- United States

- /

- Aerospace & Defense

- /

- NYSE:LHX

How the Pentagon’s Missile Push Impacts the L3Harris Technologies Stock Valuation in 2025

Reviewed by Bailey Pemberton

Thinking about what to do with L3Harris Technologies stock? You are definitely not alone. After all, we are talking about a defense giant whose share price has climbed an impressive 37.1% year-to-date, and has shot up 85.6% over the last five years. But even in a booming year, the last week delivered a -4.7% dip, reminding investors just how fast sentiment can shift in this sector.

Recent headlines have kept L3Harris firmly in the spotlight. The Pentagon’s call for missile suppliers to ramp up production is a clear signal that big opportunities could be on the horizon for companies like L3Harris. The urgency felt in Washington, coupled with persistent global tensions and supply chain stories from China, is fueling renewed appreciation for defense stocks. However, it also brings new risks to consider.

With all this in mind, it is hardly surprising that a lot of investors are wondering if now is the right moment to buy, hold, or take some profits. The key, as always, comes down to valuation. Our multi-point valuation check gives L3Harris a score of 3 out of 6. That means it’s undervalued by half the measures we look at, a sign there might be some untapped value or, at the very least, room for debate about what the market is pricing in.

So how do these valuation approaches really stack up, and how can you get beyond the surface-level numbers to decide what this stock is truly worth? Let’s dive into the key valuation checks for L3Harris, and stick around for what might just be the smartest way to look at valuation at the end of this article.

Why L3Harris Technologies is lagging behind its peers

Approach 1: L3Harris Technologies Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s worth by projecting its future cash flows and bringing those values back to today at an appropriate discount rate. This approach tries to answer one simple question: what is the business really worth based on the money it is expected to generate?

For L3Harris Technologies, the model uses a two-stage Free Cash Flow to Equity method. The latest twelve months’ free cash flow is about $2.1 Billion. Analysts forecast healthy growth, projecting free cash flow to reach roughly $3.5 Billion by 2029, with estimates out to 2035 extrapolated from both analyst and internal projections. This forecast blends near-term analyst estimates with more conservative, longer-range growth trends.

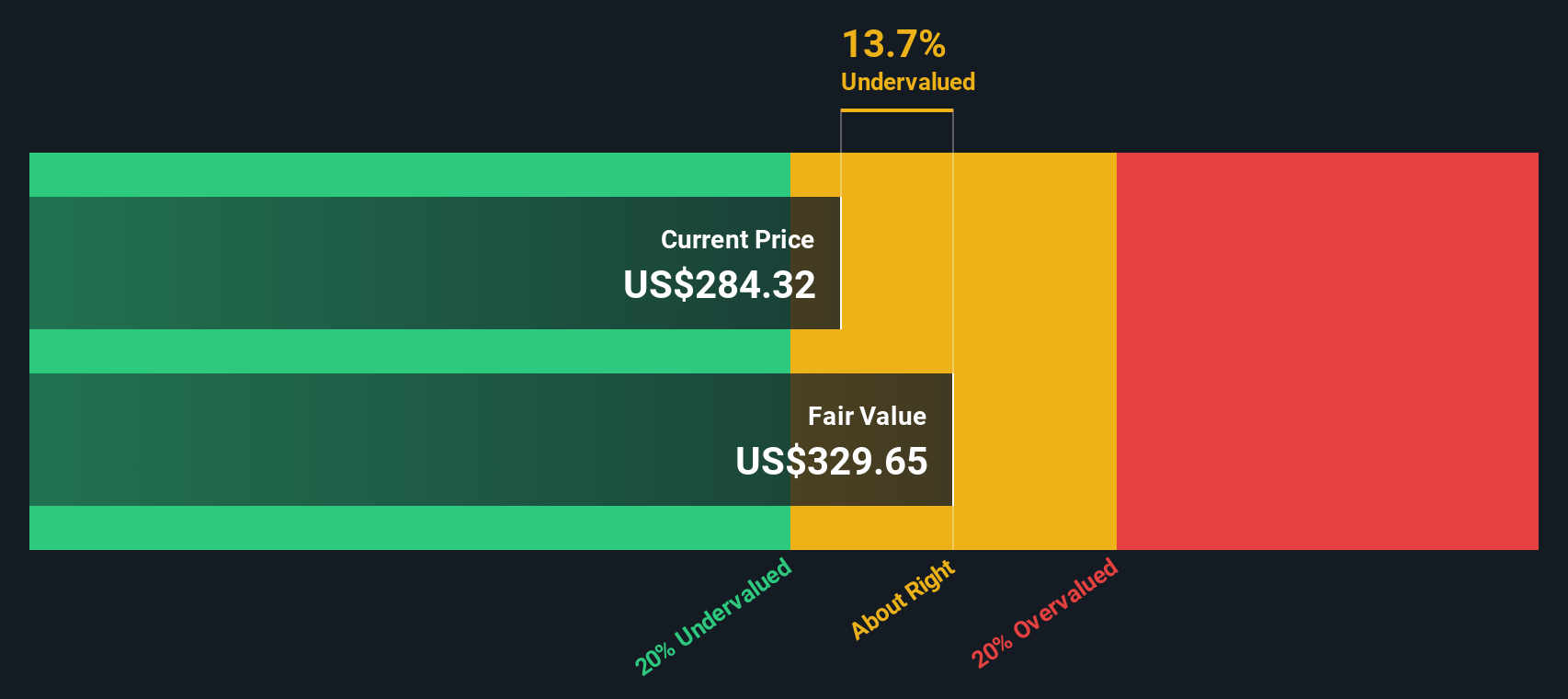

After evaluating these figures, the DCF model estimates the intrinsic value for L3Harris Technologies at $326.72 per share. That represents a 13.0% discount compared to the current share price. In other words, L3Harris appears undervalued by DCF metrics, with potential for upside if cash flows grow as projected.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests L3Harris Technologies is undervalued by 13.0%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: L3Harris Technologies Price vs Earnings

For profitable companies like L3Harris Technologies, the Price-to-Earnings (PE) ratio is one of the most trusted ways to gauge value. This metric tells us how much investors are willing to pay for each dollar of earnings, which is especially useful when consistent profits are the norm. Growth expectations and risk play a major part here. The higher the future growth, or the lower the perceived risks, the more investors are typically comfortable paying a higher PE ratio.

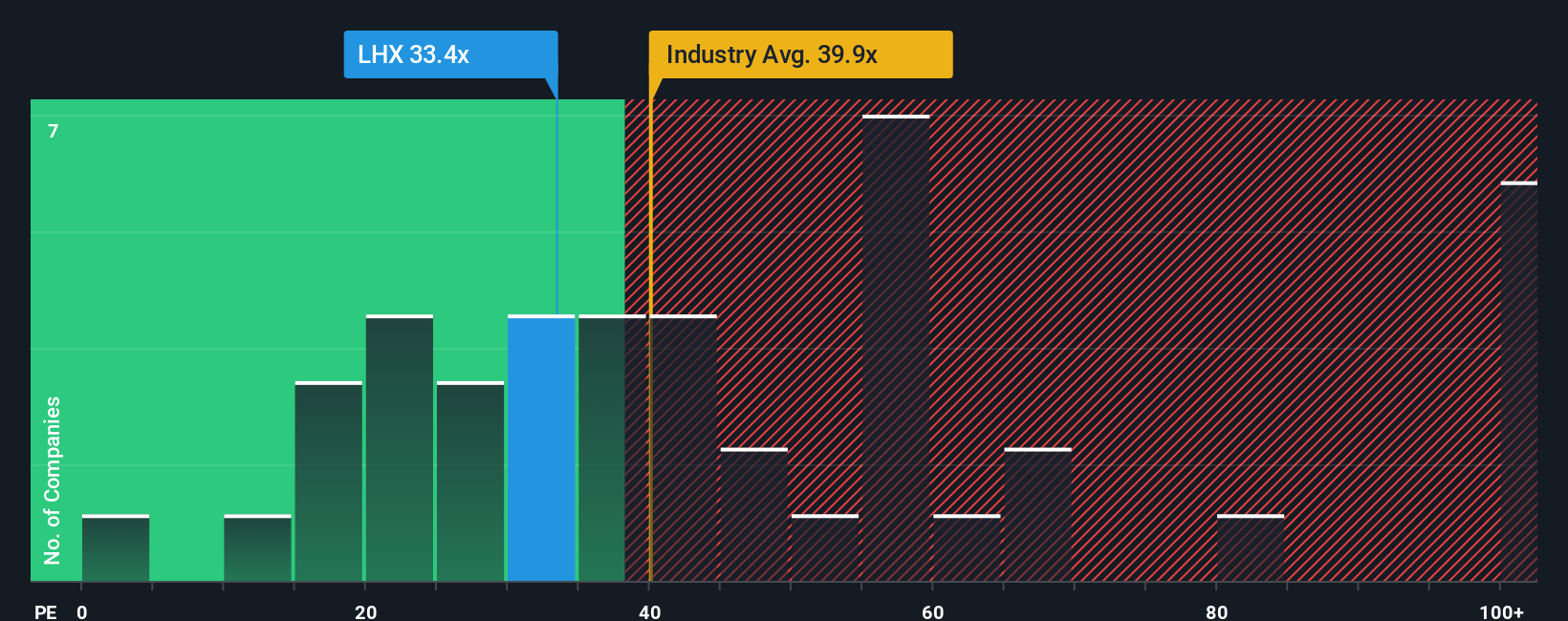

L3Harris is currently trading on a PE ratio of 31.3x. That is comfortably below the industry average of 39.4x and well beneath the peer average of 68.6x. At first glance, this might suggest the shares are attractively priced, given the company’s profitability and sector standing. However, looking only at industry and peer averages can overlook factors unique to L3Harris, such as its specific earnings growth profile, profit margins, market capitalization and risk exposures.

This is where Simply Wall St’s “Fair Ratio” comes in. This proprietary metric is designed to set a more tailored benchmark for valuation. The Fair Ratio for L3Harris comes out at 28.1x, reflecting an informed balance between growth expectations, profitability, the company’s market cap, and broader sector risks. Because it adapts to real company fundamentals rather than just simple averages, it gives a more nuanced read on what L3Harris “should” trade at.

Comparing that Fair Ratio of 28.1x to L3Harris’s actual PE ratio of 31.3x, the difference is modest, suggesting the market’s valuation is a little above fair but not stretched. There is no glaring gap demanding immediate action, but it may indicate a need for some caution if you expect slower future growth or rising sector risks.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your L3Harris Technologies Narrative

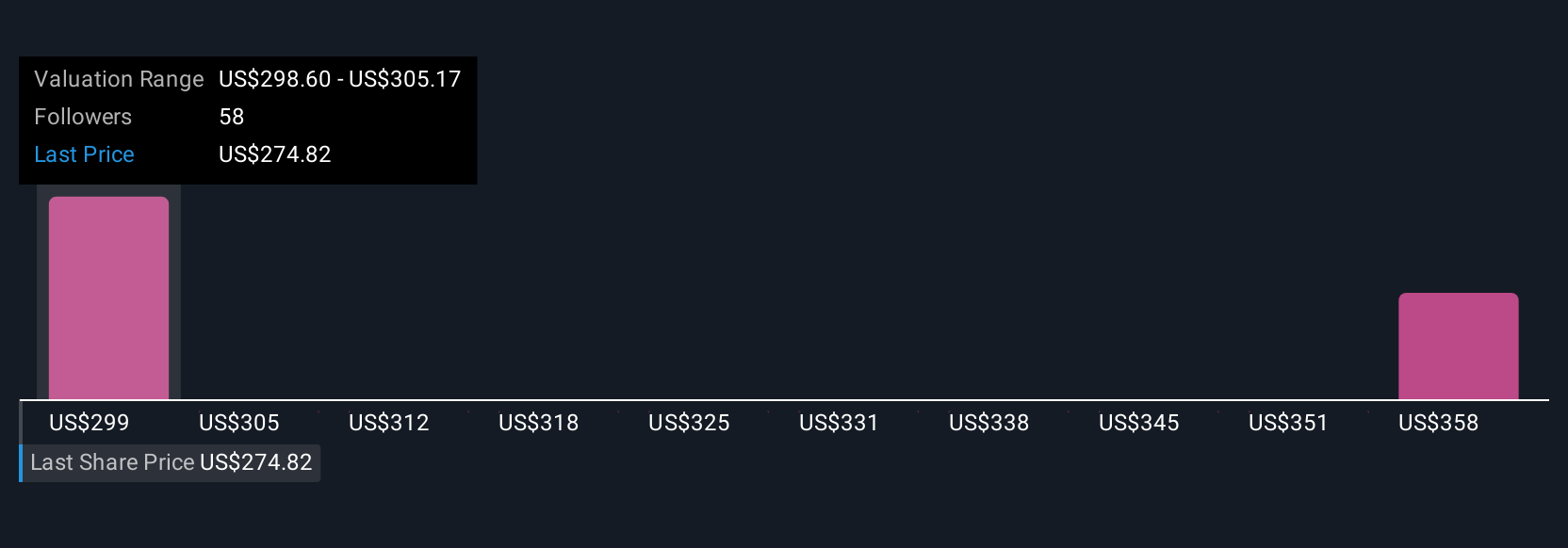

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is simply a story, your perspective about a company’s future, that shapes your assumptions about its growth, profitability, and financial health. With Narratives, you go beyond the standard ratios by linking your unique view of L3Harris Technologies to its future financial performance, which then leads to a custom fair value calculation.

Narratives make investing feel approachable because they connect a company’s real-world opportunities and risks to the numbers behind its share price. On Simply Wall St’s Community page, millions of investors use Narratives to share and explore different stories for L3Harris and other stocks. By building or following a Narrative, you can see how your forecast for revenue growth, margins, or risk stacks up, and instantly compare your implied fair value to today’s market price to decide whether L3Harris is a buy, hold, or sell.

Best of all, Narratives are dynamic: as soon as new information arrives, such as earnings reports or major news, fair values update automatically. For example, some investors are bullish and use optimistic revenue and margin assumptions, arriving at a fair value for L3Harris as high as $327.00. Others take a more cautious view and calculate a fair value as low as $250.00, showing just how much your story can shape your thinking and your investment strategy.

Do you think there's more to the story for L3Harris Technologies? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LHX

L3Harris Technologies

Provides mission-critical solutions for government and commercial customers worldwide.

Established dividend payer with proven track record.

Similar Companies

Market Insights

Community Narratives