- United States

- /

- Machinery

- /

- NYSE:KMT

Kennametal (KMT): Reassessing Value in a Climate of Market Uncertainty and Ongoing U.S. Government Shutdown

Reviewed by Kshitija Bhandaru

Shares of Kennametal (KMT) drifted alongside broader markets as investor anxiety grew over the ongoing U.S. government shutdown, which has now stretched into its seventh day and continues to drive uncertainty.

See our latest analysis for Kennametal.

Despite a stable financial footing, Kennametal’s short-term share price momentum has faded, with a 13% drop over the past quarter and a 1-year total shareholder return of -11%. This recent weakness stands out given its past three-year gains, suggesting that investors are pricing in heightened uncertainty even though fundamentals remain solid.

If the recent turbulence has you considering broader opportunities, now might be the perfect moment to broaden your investing horizons and discover fast growing stocks with high insider ownership

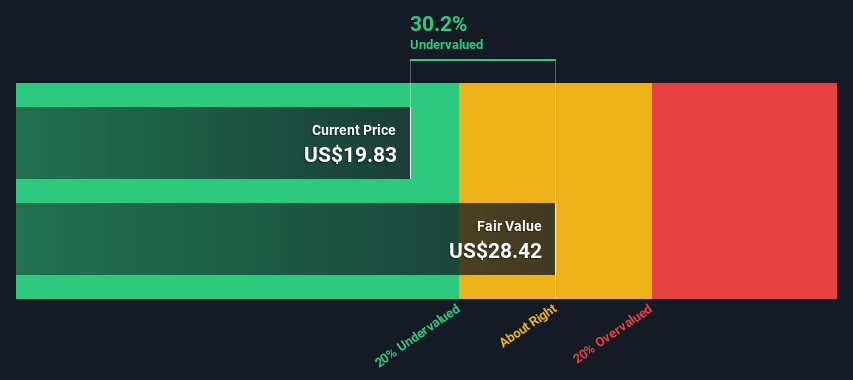

With shares trading nearly 20% below their intrinsic value estimates, the question remains: is Kennametal an overlooked bargain right now, or has the market already baked in any hopes for future growth?

Most Popular Narrative: Fairly Valued

Kennametal’s recent close of $21.53 is almost identical to the narrative’s fair value estimate of $21.06. The story behind this valuation looks deeper than short-term price swings and hinges on management’s multi-year transformation.

Focus on cost reduction, portfolio optimization, and digital innovation is expected to enhance competitive positioning, margins, and avenues for higher-quality earnings growth. Structural shifts in global infrastructure, energy transition, and advanced manufacturing trends will likely drive long-term demand across key end-markets and support topline growth.

Want to know what’s really fueling this tight fair value range? There’s one set of growth assumptions and future profit multiples lurking in the background. Can you guess how they balance conservative forecasts with bold transformation plans? Dive in to see the story behind every number powering this consensus view.

Result: Fair Value of $21.06 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, if prolonged weakness in end markets or continued cost pressures persist, Kennametal’s narrative of recovery could quickly come under strain.

Find out about the key risks to this Kennametal narrative.

Another View: SWS DCF Model Suggests Undervaluation

While the consensus valuation pegs Kennametal as fairly priced based on its future earnings and profit margins, our DCF model offers a very different story. According to this cash flow-based approach, Kennametal is trading nearly 20% below what the future cash flows suggest it could be worth. This could point to potential undervaluation. Could this disconnect signal an opportunity for patient investors, or is the market overlooking something?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Kennametal Narrative

If these fair value stories do not quite fit your view, you can dive into the data and craft your own take in just a few minutes. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Kennametal.

Looking for more investment ideas?

Seize your next opportunity. Don’t limit yourself to a single stock story when smarter, game-changing investments are just a few clicks away.

- Unlock rare value and ramp up your potential returns by targeting these 887 undervalued stocks based on cash flows highlighted for their cash flow strength.

- Accelerate your growth ambitions and ride the AI wave with these 25 AI penny stocks positioned at the forefront of transformative tech.

- Maximize stable income and build resilience into your portfolio by finding these 19 dividend stocks with yields > 3% delivering yields over 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kennametal might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KMT

Kennametal

Engages in development and application of tungsten carbides, ceramics, and hard materials and solutions worldwide.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives