- United States

- /

- Building

- /

- NYSE:LII

Lennox International (LII) Advances Digital Transformation With AI Tools For HVAC Technicians And Homeowners

Reviewed by Simply Wall St

Lennox International (LII) is actively integrating AI technology into its services with the recent rollout of its Technical Support AI Agent, designed to assist HVAC technicians more efficiently. Over the past week, LII's stock price rose by 2.5%, a movement that aligns with the general market uptick but slightly outpaces the market's 1.4% gain. While the positive market sentiment might have influenced this rise, Lennox's advancements in digital transformation, along with the validation of its cold climate heat pump, likely supported investor confidence, contributing to the favorable share price performance.

You should learn about the 2 weaknesses we've spotted with Lennox International.

Find companies with promising cash flow potential yet trading below their fair value.

The recent integration of AI technology by Lennox International, particularly through its Technical Support AI Agent, is anticipated to support its digital transformation initiatives, potentially enhancing operational efficiency for HVAC technicians. This aligns with the company's broader narrative of leveraging digital tools to maintain pricing power and generate recurring revenue as it moves toward connected solutions. The partnerships with Samsung and Ariston suggest further expansion into energy-efficient products, although macroeconomic pressures and supply chain challenges may persist as considerations.

Over a longer three-year period, Lennox's total shareholder return, including share price and dividends, reached 130.10%, indicating strong performance. While over the past year, Lennox underperformed compared to both the US Building industry and the US Market, reflecting particular sector challenges that have moderately constrained Lennox's comparative growth.

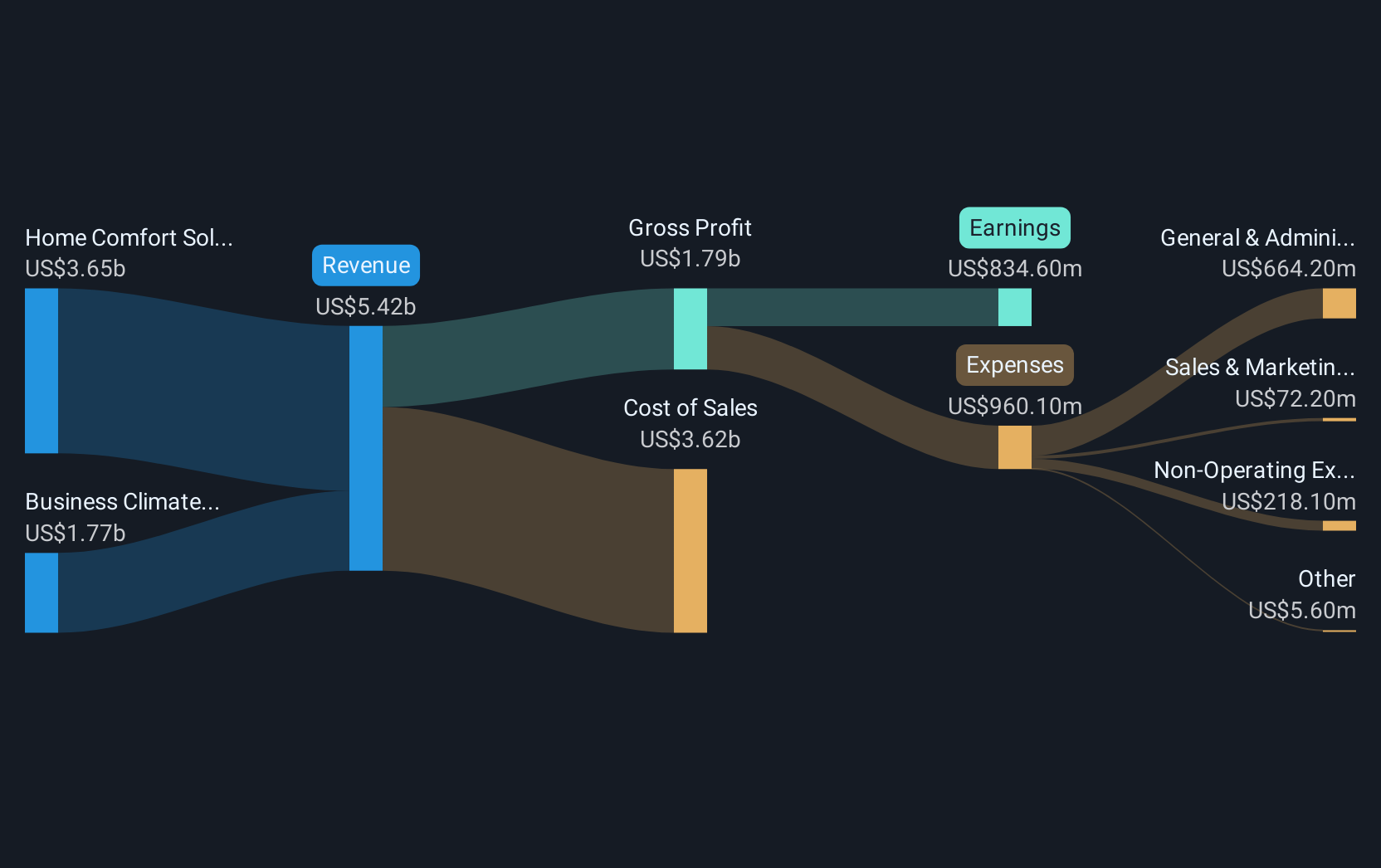

The AI developments and advancements in digital transformation could influence revenue growth and earnings forecasts. Analysts project a 4.7% annual revenue growth with earnings expected to rise to US$1.1 billion by 2028. As for the price target, Lennox is slightly below the estimated analyst consensus, with a share price of US$558.78 compared to the target of US$661.35, representing a potential increase, assuming these growth assumptions hold. Investors should consider the degree of variability in analyst opinions and the current market environment.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LII

Lennox International

Designs, manufactures, and markets products for the heating, ventilation, air conditioning, and refrigeration markets in the United States, Canada, and internationally.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives