- United States

- /

- Machinery

- /

- NYSE:ITT

Did KONI's Sustainability Award Just Shift ITT's (ITT) Competitive Positioning and Growth Outlook?

Reviewed by Sasha Jovanovic

- ITT Inc. recently announced that its KONI business received the 2025 Railsponsible Supplier Award for extending railway damper lifecycles and achieving over 60% reduction in greenhouse gas emissions through a refurbishment partnership with a European rail operator.

- This recognition highlights ITT's commitment to sustainability and innovation, as KONI’s process both cuts emissions and significantly lowers lifecycle costs for rail operators.

- We'll explore how KONI's award-winning sustainability achievements could influence ITT's future growth outlook and competitive positioning.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

ITT Investment Narrative Recap

At its core, ITT Inc. is for investors who believe in technology-driven industrial solutions, recurring service revenue, and disciplined capital allocation. While KONI’s award sharpens ITT's credibility as an innovator in sustainability, it does not have a material near-term impact on the main catalyst, visibility and execution on ITT’s growing, project-based backlog, or offset the elevated risk of increased revenue volatility if customer projects face delays or cancellations.

The most relevant recent announcement is ITT’s raised 2025 guidance, which targets total revenue of US$3,850 million and organic growth of 3 to 5 percent, reflecting confidence in the company’s order book and backlog. This directly ties into the main catalyst driving the story: strong backlog and order growth, especially in sectors like decarbonization and green infrastructure where sustainability wins like KONI’s offer further support. Yet, despite visible strengths, investors should not ignore the elevated concentration of project revenue, as...

Read the full narrative on ITT (it's free!)

ITT's outlook forecasts revenue of $4.4 billion and earnings of $651.2 million by 2028. This is based on analysts' assumptions of 6.3% annual revenue growth and a $134.7 million increase in earnings from the current $516.5 million.

Uncover how ITT's forecasts yield a $193.00 fair value, a 12% upside to its current price.

Exploring Other Perspectives

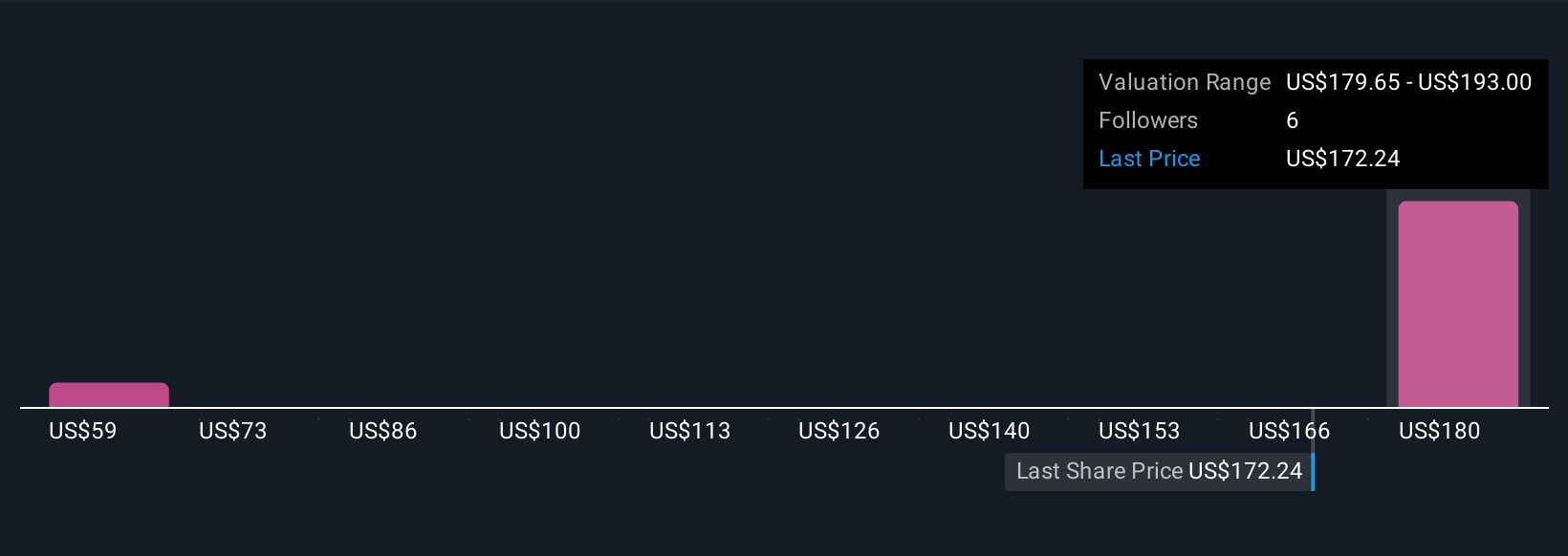

The Simply Wall St Community’s fair value estimates for ITT Inc. range widely from US$59.46 to US$193, with three viewpoints represented. In contrast, the company’s rising share of project-based revenue introduces swings in earnings potential that every investor considering these different values should be aware of.

Explore 3 other fair value estimates on ITT - why the stock might be worth less than half the current price!

Build Your Own ITT Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- Our free ITT research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate ITT's overall financial health at a glance.

Interested In Other Possibilities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ITT

ITT

Manufactures and sells engineered critical components and customized technology solutions for the transportation, industrial, and energy markets.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives