- United States

- /

- Aerospace & Defense

- /

- NYSE:LHX

Is L3Harris Still Attractive After Pentagon Pushes for Missile Production Surge?

Reviewed by Bailey Pemberton

If you have been watching L3Harris Technologies lately, you are not alone. After climbing an impressive 43.4% so far this year and notching a 9.2% gain over the past month, investors are weighing what these moves mean for the stock’s future. Is this a company still poised for growth, or has the pace of recent gains made it riskier going forward?

What is fueling this kind of momentum? Some of the answer has to do with sudden changes in the broader defense sector. The Pentagon’s recent call for missile suppliers to dramatically ramp up production amid global tensions has shone a spotlight on key industry players. Alongside that, news such as the U.S. Defense Secretary summoning top commanders for urgent talks adds fresh urgency for companies at the heart of military manufacturing. The backdrop of rising global uncertainty, especially surrounding critical materials and shifting supply chains, has steadily propelled L3Harris’s stock higher over both the short and long term, as seen in its 87.7% five-year return.

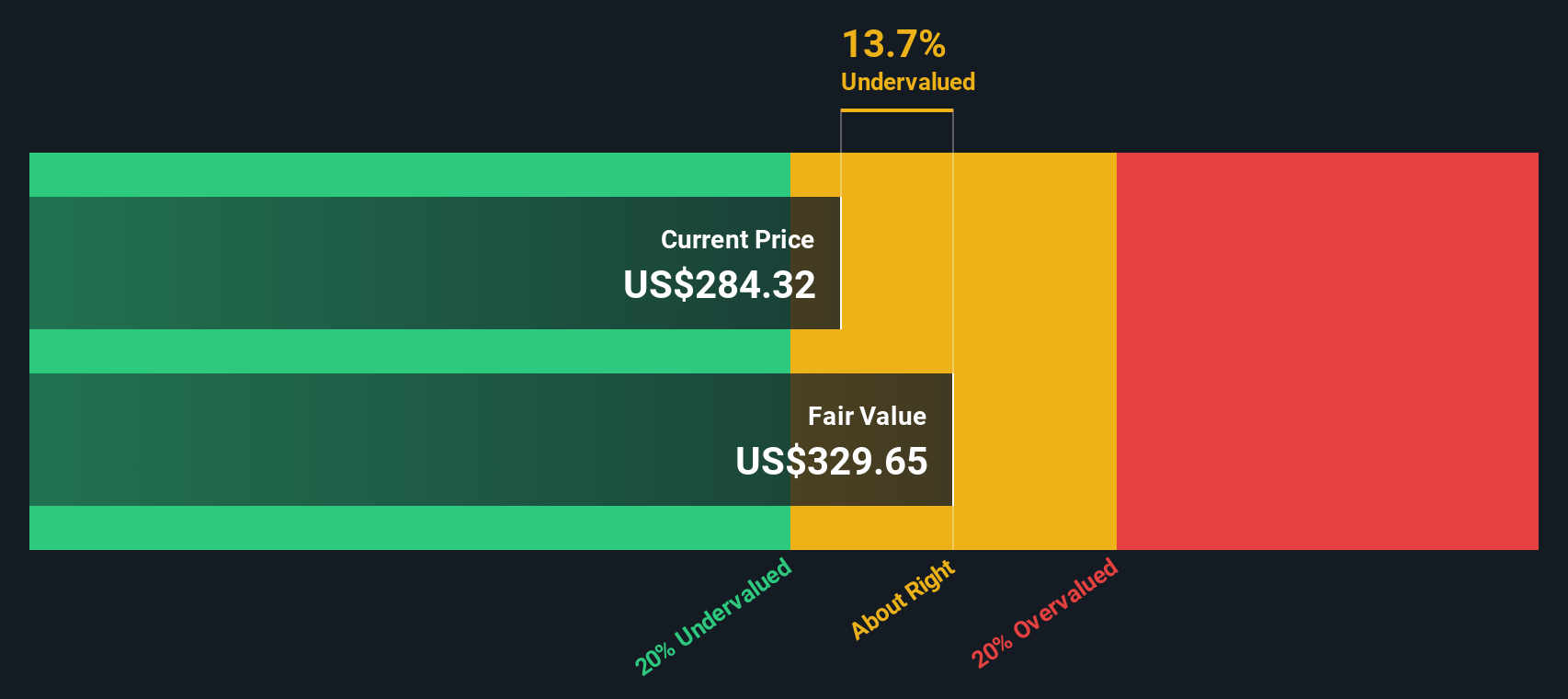

Of course, sharp price appreciation can leave investors wondering if the stock is now expensive relative to its fundamentals. That brings us to valuation: a systematic look at whether L3Harris remains a good deal. Based on six widely used valuation checks, L3Harris passes three, so its official valuation score sits at 3 out of 6. But not all valuation checks are created equal, and there is more to the story than a simple tally. Up next, we will break down exactly how those valuation methods work, and later, explore an even more insightful way to judge whether the stock might still be undervalued.

Why L3Harris Technologies is lagging behind its peers

Approach 1: L3Harris Technologies Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting its future cash flows and then discounting those amounts back to today at an appropriate rate. This approach aims to determine what L3Harris Technologies is truly worth based on how much cash the business is expected to generate in the years to come.

For L3Harris, analysts expect Free Cash Flow (FCF) to rise steadily over time. The company’s latest reported FCF sits at just over $2.1 billion. Projections suggest it could reach $3.5 billion by the end of 2029, with subsequent years extrapolated to continue that upward trend. These estimates blend both direct analyst forecasts for the near term and extended projections up to ten years out, providing a broad picture of future profitability in USD terms.

According to this two-stage DCF analysis, L3Harris Technologies has an intrinsic share value of $331.16. This is about 10.2% higher than its current trading price, pointing to the stock being undervalued right now based on long-run cash flow expectations.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests L3Harris Technologies is undervalued by 10.2%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: L3Harris Technologies Price vs Earnings

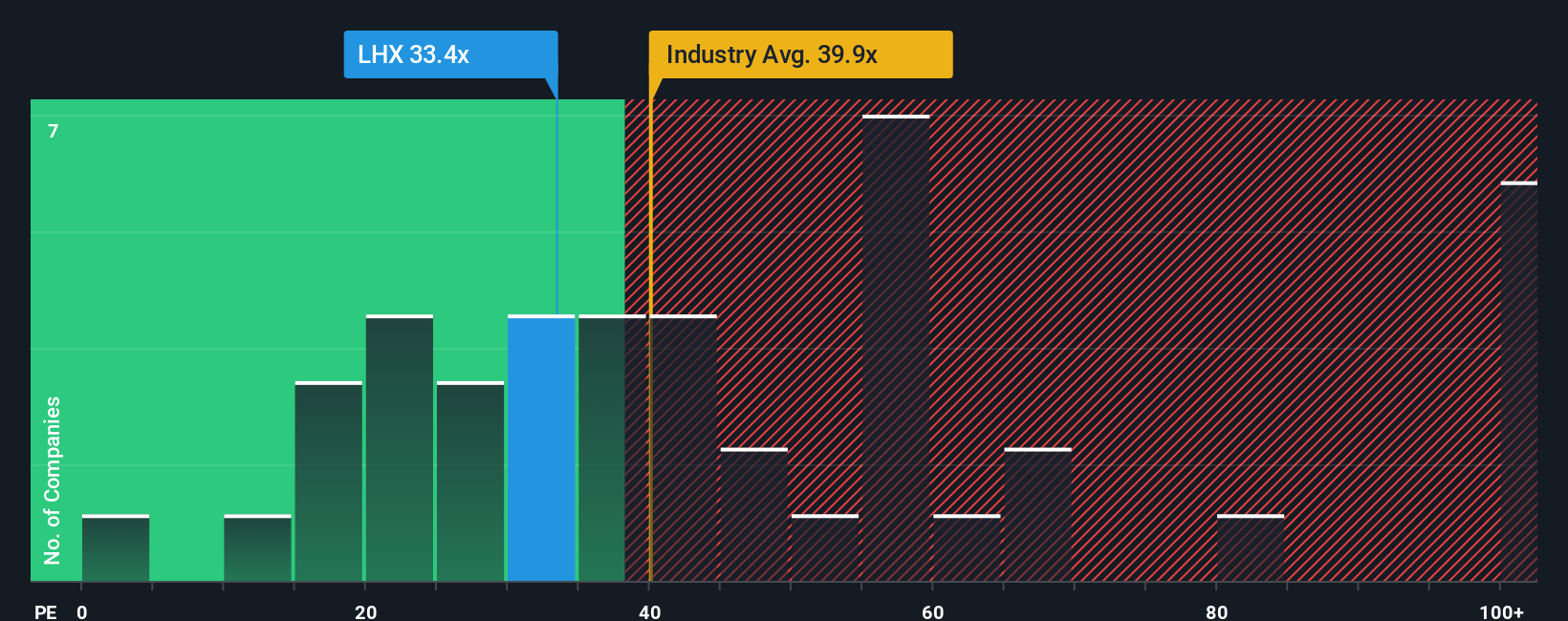

For established, profitable companies like L3Harris Technologies, the Price-to-Earnings (PE) ratio is a core valuation metric. The PE ratio gives investors a sense of how much they are paying for each dollar of current earnings. In general, a higher PE ratio can reflect expectations of faster future growth, higher quality earnings, or simply a market willing to pay up for perceived stability. On the other hand, a lower PE may suggest slower expected growth or more risk.

L3Harris currently trades at a PE ratio of 32.8x. When compared to the aerospace and defense industry’s average of 39.1x and the peer group average of 72.7x, L3Harris looks reasonably priced, if not inexpensive. However, simply comparing PE ratios to industry averages or peers only tells part of the story, since different companies can have distinct growth prospects, risk profiles, or profit margins that justify higher or lower multiples.

This is where the Simply Wall St “Fair Ratio” comes in. This metric calculates what a justifiable PE ratio should be for L3Harris by considering not just its earnings, but a blend of key factors including expected future growth, industry dynamics, market cap, profitability, and risk. For L3Harris, the Fair Ratio is 28.1x, which means the stock is trading slightly above what the algorithms estimate is fair given all those elements combined. Since the difference between the actual PE and the Fair Ratio is relatively modest, the valuation appears about right.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your L3Harris Technologies Narrative

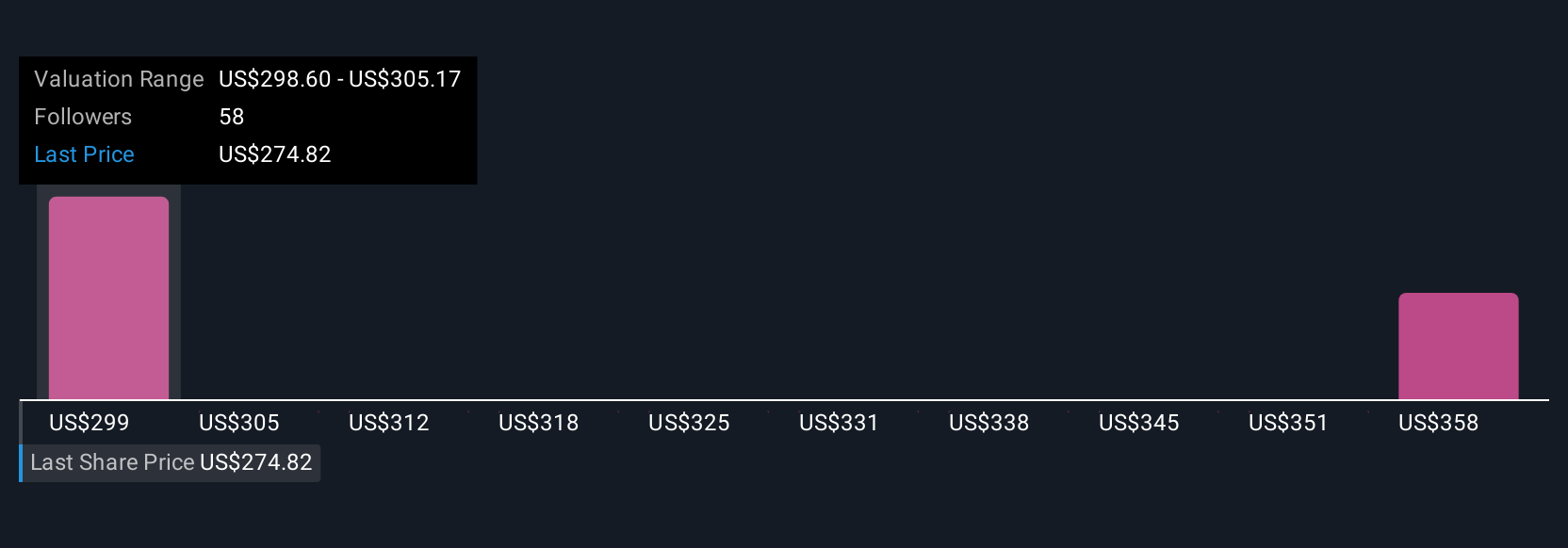

Earlier, we mentioned there is an even better way to understand valuation. Let’s introduce you to Narratives. Narratives are a simple, powerful tool that lets you connect a company’s story—your own perspective or thesis—directly to financial forecasts and a fair value, turning raw data into an actionable investment insight. Instead of relying solely on numbers like PE ratios, you can outline your assumptions about L3Harris Technologies’s future revenue, earnings, and margins and see how these beliefs shape a reasonable value for the stock. Narratives make this process easy and accessible. They are built right into Simply Wall St’s Community page, where millions of investors share, compare, and update their views as new information emerges, such as recent earnings or major news.

With Narratives, you can see how your investment thesis compares to others, and instantly decide if the current price looks attractive, fair, or expensive based on common or contrasting views. For example, one investor might set an optimistic Narrative around ongoing U.S. defense initiatives and partnerships in AI, expecting a fair value of $327.00 per share. Another, more cautious investor, might focus on reliance on contractors and global tensions, arriving at a value closer to $250.00. Narratives help you validate or challenge your thinking in real time and take ownership of your buy or sell decision.

Do you think there's more to the story for L3Harris Technologies? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LHX

L3Harris Technologies

Provides mission-critical solutions for government and commercial customers worldwide.

Established dividend payer with proven track record.

Similar Companies

Market Insights

Community Narratives