- United States

- /

- Machinery

- /

- NYSE:IR

How the Recent Earnings Report Shapes the Outlook for Ingersoll Rand in 2025

Reviewed by Bailey Pemberton

If you are weighing what to do with your Ingersoll Rand shares right now, you are far from alone. The stock has grabbed a lot of attention over the past several years, and for good reason. Despite a rocky stretch this year, with shares down 7.3% year-to-date and almost 17% over the past 12 months, long-term investors have still seen a remarkable 127.2% return over five years and an 84.5% jump in three. That says a lot about the company's ability to bounce back, as well as how investor sentiment can shift as market conditions change.

Recently, the stock has notched modest positive movement, up 2.0% for the week and 3.7% in the past month. Much of that interest connects to broader industrial tailwinds, such as increasing demand for automation and energy efficiency, both areas where Ingersoll Rand is seen as a leader. However, these price changes also reflect shifting risk perception among market participants, especially as global economic signals stay mixed.

When it comes to valuation, Ingersoll Rand currently earns a value score of just 1 out of 6, indicating it is considered undervalued by only one major valuation check. That means the bulk of standard measures say the stock is not a bargain, at least not on the surface.

Up next, we will break down how analysts arrive at these scores, looking at the most common valuation methods. If you want a deeper edge on figuring out where the stock really stands, stick around for the end, where we will share a smarter way to think about value in today's market.

Ingersoll Rand scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Ingersoll Rand Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future free cash flows and discounting them back to today's dollars. This provides a way to assess whether a stock is overvalued or undervalued compared to its fundamentals.

For Ingersoll Rand, analysts currently estimate Free Cash Flow (FCF) for the past twelve months at $1.30 billion. Projections indicate annual growth, reaching about $1.90 billion by the end of 2029. These forecasts use a two-stage approach: near-term numbers are provided by multiple analysts, while extended figures through the next decade are extrapolated by independent models.

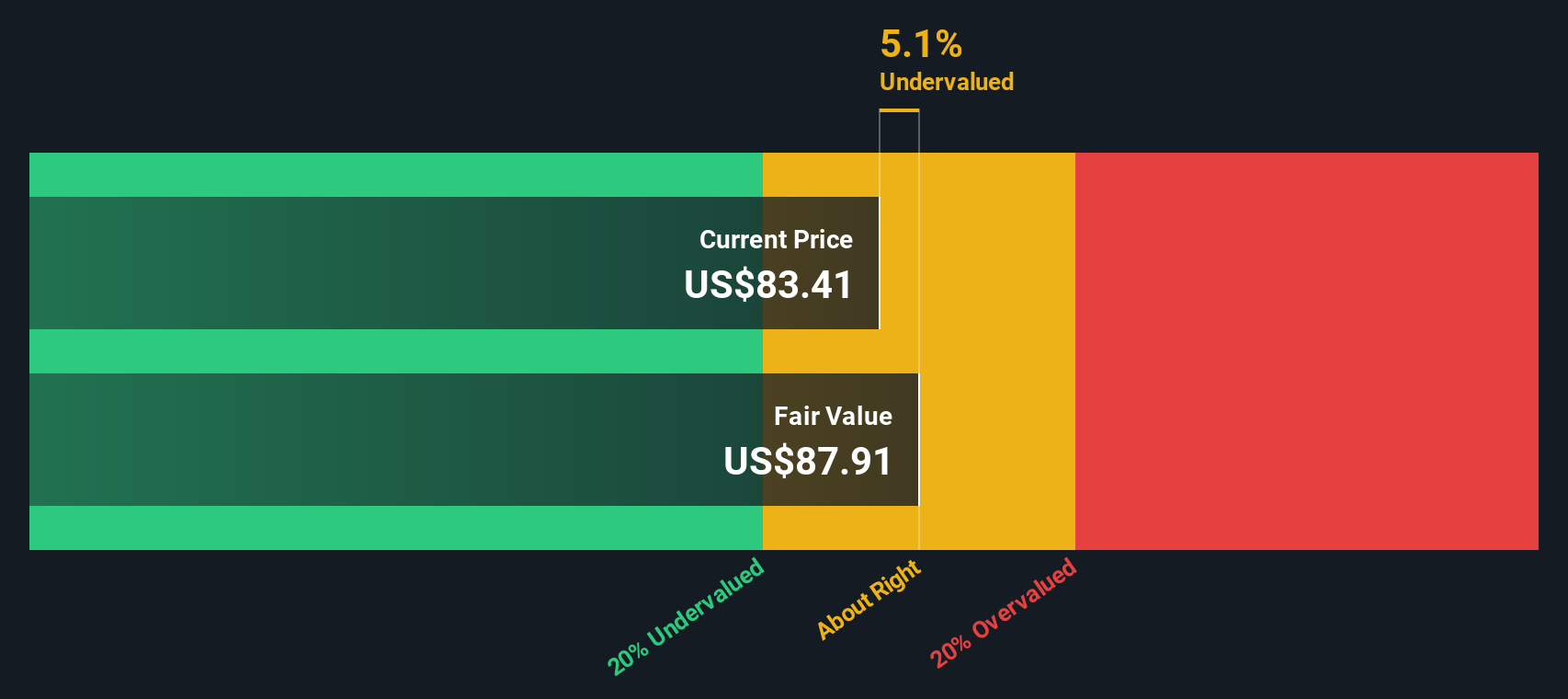

The DCF analysis arrives at an intrinsic value of $87.91 per share. Right now, this suggests the stock is trading at a 4.5% discount relative to its estimated fair value, meaning it is only slightly undervalued based on these cash flow projections.

Result: ABOUT RIGHT

Simply Wall St performs a valuation analysis on every stock in the world every day (check out Ingersoll Rand's valuation analysis). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes.

Approach 2: Ingersoll Rand Price vs Earnings

For companies like Ingersoll Rand that are consistently profitable, the price-to-earnings (PE) ratio is a popular and meaningful way to assess valuation. The PE ratio puts the stock price in context with how much the company is actually earning, offering a quick sense of how much investors are paying for each dollar of profit.

A high or low PE ratio can be driven not just by current earnings, but by market expectations for a company's future growth and the risks involved. Fast-growing, stable businesses generally justify higher PE ratios, while slower or riskier companies might deserve lower ones.

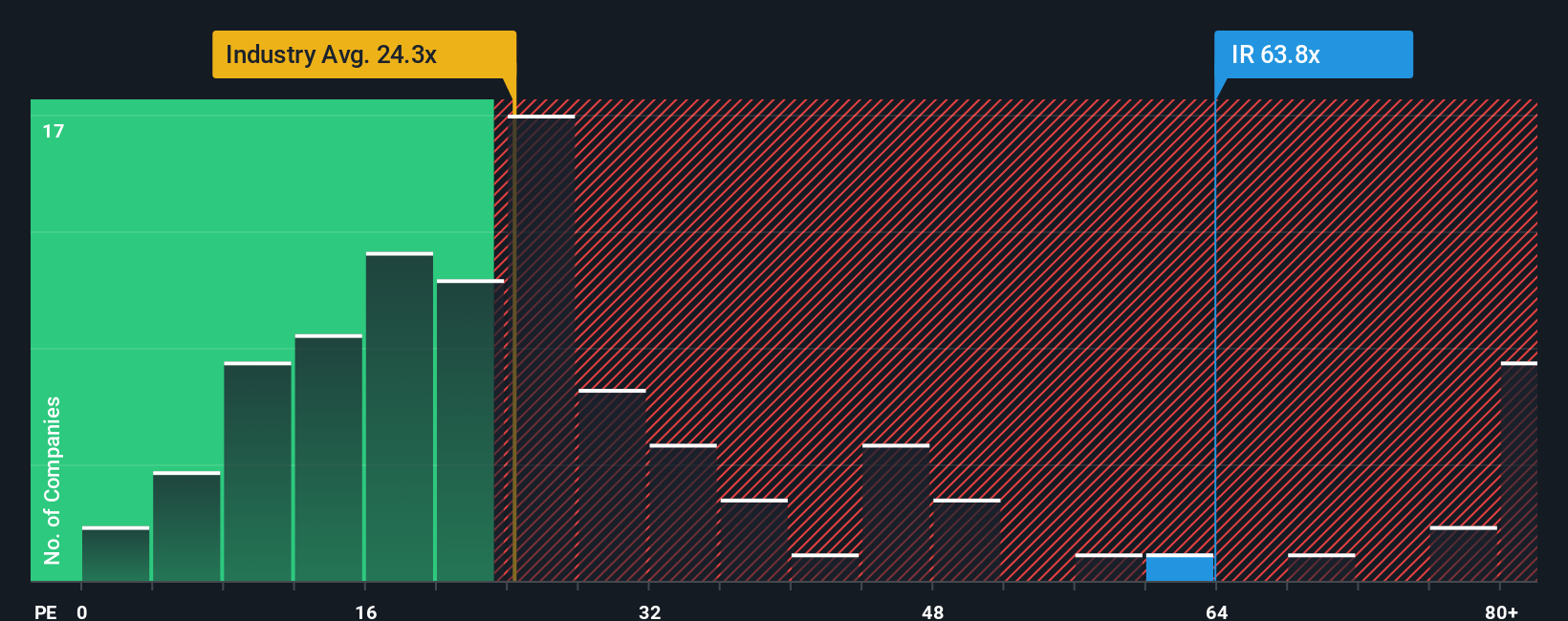

Ingersoll Rand’s current PE sits at 63.8x, which is substantially above the machinery industry average of 24.5x and also higher than the peer group average of 25.5x. At first glance, that suggests the stock is priced at a premium, possibly reflecting strong growth prospects or investor confidence in management’s execution.

However, Simply Wall St’s proprietary “Fair Ratio” for Ingersoll Rand is 37.2x. Unlike a simple industry or peer comparison, the Fair Ratio filters in factors like the company’s expected earnings growth, its profit margin, its industry and market cap, and known business risks. Because it adjusts for these deeper elements, it can provide a more relevant sense of value than headline peer or industry multiples alone.

With the PE ratio at 63.8x and the Fair Ratio at 37.2x, the stock trades well above what would be considered “fair” for its outlook and risk profile. This points to Ingersoll Rand being overvalued on this metric.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Ingersoll Rand Narrative

Earlier, we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is a user-friendly approach that allows you to create and share your own story about a company, linking your perspective and research on Ingersoll Rand to specific financial forecasts, such as expected future revenues, profit margins, and a fair value estimate. Rather than relying solely on traditional ratios or analyst consensus, Narratives connect what you believe is driving the company’s future, such as new technology launches or changing global markets, to clear numbers and a transparent price target.

Available to millions of investors on Simply Wall St’s Community page, Narratives are a practical tool for making buy or sell decisions by showing how your assumed fair value compares to the current share price. They update dynamically as new earnings or major news comes in, so your viewpoint stays current without extra effort.

For example, while some investors may build a bullish Narrative around international growth and set their fair value at $104, others might focus on margin risks from acquisitions and choose a fair value closer to $78. Narratives empower you to put your view into action and compare it side by side with others, so your decisions are guided by a clear, data-driven story.

Do you think there's more to the story for Ingersoll Rand? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:IR

Ingersoll Rand

Provides various mission-critical air, fluid, energy, and medical technologies services and solutions worldwide.

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives