- United States

- /

- Building

- /

- NYSE:LII

Lennox International (LII): Evaluating Valuation After New Sustainability-Focused Partnerships with Samsung and Ariston

Reviewed by Kshitija Bhandaru

Lennox International (LII) has announced new partnerships with Samsung and Ariston, aiming to broaden its lineup of energy-efficient products. These collaborations position Lennox for greater access to markets focused on sustainability and may fuel substantial revenue growth from 2026 onward.

See our latest analysis for Lennox International.

Lennox International’s share price has been under pressure this year, sliding about 13% year-to-date and losing ground steadily over the past quarter. Despite the recent dip, its long-term total shareholder return remains impressive, with a 153% gain over three years and 93% over five years. While momentum has faded lately, optimism persists thanks to new partnerships and ongoing market demand for sustainable HVAC solutions.

If news about Lennox’s next moves has you curious about other opportunities, now is an ideal moment to broaden your search and discover fast growing stocks with high insider ownership

Given that Lennox shares are trading nearly 20% below analyst targets after this year’s declines, the big question is whether investors are being offered genuine value or if the market has already factored in future growth prospects.

Most Popular Narrative: 16% Undervalued

With the fair value pegged at $626.50 and the last close at $524.50, the market is lagging behind analyst expectations. The narrative shaping this view centers on product innovation and expanding digital capabilities.

Investments in digital platforms, AI-based pricing tools, and proprietary data analytics are enabling Lennox to optimize pricing, streamline dealer interactions, and maintain premium pricing power, supporting higher net margins and recurring revenue as digital adoption in the HVAC market accelerates.

Curious how advanced technology pushes margins higher while analysts make bold profit and sales projections? The next details reveal the ambitious forecasts driving this bullish price target. Uncover what makes this narrative so optimistic. Will Lennox surpass expectations or is the hype overblown?

Result: Fair Value of $626.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, greater price sensitivity among consumers or ongoing supply chain disruptions could quickly challenge Lennox’s growth outlook and put pressure on its margin recovery.

Find out about the key risks to this Lennox International narrative.

Another View: Valuing Lennox by Profit Multiples

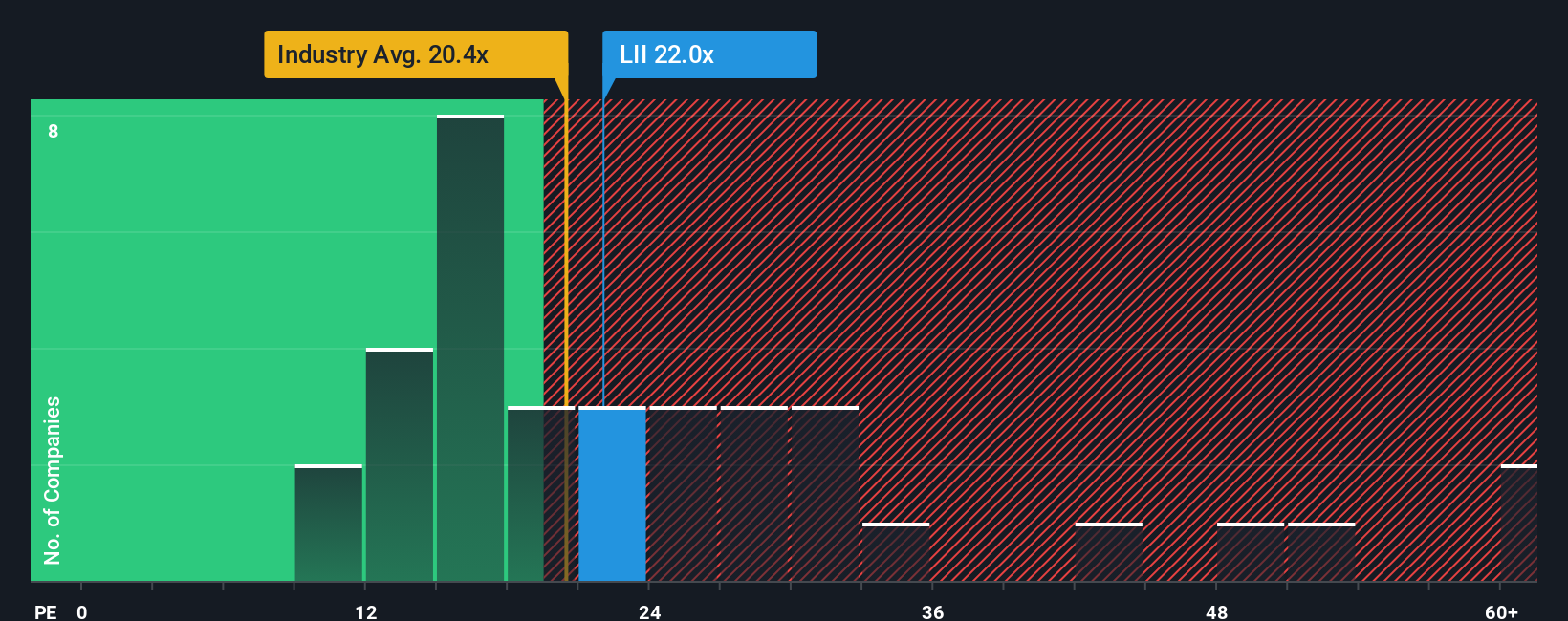

Looking at valuation through the lens of price-to-earnings, Lennox trades at 22.1 times earnings, which is above the US Building industry’s 21.5x average and well above its peer group at 18.2x. However, it remains below its own fair ratio estimate of 25.3x. This suggests the market values Lennox’s growth prospects, but also raises questions about valuation risk, especially if performance falters. Is the premium justified? Could sentiment shift if the business stumbles?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Lennox International Narrative

If you see things differently or want to challenge the consensus, explore the numbers yourself and craft a personalized view in just a few minutes: Do it your way

A great starting point for your Lennox International research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Ways to Grow Your Portfolio?

Smart investors never settle for the obvious. Broaden your outlook now and take advantage of must-see opportunities across thriving, high-potential sectors on Simply Wall Street.

- Capitalize on tomorrow’s innovation by checking out these 24 AI penny stocks featuring real businesses poised to disrupt industries using artificial intelligence.

- Unlock steady income streams by starting with these 19 dividend stocks with yields > 3% and uncover companies offering attractive yields above 3% to strengthen your returns.

- Get ahead of the curve by finding niche opportunities in future tech with these 26 quantum computing stocks, where quantum computing breakthroughs could change the world.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LII

Lennox International

Designs, manufactures, and markets products for the heating, ventilation, air conditioning, and refrigeration markets in the United States, Canada, and internationally.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives