- United States

- /

- Aerospace & Defense

- /

- NYSE:LHX

L3Harris Technologies (NYSE:LHX) Wins US$214 Million German Military Communication Contracts

Reviewed by Simply Wall St

L3Harris Technologies (NYSE:LHX) experienced a recent 8% increase in its stock price, which could be linked to securing substantial orders, notably a $214 million contract under Germany's Digitalization - Land Based Operations program. This order reflects the company's growing presence in international defense contracts. While this impressive contract underscores the company's resilience and innovation in meeting global defense needs, broader market trends saw fluctuations due to tariff speculation and Federal Reserve meetings. Still, L3Harris' recent achievements likely added positive weight against these uncertainties, contributing to the overall favorable movement in its stock price.

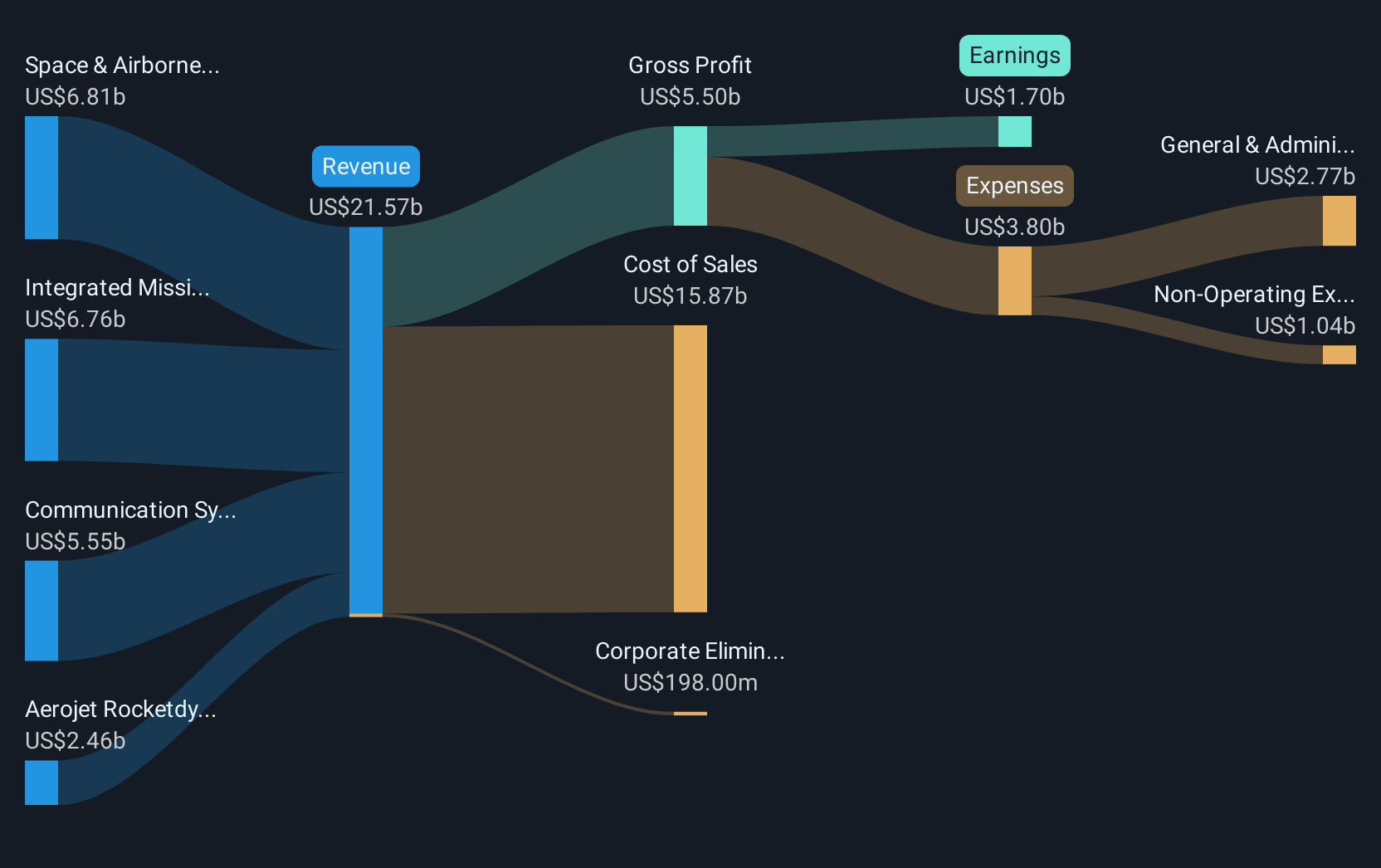

The recent 8% rise in L3Harris Technologies' share price aligns with its success in securing substantial international defense contracts, such as the US$214 million German deal. This positive development is likely to enhance the company's already robust US and international defense sector positioning, contributing to potential revenue and earnings growth. As the US defense budget expands alongside increased demand from NATO allies, these contracts could drive incremental revenue, supporting the company's growth trajectory and optimism reflected in analyst forecasts.

Over the past five years, L3Harris Technologies achieved a total shareholder return of 34.89%, highlighting solid long-term performance. However, when assessing recent performance, L3Harris underperformed relative to the Aerospace & Defense industry, which saw a 20.3% increase, and the US market, which registered an 8.2% gain over the last year. Understanding both long-term and more recent performance contexts may aid in comprehending the potential resilience or challenges the company faces under current market conditions.

Looking forward, the current stock price of US$221.23 represents a 13.9% discount to the consensus analyst target price of US$256.90, indicating room for potential appreciation based on projected earnings growth. Analysts forecast revenue growth of 4.3% per annum and increasing margins, potentially reaching earnings of US$2.6 billion by April 2028. The recent contract win and ongoing U.S. defense initiatives could reinforce or accelerate these projections, depending on L3Harris's execution and market dynamics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LHX

L3Harris Technologies

Provides mission-critical solutions for government and commercial customers worldwide.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives