- United States

- /

- Aerospace & Defense

- /

- NYSE:HXL

A Fresh Look at Hexcel (HXL) Valuation Following Leadership Transition and CFO Appointment

Reviewed by Simply Wall St

Hexcel (HXL) is undergoing a leadership transition, as Chief Financial Officer Patrick Winterlich is stepping down at the end of November. Michael C. Lenz, with a background at FedEx, will serve as interim CFO while the search for a permanent replacement is conducted.

See our latest analysis for Hexcel.

Hexcel’s recent leadership shakeup comes amid an upswing in price momentum, with the share price advancing by 18.01% year-to-date and a 14.74% gain in the past quarter. While executive transitions can introduce short-term uncertainty, the company’s one-year total shareholder return of 17.77% and a solid 52.51% over five years show consistent long-term value creation as investors weigh both growth prospects and evolving risks.

If management moves like these have you looking to diversify, now is a great time to broaden your outlook and discover See the full list for free.

But with shares already up double digits this year and trading just shy of analyst price targets, is Hexcel currently undervalued for long-term investors, or has the market already priced in its next phase of growth?

Most Popular Narrative: 3.8% Undervalued

Hexcel's latest fair value narrative places its shares at $75.79, modestly above the recent closing price of $72.93. This valuation sets the stage for debate around fundamentals, buybacks, and ambitious growth assumptions.

Bullish analysts highlight the recent increase in Hexcel's price target, which reflects growing optimism about the company's medium-term opportunities. The announcement of a $600 million share repurchase program is viewed as a sign of management's commitment to capital returns and shareholder value.

Want to know why Hexcel’s estimated fair value sits above the market price? The narrative centers on bold projections for revenue, margins, and future earnings power. The surprise is that it hinges on a profit outlook that rivals industry heavyweights. Don’t miss the driving forces behind this confident valuation.

Result: Fair Value of $75.79 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing supply chain challenges and reliance on major customers like Airbus could quickly shift Hexcel’s outlook if disruptions or production delays continue.

Find out about the key risks to this Hexcel narrative.

Another View: Multiples Paint a Cautious Picture

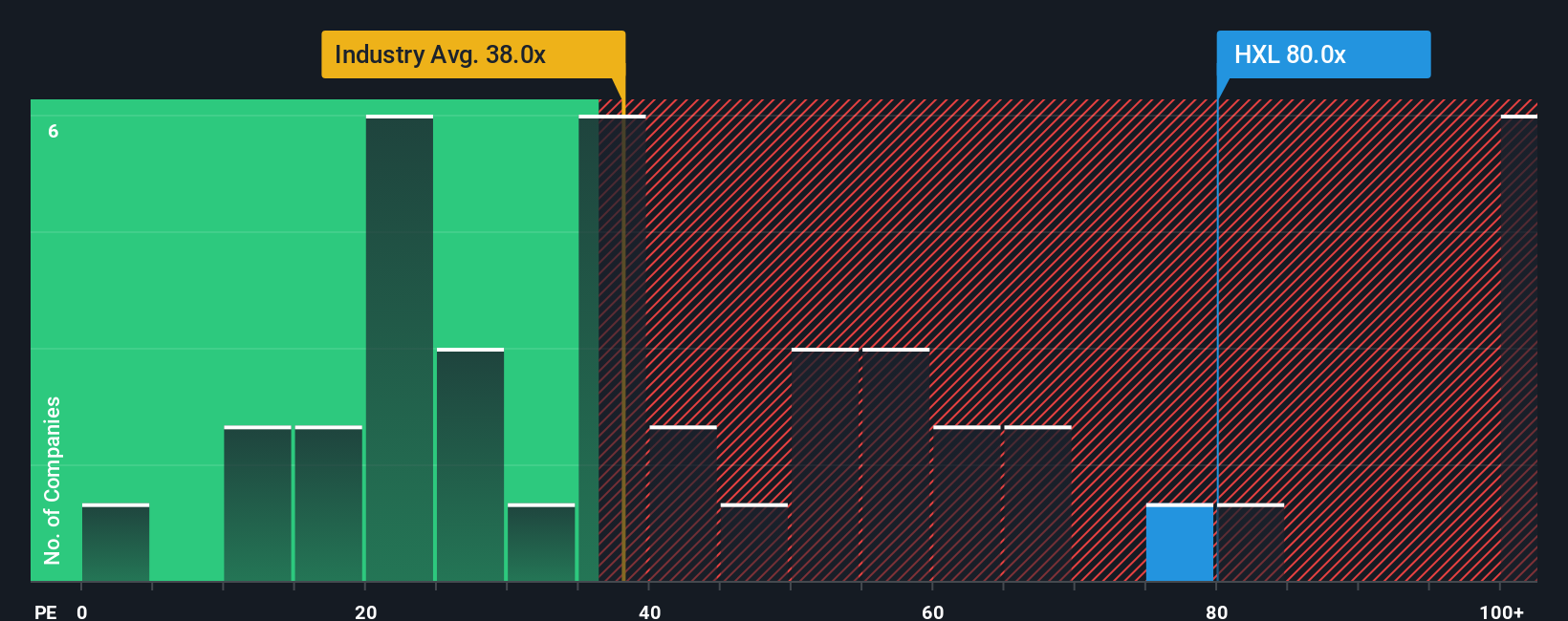

Taking a glance at valuation from another angle, Hexcel’s price-to-earnings ratio sits at 84.4x. This is a notable premium compared to peers averaging 51.4x and the industry at just 36.1x. Even when stacked against our fair ratio estimate of 38x, the stock looks richly priced. Does this premium signal strong investor confidence, or does it set the stage for disappointment if growth stumbles?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Hexcel Narrative

If you see the story differently or want to dig into the details on your own, you can quickly craft your own perspective. Do it your way

A great starting point for your Hexcel research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors know that opportunities go far beyond a single stock. Don’t miss out on potential big winners by expanding your strategy and letting Simply Wall Street’s advanced screeners guide your search.

- Boost your passive income by tapping into these 14 dividend stocks with yields > 3% with consistently high yields and strong financial foundations.

- Target the next generation of market leaders by checking out these 26 AI penny stocks innovating in artificial intelligence and automation.

- Capitalize on overlooked value by evaluating these 924 undervalued stocks based on cash flows primed for a rebound based on their robust cash flow and solid fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hexcel might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HXL

Hexcel

Develops, manufactures, and markets carbon fibers, structural reinforcements, honeycomb structures, resins, and composite materials and parts for use in commercial aerospace, space and defense, and industrial applications.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026