- United States

- /

- Building

- /

- NYSE:JCI

Johnson Controls’ Bet on Data Center Cooling Could Be a Game Changer for JCI

Reviewed by Sasha Jovanovic

- Earlier this month, Johnson Controls announced a multi-million dollar investment in Accelsius, a leading provider of advanced direct-to-chip liquid cooling systems for data centers.

- This development signals Johnson Controls’ increasing focus on innovative technologies aimed at improving efficiency and sustainability in the fast-growing data center sector.

- We will explore how this move to expand data center cooling solutions could reshape Johnson Controls’ future business outlook and market positioning.

AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Johnson Controls International Investment Narrative Recap

Owning Johnson Controls International means believing in the company’s ability to capitalize on growth in smart buildings, data center solutions, and recurring service revenues, while managing complex execution risks during its ongoing operational transition. The recent investment in advanced data center cooling reinforces a key growth catalyst but does not immediately resolve near-term risks tied to restructuring disruptions or the challenge of integrating new technologies, investors may wish to monitor short-term earnings impacts as changes play out.

Among recent developments, the expanded partnership with Everbridge to deliver managed critical event management services demonstrates Johnson Controls’ emphasis on integrating technology and service capabilities. This aligns with the company’s catalyst of broadening service attachment rates, which is integral for improving margin predictability and driving future growth.

On the other hand, investors should note the risk that, despite these forward-looking moves, disruption from the ongoing restructuring could...

Read the full narrative on Johnson Controls International (it's free!)

Johnson Controls International's outlook anticipates $27.0 billion in revenue and $3.3 billion in earnings by 2028. This scenario assumes a 4.9% annual revenue growth rate and a $1.3 billion increase in earnings from the current $2.0 billion.

Uncover how Johnson Controls International's forecasts yield a $113.55 fair value, a 4% upside to its current price.

Exploring Other Perspectives

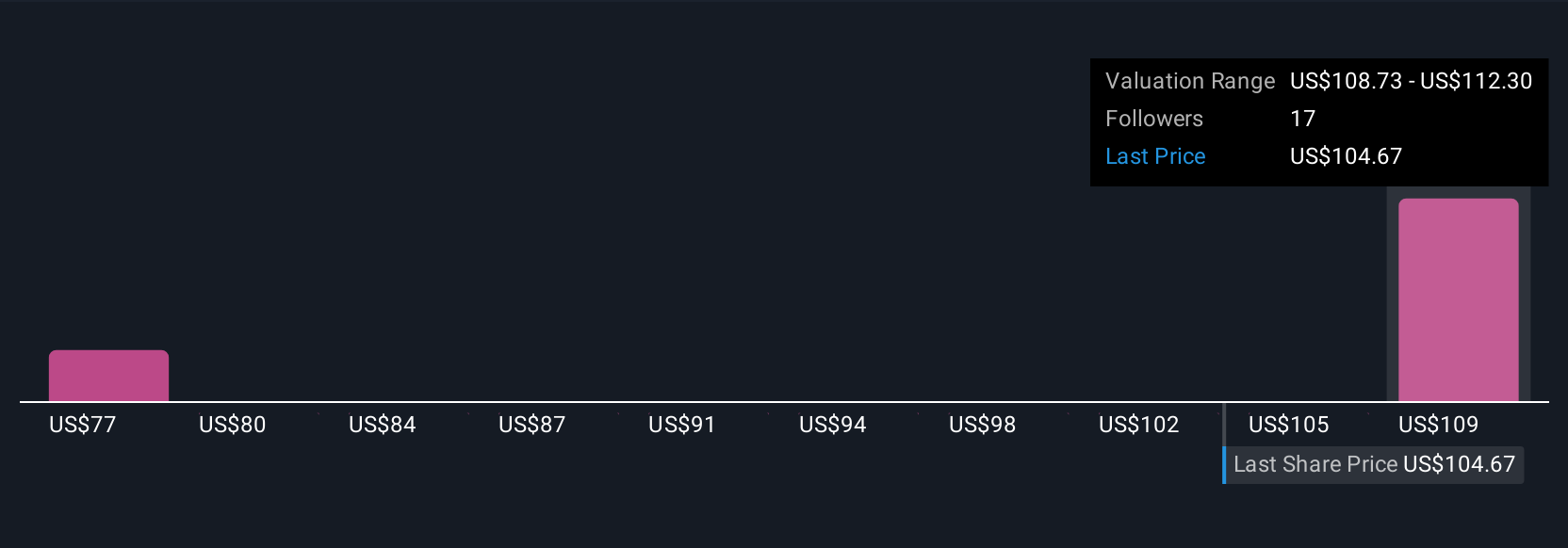

Simply Wall St Community fair value estimates for JCI range from US$74.40 to US$113.55 based on 2 different analyses. While some focus on margin improvement opportunities, keep in mind that short-term operational challenges remain an important factor for the business’s future performance.

Explore 2 other fair value estimates on Johnson Controls International - why the stock might be worth as much as $113.55!

Build Your Own Johnson Controls International Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Johnson Controls International research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Johnson Controls International research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Johnson Controls International's overall financial health at a glance.

Want Some Alternatives?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:JCI

Johnson Controls International

Engages in engineering, manufacturing, commissioning, and retrofitting building products and systems in the United States, Europe, the Asia Pacific, and internationally.

Proven track record second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives