- United States

- /

- Machinery

- /

- NYSE:KAI

Should Kadant’s (KAI) Expanded Credit Facility Reshape Expectations for Its Growth Strategy?

Reviewed by Sasha Jovanovic

- On September 26, 2025, Kadant Inc. amended its credit agreement to increase its revolving loan commitments from US$400 million to US$750 million, extend the maturity date to September 2030, and add several enhancements including expanded foreign currency and borrowing capabilities.

- This significant boost to financial flexibility positions Kadant to better support its international operations and potential future investments.

- We'll examine how this expanded credit facility could influence Kadant's investment narrative, particularly regarding its ability to fund growth initiatives and weather business cycles.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Kadant Investment Narrative Recap

Being a Kadant shareholder means believing in the company’s ability to generate resilient, high-margin recurring revenue from its installed base, while capital investments in modernization and process efficiency slowly return. The recent increase in Kadant’s revolving credit facility provides additional financial flexibility, but does not materially alter risks around demand timing or reliance on replacement parts; near-term catalysts remain rooted in aftermarket growth, while the biggest risk continues to be slower progress in securing new greenfield projects outside North America.

The most relevant recent announcement is Kadant’s affirmation of a quarterly cash dividend of US$0.34 per share, reflecting ongoing commitment to capital returns even as credit capacity expands. This alignment of shareholder distributions alongside financial flexibility underscores the company’s focus on balancing growth initiatives and shareholder value, but also invites scrutiny should end-market demand or margin stability waver.

However, investors should also be aware that much of Kadant’s current strength relies on parts demand from an aging installed base, which may shift as customers eventually...

Read the full narrative on Kadant (it's free!)

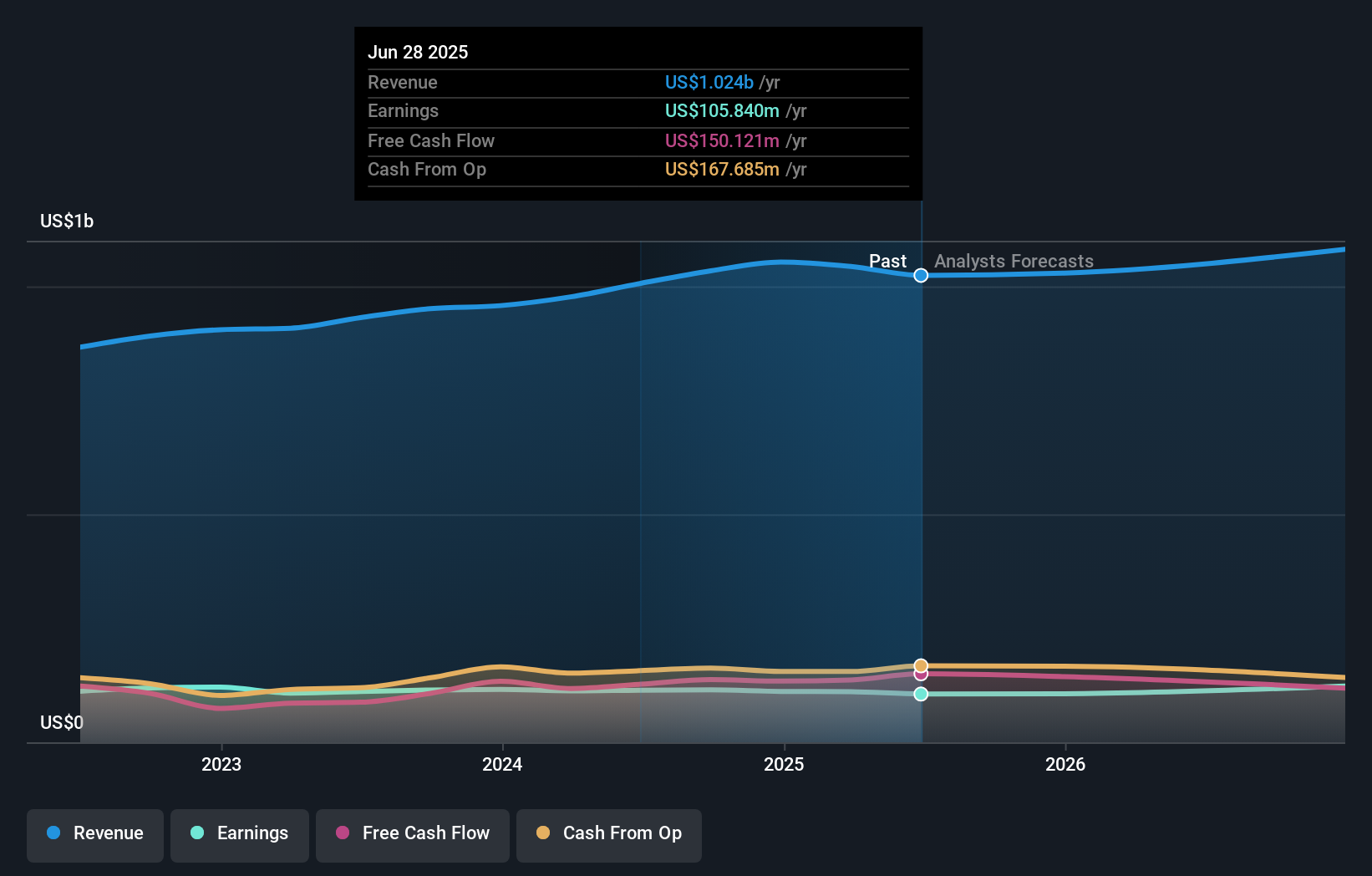

Kadant's narrative projects $1.1 billion in revenue and $141.4 million in earnings by 2028. This requires 3.5% yearly revenue growth and a $35.6 million earnings increase from $105.8 million today.

Uncover how Kadant's forecasts yield a $343.33 fair value, a 15% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members assessed Kadant’s fair value from US$176 to US$200 (2 perspectives), despite analysts pointing to limited new greenfield project momentum. Explore several distinct viewpoints to see how investor opinions can differ.

Explore 2 other fair value estimates on Kadant - why the stock might be worth as much as $200.00!

Build Your Own Kadant Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Kadant research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free Kadant research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Kadant's overall financial health at a glance.

Looking For Alternative Opportunities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kadant might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KAI

Flawless balance sheet with questionable track record.

Similar Companies

Market Insights

Community Narratives