- United States

- /

- Building

- /

- NYSE:LII

Lennox International (LII) Premium Valuation Faces Scrutiny as Growth Guidance Trails Market Expectations

Reviewed by Simply Wall St

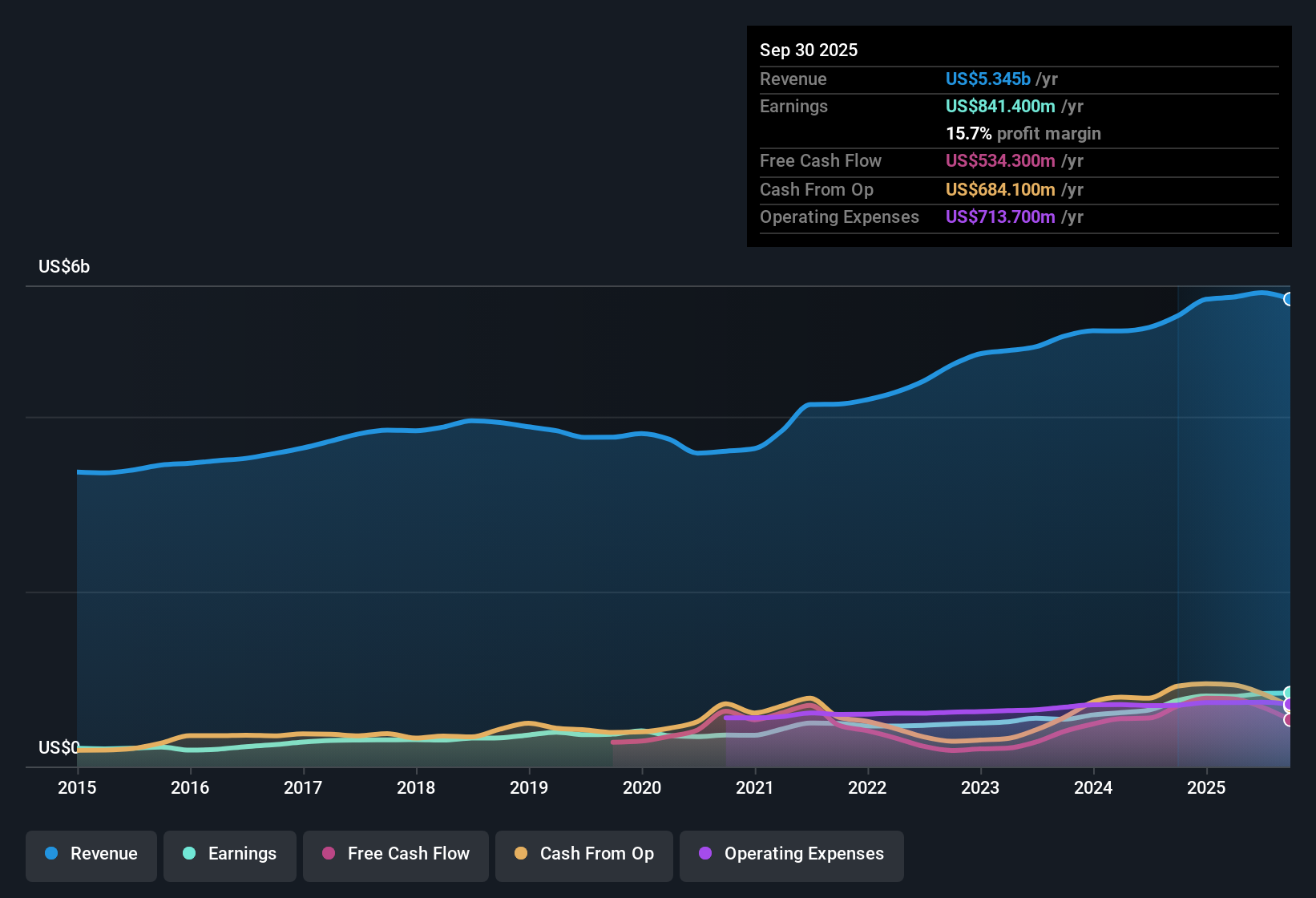

Lennox International (LII) posted 11.6% earnings growth for the most recent year, a step down from its five-year compound rate of 16.2%. Profit margins climbed to 15.7% from last year’s 14.6%, while management characterizes the company’s earnings quality as high. Despite a robust track record, guidance points to slower growth ahead. Earnings and revenue are projected to rise by 5.7% and 5.1% annually, respectively, trailing the US market’s expected pace.

See our full analysis for Lennox International.Next, we compare the fresh earnings numbers to the market’s go-to narratives for Lennox International, looking at where the data strengthens or challenges investor assumptions.

See what the community is saying about Lennox International

Margin Expansion and High-Quality Profits

- Lennox International's profit margin rose to 15.7% this year, an improvement from last year's 14.6%, supporting its classification as having high-quality earnings.

- Analysts' consensus view highlights that strong margins are underpinned by digital tool adoption and aftermarket services, but they warn that margin resilience will be tested if cost inflation persists or if dealers and consumers push back against higher prices.

- Consensus narrative notes improved factory productivity and a push for smart, connected HVAC products, which are expected to drive margin expansion to a projected 17.3% over the next three years.

- However, critics point out that prolonged material and distribution cost inflation could compress margins if productivity gains or price increases are not enough to offset rising expenses.

- See how margin trends fit into the bigger story and how analysts are debating Lennox's resilient profitability in the consensus narrative. 📊 Read the full Lennox International Consensus Narrative.

Premium Valuation Outpaces Sector Peers

- The shares currently trade at a Price-To-Earnings Ratio of 20.7x, above both the US Building industry average (19.7x) and peer group (18.7x), and are 11% above their DCF fair value estimate of $445.26.

- Analysts' consensus view notes that the market is expecting Lennox to sustain premium pricing and recurring revenue from digital, aftermarket, and energy-efficient solutions. They caution that slower forecasted growth of 5.7% for earnings and 5.1% for revenue trails the US market averages, which puts pressure on the justification for this valuation premium.

- Consensus narrative highlights that a consensus price target of 575.25 implies about 16% upside from the current share price of $494.99, reflecting expectations that segment profitability and favorable price/mix gains will overcome market growth headwinds.

- However, the combination of higher-than-average multiples and lagging growth forecasts could cause investors to question whether Lennox merits such a premium in a slower-growth environment.

Strategic Shifts Aim for Long-Term Growth

- Major strategic partnerships, such as those with Samsung and Ariston, are designed to expand Lennox’s advanced, energy-efficient product line. Analysts are projecting significant revenue growth from these segments starting in 2026 to 2027.

- Analysts' consensus view underscores that digital investments, regulatory-driven product transitions, and expansion into replacement markets are central to capturing future demand. The narrative warns that ongoing supply chain pressures, rising inventory, and price-sensitive customers create headwinds that will need to be managed carefully.

- Consensus narrative stresses that the success of these growth drivers depends on maintaining dealer confidence and ensuring effective inventory management during the regulatory transition to new refrigerants.

- At the same time, risks such as the potential for inventory markdowns and lost equipment sales could threaten the stability of upcoming revenue streams, making execution crucial in the next phase.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Lennox International on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Looking at the results in a new light? Shape your own outlook and add your voice in just a few minutes. Do it your way.

A great starting point for your Lennox International research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Lennox International faces pressure to justify its premium valuation because its earnings and revenue growth projections are slower compared to market averages.

If you want more growth at a fairer price, use our these 877 undervalued stocks based on cash flows to search for alternatives offering stronger value opportunities in today’s market.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LII

Lennox International

Designs, manufactures, and markets products for the heating, ventilation, air conditioning, and refrigeration markets in the United States, Canada, and internationally.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives