- United States

- /

- Building

- /

- NYSE:LII

How Lennox International’s (LII) Revenue Outlook Cut and Buybacks Are Shaping Its Investment Narrative

Reviewed by Sasha Jovanovic

- Lennox International recently reported third quarter 2025 results, showing net income growth to US$245.8 million despite a decline in sales to US$1,426.8 million, and the company revised its full-year revenue guidance to anticipate a 1% decrease.

- An interesting insight is that Lennox continues with its share buyback program, having repurchased 63,332 shares for US$37 million in the past quarter, reflecting ongoing capital return to shareholders amid industry headwinds.

- We'll examine how Lennox International's lowered revenue outlook for 2025 could reshape its investment narrative and future growth assumptions.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Lennox International Investment Narrative Recap

To be a shareholder in Lennox International, you need to believe in its ability to drive earnings growth through operational efficiency and resiliency in core North American HVAC demand, even when headline revenues soften. The recent downward revision of 2025 revenue guidance to a 1% decline may temper near-term expectations but does not appear to materially affect the central catalyst: ongoing margin expansion from premium product mix and improved productivity. The biggest risk remains persistent weakness in residential shipments and dealer confidence, potentially exacerbated by refrigerant supply uncertainties.

Among Lennox's recent announcements, its ongoing share buyback program stands out for its consistency, with 63,332 shares repurchased for US$37 million this past quarter. This capital return underscores management’s focus on shareholder value, though it occurs against a backdrop of flat-to-declining sales growth, highlighting the importance of margin discipline as a short-term driver.

Yet, while the company’s margin gains have supported recent earnings, investors should be aware that persistent softness in residential new construction could undermine ...

Read the full narrative on Lennox International (it's free!)

Lennox International is projected to reach $6.2 billion in revenue and $1.1 billion in earnings by 2028. This outlook assumes annual revenue growth of 4.7% and represents a $265.4 million increase in earnings from the current level of $834.6 million.

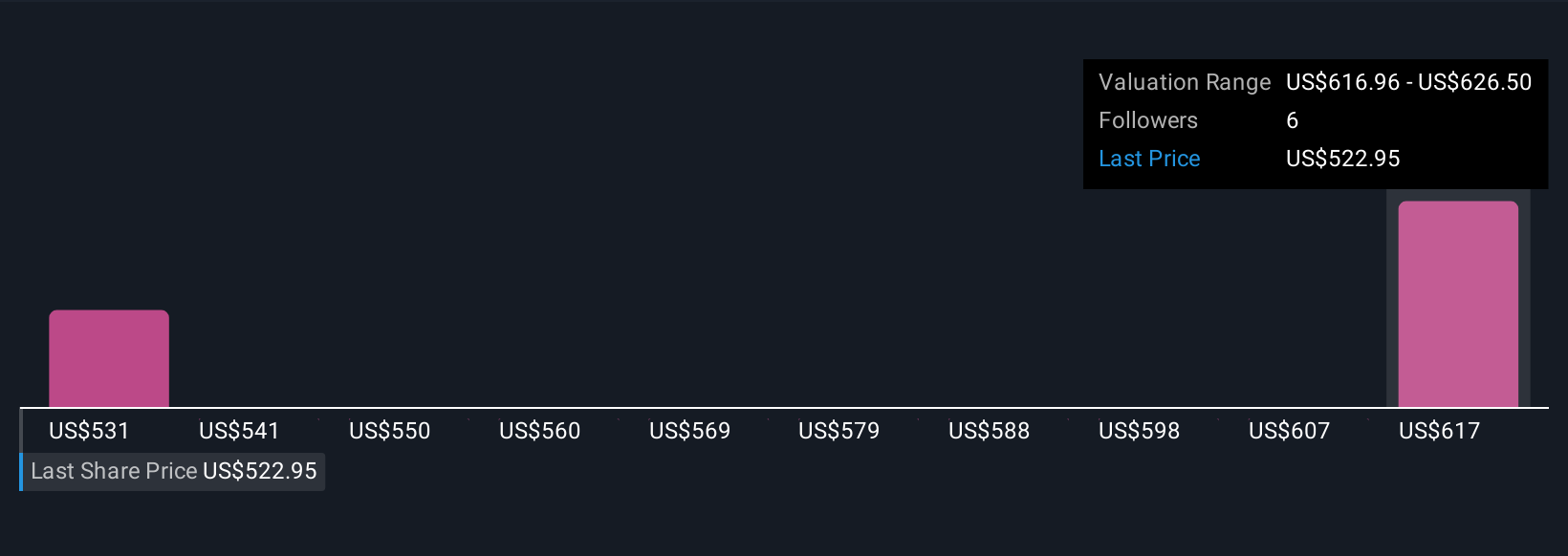

Uncover how Lennox International's forecasts yield a $626.50 fair value, a 14% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members provided 2 fair value estimates for Lennox International, ranging from US$512.68 to US$626.50. While opinions vary widely, ongoing softness in residential demand adds uncertainty to revenue stability, so it pays to review different perspectives before weighing in.

Explore 2 other fair value estimates on Lennox International - why the stock might be worth 7% less than the current price!

Build Your Own Lennox International Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Lennox International research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Lennox International research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Lennox International's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LII

Lennox International

Designs, manufactures, and markets products for the heating, ventilation, air conditioning, and refrigeration markets in the United States, Canada, and internationally.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives