- United States

- /

- Aerospace & Defense

- /

- NYSE:LHX

L3Harris Technologies (LHX) Completes New Spacecraft Manufacturing Facility With Austin Company

Reviewed by Simply Wall St

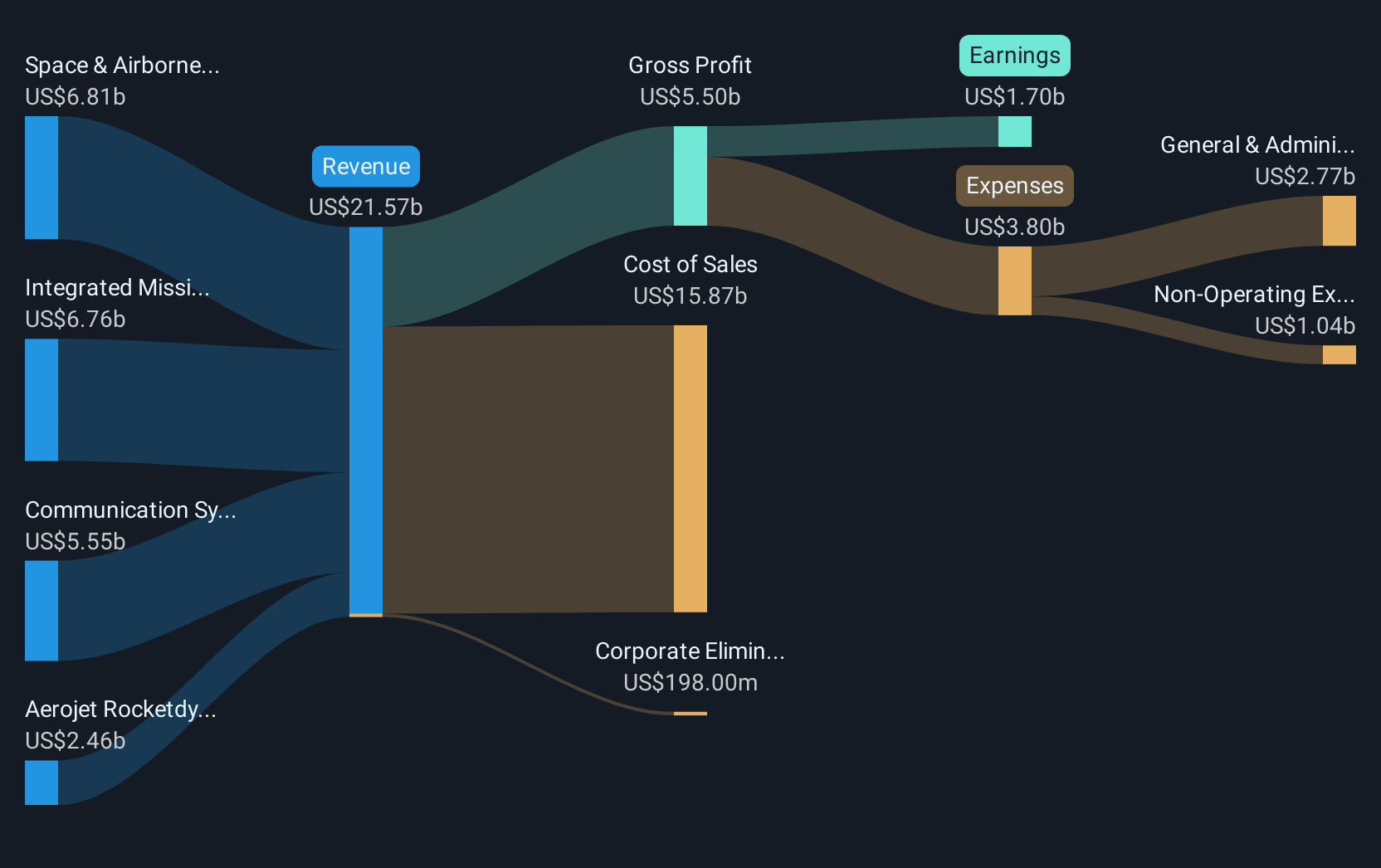

L3Harris Technologies (LHX) has recently completed a significant milestone with The Austin Company, unveiling a new spacecraft manufacturing facility. The move aligns with L3Harris' ongoing efforts to bolster its presence in advanced aerospace capabilities. This development, alongside robust corporate earnings and strategic agreements, may have provided momentum for the company’s stock, which rose 10% over the last quarter. The increase corresponds with broader market trends, as the major indexes reached record highs, buoyed by favorable inflation data hinting at potential interest rate cuts. This overall market optimism likely supported L3Harris' positive pricing shift during this period.

Be aware that L3Harris Technologies is showing 1 weakness in our investment analysis.

The unveiling of L3Harris Technologies' new spacecraft manufacturing facility could influence its revenue growth trajectory and earnings forecasts by enhancing its advanced aerospace capabilities. This expansion may position the company to capture increased international demand and benefit from a potentially expanding U.S. defense budget. These factors could contribute to L3Harris's anticipated revenue and earnings growth, as outlined in analyst expectations.

Over the past five years, L3Harris's total return, including share price and dividends, reached 67.55%. This longer-term performance offers context to its current stock movements. In comparison, L3Harris's share underperformed the U.S. Aerospace & Defense industry over the past year, which saw a 34.7% increase, while the company's shares rose in line with broader market trends, exceeding a 19.1% return for the U.S. market.

Despite the short-term share price increase to US$275.64, the stock trades below the average analyst price target of US$299.94, suggesting potential for further growth if analyst forecasts materialize. While this share price discount indicates market skepticism about attaining the anticipated 2028 earnings of US$2.7 billion, ongoing developments in aerospace projects could boost investor confidence in meeting these targets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LHX

L3Harris Technologies

Provides mission-critical solutions for government and commercial customers worldwide.

Established dividend payer with proven track record.

Similar Companies

Market Insights

Community Narratives