- United States

- /

- Electrical

- /

- NYSE:HUBB

Hubbell (NYSE:HUBB) Reports Growth In Earnings Despite Sales Decline

Reviewed by Simply Wall St

Hubbell (NYSE:HUBB) recently declared a regular quarterly dividend of $1.32 per share, reinforcing its commitment to returning value to shareholders. The company's share price rose by 11% over the last week, a performance that outpaced the broader market's 4% increase. This price movement might reflect investor optimism following the announcement of improved earnings results, with first-quarter net income and EPS both showing growth despite a slight decline in sales. These positive developments, along with the adoption of a majority voting standard for Director elections, may have contributed to the increase, aligning with broader market trends.

Hubbell has 1 risk we think you should know about.

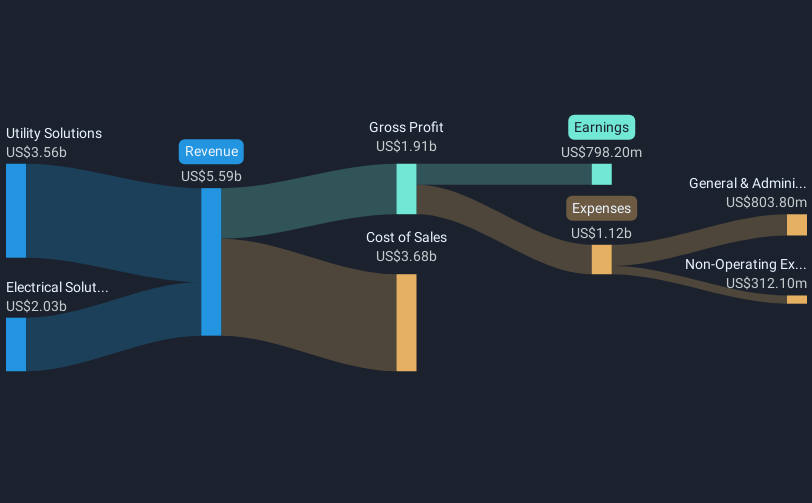

The recent 11% rise in Hubbell's share price, along with a declared dividend of US$1.32 per share, suggests increased investor confidence potentially triggered by the company's improved earnings results despite a slight decline in sales. This price movement, which outpaced the market's 4% increase, may also reflect optimism about future revenue growth, driven by strong demand in the Electrical and Utility Solutions segments. Over the past five years, Hubbell's total returns, including dividends, grew by a large figure of 260.41%, showcasing robust performance.

In contrast, Hubbell underperformed the US Electrical industry over the past year. Looking ahead, the adoption of a majority voting standard for Director elections and the focus on demand from data centers and grid modernization could positively affect revenue and earnings forecasts. However, risks such as tariff impacts and macroeconomic uncertainty remain. With the share price at US$348.31, it's currently trading at a 14.3% discount to the consensus price target of US$406.46, indicating potential upside if growth expectations materialize.

Click to explore a detailed breakdown of our findings in Hubbell's financial health report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hubbell might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HUBB

Hubbell

Designs, manufactures, and sells electrical and utility solutions in the United States and internationally.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives