see strong growth forecasts like this, we can only assume potential risks are what might be placing significant pressure on the P/S ratio. At least price risks look to be very low, but investors seem to think future revenues could see a lot of volatility.

You should always think about risks. Case in point, we've spotted 5 warning signs for Terran Orbital you should be aware of, and 2 of them can't be ignored.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Terran Orbital might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:LLAP

Terran Orbital

Manufactures and sells satellites for aerospace and defense industries in the United States and internationally.

Medium-low and fair value.

Similar Companies

Market Insights

Community Narratives