- United States

- /

- Machinery

- /

- NYSE:IEX

Is IDEX Attractively Priced After Recent Strategic Investments and Stock Rally?

Reviewed by Bailey Pemberton

- Wondering if IDEX is a hidden gem or an overhyped ticker? You are not alone. Let's unpack what the numbers say about its value right now.

- The stock just climbed 4.2% over the last week and is up 6.9% for the past month, even though its year-to-date return still sits at -15.8%. This shows big swings in sentiment and changes in risk perception.

- Recent news has centered on IDEX's strategic investments and industry partnerships, which are impacting the stock's narrative. As investors digest these developments, it is clear that opinions are shifting about the company's long-term prospects.

- On our valuation checks, IDEX scores a 2 out of 6, indicating a few promising signs for value seekers but also some red flags. Let's dive into how that score is determined and stick around for a smarter way to interpret value at the end.

IDEX scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: IDEX Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows and then discounting them back to today. This provides a clearer picture of what the business is fundamentally worth right now.

For IDEX, analysts expect Free Cash Flow (FCF) to rise from its last twelve months level of $570.6 Million to $997.2 Million by 2029, with annual estimates up to five years and additional years extrapolated. This steady climb in FCF suggests a positive outlook for the company’s cash-generating ability.

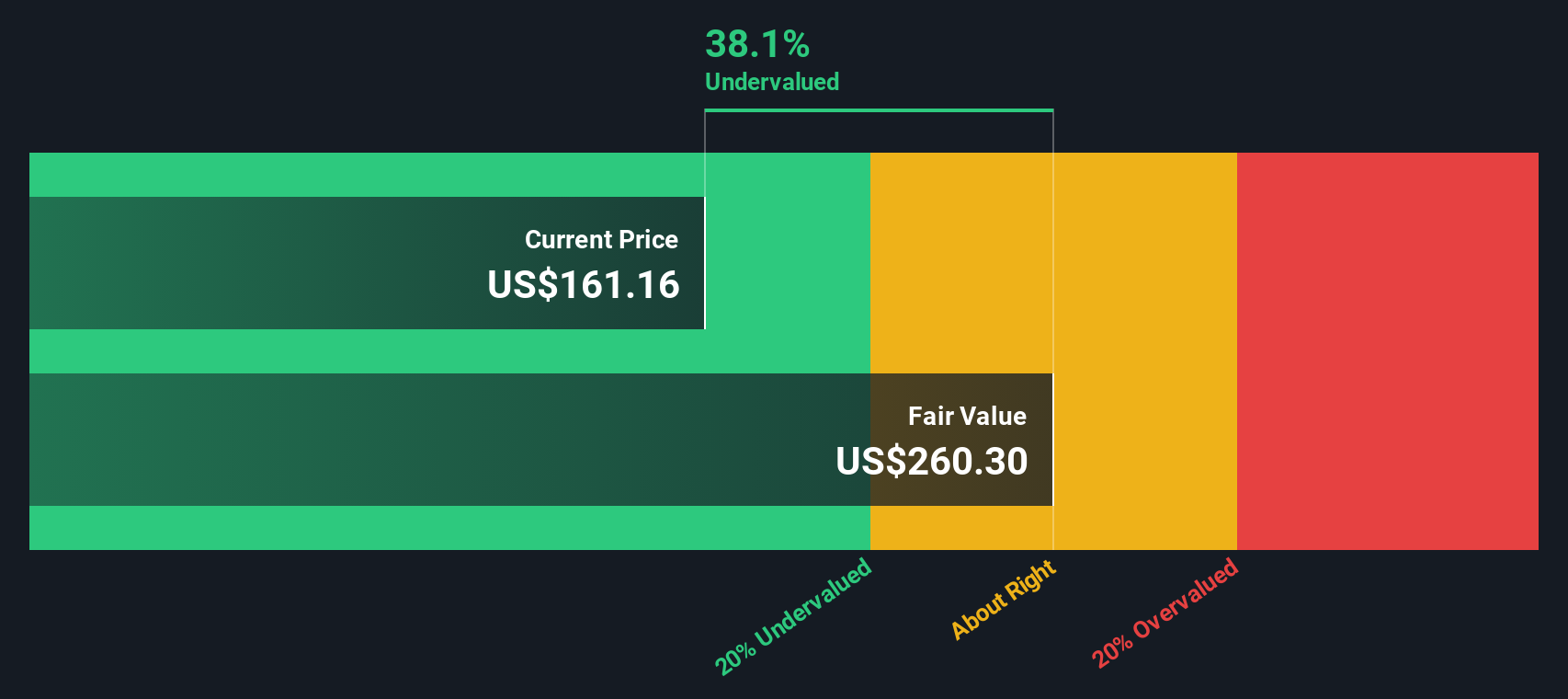

Using the DCF approach, IDEX’s fair value is calculated at $259.40 per share. Compared to its current trading price, this represents a significant intrinsic discount of 33.2 percent, indicating the stock is currently undervalued based on the projected future cash flows in dollars.

If you are considering IDEX, the DCF model points to a compelling opportunity for value-oriented investors.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests IDEX is undervalued by 33.2%. Track this in your watchlist or portfolio, or discover 849 more undervalued stocks based on cash flows.

Approach 2: IDEX Price vs Earnings

The Price-to-Earnings (PE) ratio is widely used for valuing profitable companies like IDEX because it directly connects a business’s current share price to its earnings power. For firms generating steady profits, PE offers a simple way to gauge how much investors are willing to pay for each dollar of earnings.

Growth expectations and risk are key factors in deciding what a “normal” or “fair” PE ratio should be. Higher expected earnings growth or lower perceived risks typically push the fair PE higher. Companies facing headwinds or uncertainty might deserve a discount.

Looking at IDEX, its current PE ratio stands at 27.8x. This is above the Machinery industry average of 24.6x and also exceeds the average of its closest peers, which sits at 24.2x. At first glance, this might suggest the stock is priced rich compared to others in its space.

However, Simply Wall St’s “Fair Ratio” refines this picture. The Fair Ratio uses a proprietary calculation that weighs IDEX’s growth prospects, profit margins, size, risks, and how these compare across its industry and the broader market. It is a more tailored benchmark than a blunt comparison to peers or industry averages.

For IDEX, the Fair Ratio is 24.9x. This is just below its actual PE ratio, and the difference between the two is less than 0.10x. This means the stock’s market valuation is essentially in line with what fundamentals would justify.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1386 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your IDEX Narrative

Earlier we mentioned there's an even better way to understand valuation, so let's introduce you to Narratives. In simple terms, a Narrative is a personalized story behind your numbers. It connects your specific view of a company like IDEX with assumptions about its future revenue, earnings, and margins, and turns them into an actionable fair value estimate.

By building a Narrative, you’re not just relying on static models or single-point estimates; you are expressing the reasons why you expect a certain future for the company and seeing in real-time how news, earnings, and new information can shift that story and its valuation. Narratives are designed for all investors and are easily accessible on Simply Wall St’s Community page, where millions already use them for more informed decisions.

Narratives even help you know when to buy or sell by directly comparing your Fair Value to the latest share Price, keeping your investing process dynamic and adaptable. For example, on IDEX, some investors may follow a bullish Narrative, expecting ongoing global sector growth and margin expansion, which points to a fair value as high as $213.00 per share. More cautious investors, weighing risks like tariffs and sector volatility, may estimate a much lower fair value, around $170.00. Your Narrative is about your perspective, so you can invest with confidence, tailored to what you believe the future holds.

Do you think there's more to the story for IDEX? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:IEX

IDEX

Provides applied solutions in the United States, rest of North America, Europe, Asia, and internationally.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives