- United States

- /

- Machinery

- /

- NYSE:KAI

Kadant (KAI): Valuation Insights as Flat Earnings and Shrinking Cash Flow Raise Operational Concerns

Reviewed by Simply Wall St

Recent updates around Kadant (KAI) point to flat earnings per share and a shrinking free cash flow margin. These developments raise questions about the company’s competitive position among its industrial peers and could impact how investors view its prospects.

See our latest analysis for Kadant.

Kadant shares have struggled for momentum lately, with a share price return of -15.41% year-to-date and a 1-year total shareholder return of -7%. This reflects some caution as operational concerns crop up. Still, long-term investors have seen impressive 3- and 5-year total returns of 72% and 169%, which shows the company has delivered for patient holders even as sentiment has cooled in recent months.

If you’re curious about broadening your investment search beyond Kadant, now is a great time to check out fast growing stocks with high insider ownership.

With Kadant’s share price down and operational concerns mounting, investors must now consider whether this weakness has uncovered an undervalued opportunity or if the market has already built future growth expectations into the current price.

Most Popular Narrative: 14.5% Undervalued

With Kadant’s fair value set notably above the last close price, the narrative sees meaningful upside potential even with recent operational headwinds. This view is built on recurring revenues, long-term catalysts, and ambitious growth targets.

Strategic acquisitions (Dynamic Sealing Technologies, Babbini, GPS) are broadening Kadant's addressable markets and technology capabilities in upcycling, fluid rotary unions, and dewatering. This enhances diversification and positions Kadant to tap into growing sustainability and circular economy-focused customer requirements. These moves could potentially accelerate revenue and market share.

Wondering what bold forecasts justify this premium? Find out how capital investments and a push into sustainable technologies are reshaping the company’s growth profile. The numbers the narrative uses might surprise you.

Result: Fair Value of $343.33 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing global trade uncertainty and possible saturation in key end markets could delay capital orders, which may challenge this optimistic outlook for Kadant.

Find out about the key risks to this Kadant narrative.

Another View: High Valuation on Earnings

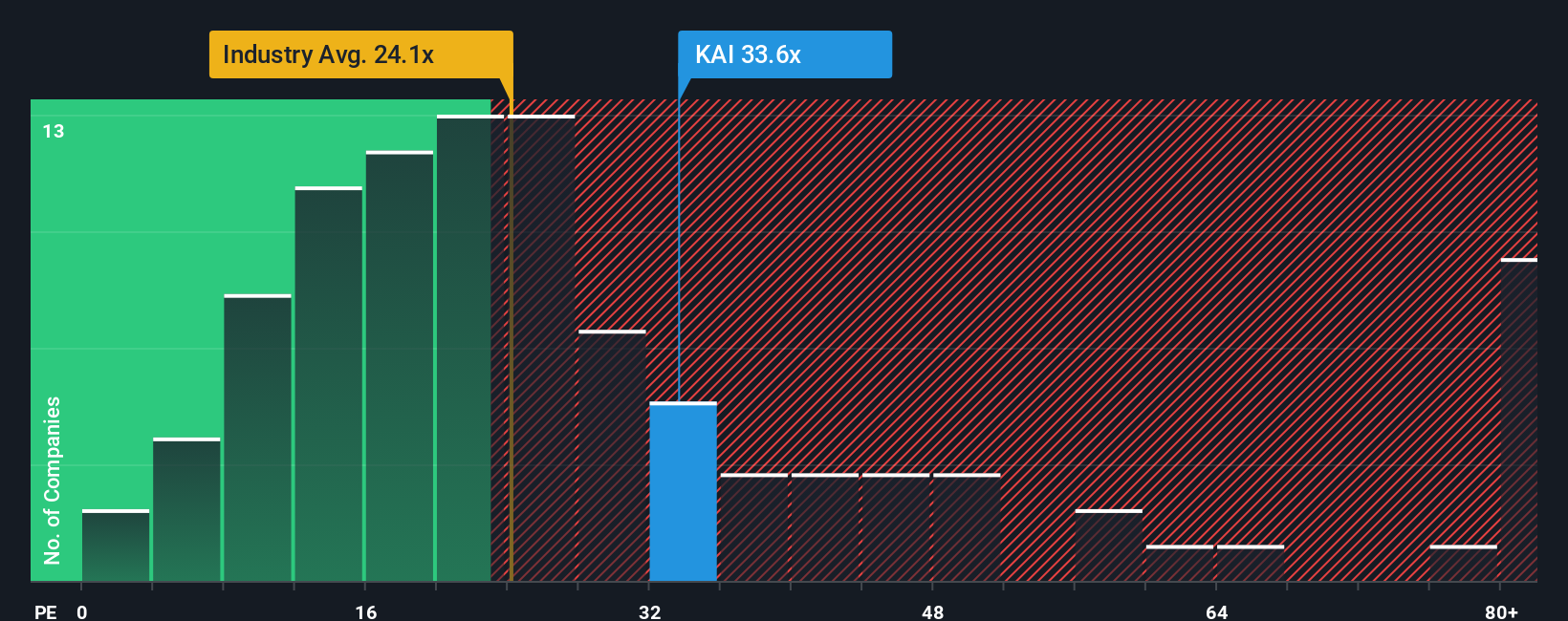

Looking at Kadant’s valuation through the lens of its price-to-earnings ratio presents a different story. The company’s ratio of 33.6 times earnings is well above both the US Machinery industry average of 24.3 and the fair ratio of 24.6. This premium means investors are paying significantly more for each dollar of Kadant’s earnings compared to peers and market trends, which could either signal confidence in growth or expose downside if expectations fall short. Could the market be overestimating Kadant’s momentum at these levels?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Kadant Narrative

If you see things differently or want to dig into the details on your own, you can build a personalized narrative in just a matter of minutes with Do it your way.

A great starting point for your Kadant research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t miss your chance to get ahead by expanding your watchlist with promising companies identified through these top investing themes.

- Tap into tomorrow’s potential by evaluating these 25 AI penny stocks at the forefront of breakthroughs in automation, language processing, and intelligent platforms.

- Boost your income strategy by comparing these 17 dividend stocks with yields > 3% featuring companies with yields above 3% and a track record of reliable payouts.

- Capitalize on unique opportunities in blockchain innovation by reviewing these 79 cryptocurrency and blockchain stocks with exposure to cryptocurrency and decentralized finance trends.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kadant might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KAI

Flawless balance sheet with questionable track record.

Similar Companies

Market Insights

Community Narratives