- United States

- /

- Aerospace & Defense

- /

- NYSE:LHX

Major Korea AEW&C Contract Might Change The Case For Investing In L3Harris Technologies (LHX)

Reviewed by Sasha Jovanovic

- L3Harris Technologies recently announced it has secured a contract valued at over US$2.26 billion to deliver modified Bombardier Global 6500 airborne early warning and control (AEW&C) aircraft to the Republic of Korea Air Force, in collaboration with Bombardier, Israel Aerospace Industries' ELTA Systems, and Korean Air.

- This project stands out for its scale, technological integration, and focus on enhanced interoperability with U.S., NATO, and allied defense partners in the Indo-Pacific region.

- We'll explore how this major international AEW&C aircraft contract may reinforce L3Harris Technologies’ defense leadership and future revenue outlook.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

L3Harris Technologies Investment Narrative Recap

To believe in L3Harris Technologies as a shareholder, you must see enduring international demand for advanced defense and communications solutions as a driver for long-term growth. The recently secured US$2.26 billion AEW&C contract with Korea serves as a significant short-term catalyst, directly reinforcing L3Harris’s leadership in high-value defense projects; however, dependency risks from large partnership-driven contracts remain one of the largest uncertainties that could affect revenue timing and margins. Among the recent announcements, L3Harris's expanded VAMPIRE™ system, designed to counter small unmanned threats, highlights how product innovation supports its portfolio and aligns with trends in allied defense requirements. This product line's continued evolution signals management’s focus on diversified capabilities, which may complement large program wins but does not significantly alter the risk of partnership dependencies seen in the new Korea contract. In contrast, investors should be aware that as L3Harris’s role often involves working with multiple partners, the resulting execution risks from...

Read the full narrative on L3Harris Technologies (it's free!)

L3Harris Technologies' outlook projects $24.9 billion in revenue and $2.7 billion in earnings by 2028. This implies annual revenue growth of 5.2% and a $1.0 billion increase in earnings from the current level of $1.7 billion.

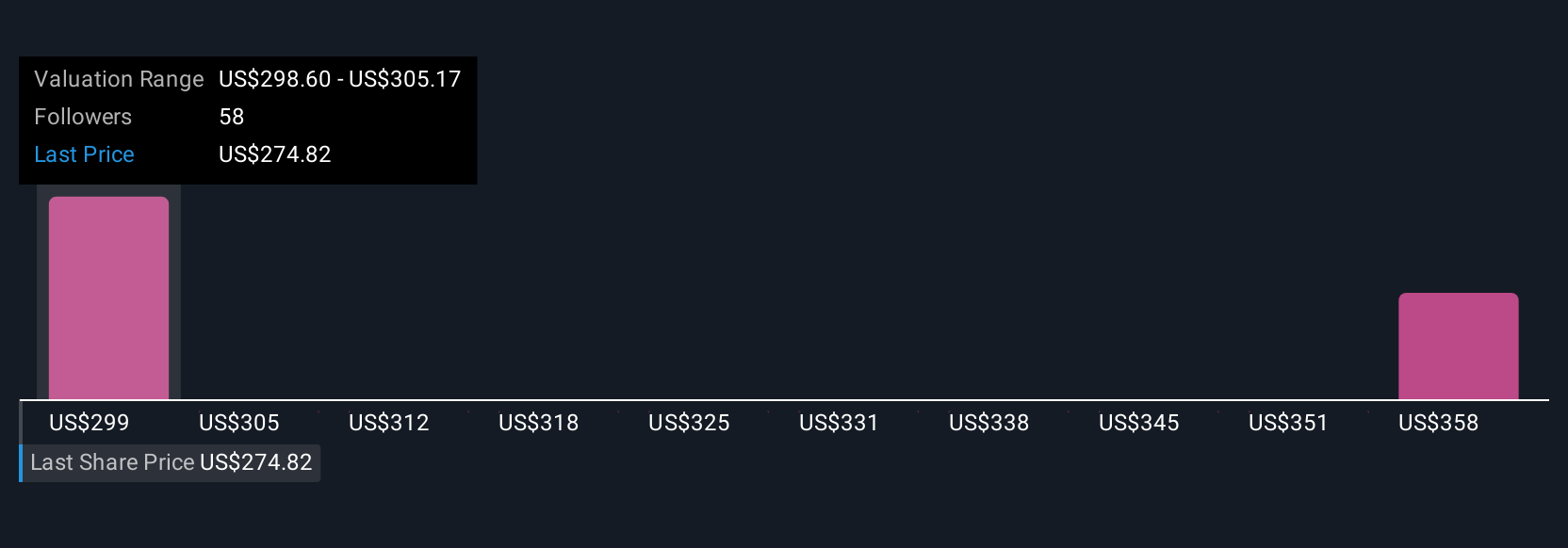

Uncover how L3Harris Technologies' forecasts yield a $309.11 fair value, a 6% upside to its current price.

Exploring Other Perspectives

Two Simply Wall St Community fair value estimates for L3Harris range from US$309.11 to US$327.48 per share. While you weigh these differing community views, remember that dependency on major program partners could materially shape future contract outcomes and revenue streams.

Explore 2 other fair value estimates on L3Harris Technologies - why the stock might be worth as much as 12% more than the current price!

Build Your Own L3Harris Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your L3Harris Technologies research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free L3Harris Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate L3Harris Technologies' overall financial health at a glance.

Ready For A Different Approach?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LHX

L3Harris Technologies

Provides mission-critical solutions for government and commercial customers worldwide.

Established dividend payer with proven track record.

Similar Companies

Market Insights

Community Narratives